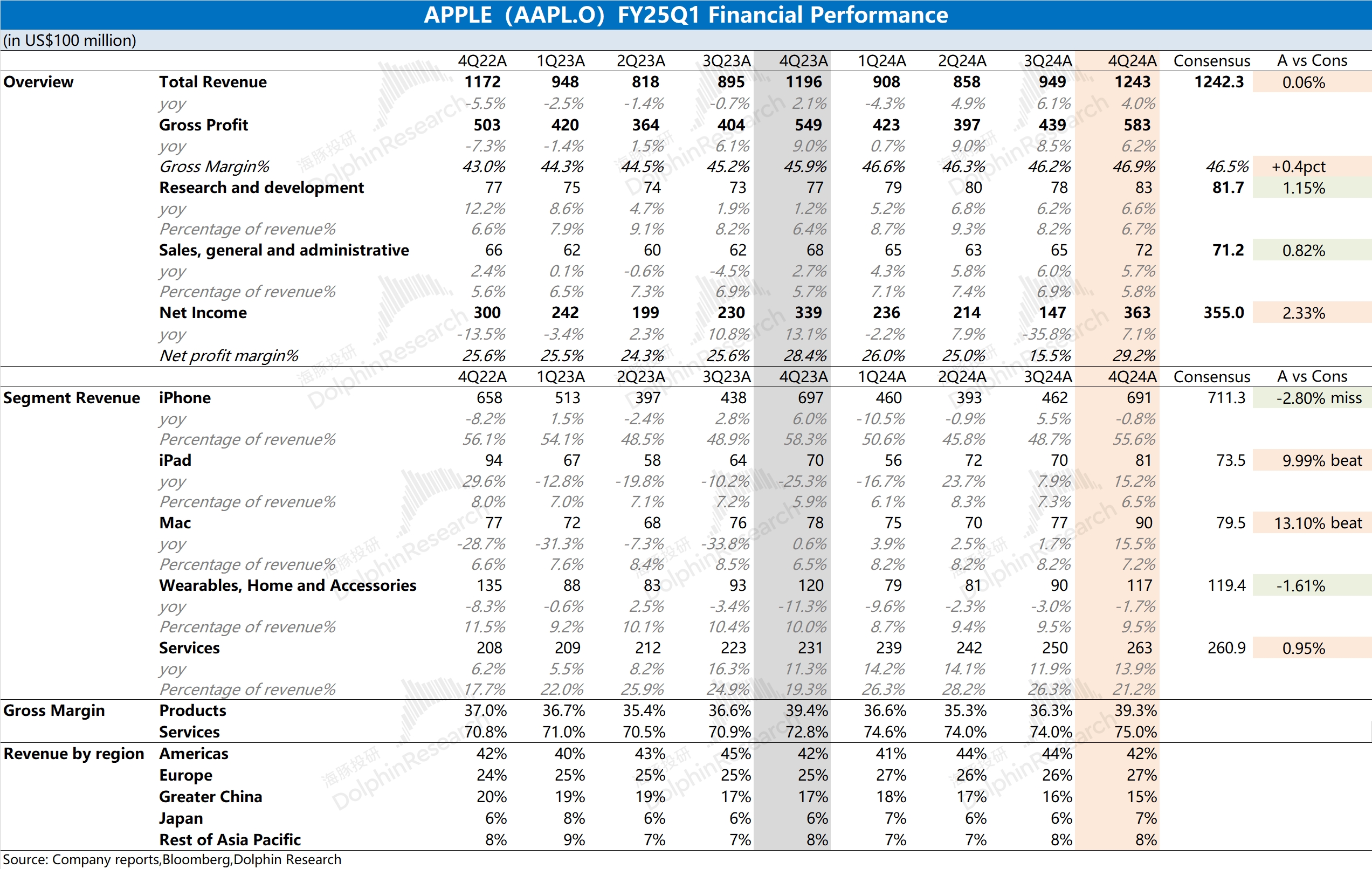

$Apple(AAPL.US) 1QFY25 Quick Interpretation: The company's financial report for this quarter basically meets expectations. Revenue maintained single-digit growth, gross margin continued to steadily improve, and R&D and sales expenses remained at a healthy level, ultimately achieving profit growth for the company.

From a business perspective, the company's software revenue maintained double-digit growth, while hardware performance showed some divergence. This quarter, the iPad and Mac businesses performed well, with both segments experiencing a 15% growth, showing signs of recovery. However, the iPhone and wearable businesses were relatively weak, with insufficient innovation in new iPhone models and facing significant market competition, leading to a decline in market share this quarter.

With a large user base and ecological barriers, Apple's software business will continue to grow steadily. On the hardware side, after going through a low point, the iPad and Mac are expected to continue to recover. As for the iPhone in the Chinese market, it will still face strong competition from domestic Android phones under the influence of policies such as national subsidies. If more AI features are implemented in the future, it is expected to boost the company's hardware segment, which is currently a major focus for the company.

For more detailed information, please continue to follow Dolphin's detailed interpretation and conference call summary content.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.