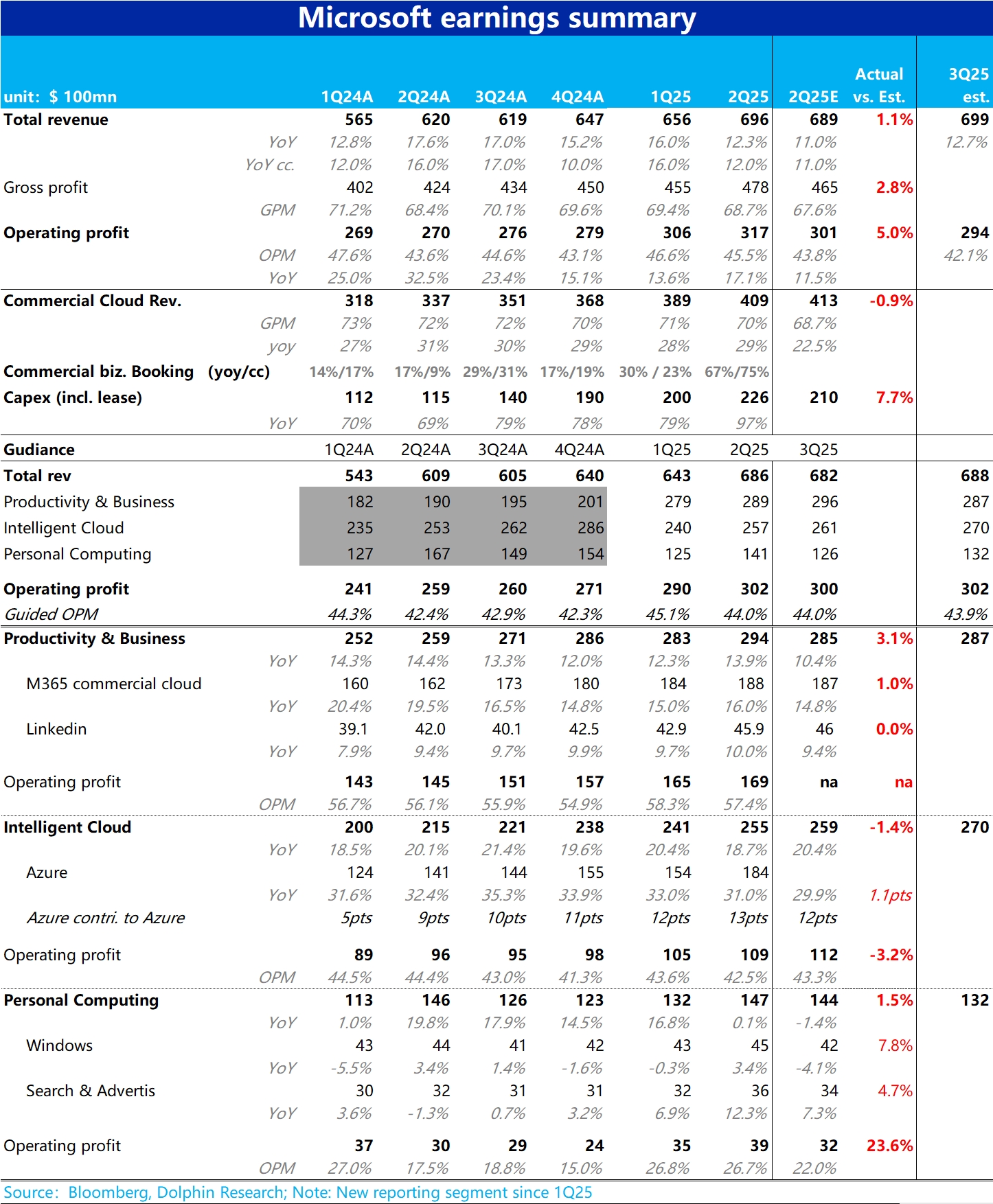

$Microsoft(MSFT.US) 2Q25 Quick Interpretation: At first glance, Microsoft's performance this quarter seems good, with total revenue and operating profit slightly exceeding expectations, and operating profit growing over 17% year-on-year, reversing the previous three quarters of decent revenue growth but declining profit growth. However, upon closer inspection, negative and positive signals are intertwined, making it quite controversial.

First, looking at the negative signals, the main issue is that the core Azure business's growth rate fell short of expectations, with a year-on-year growth of 31% this quarter, at the lower limit of the previous guidance range of 31% to 32%. Although it seems to barely meet the standard, in reality, due to the consensus expectation that Azure will accelerate in the second half of the year, buyers are more optimistic about this quarter's growth expectations, expecting it to be greater than or equal to 32%.

Compounding the problem, the company's guidance for 3Q25 indicates that Azure's growth rate (constant currency) remains in the range of 31% to 32%, meaning it has not accelerated, contradicting the management's guidance during the 1Q conference call that Azure would accelerate in the second half. The core business's performance this quarter and the guidance for the next quarter both missed expectations, which not only shatters the market's generally optimistic "vision" for Azure's improvement but may also shake the market's long-term confidence in Microsoft as the biggest and most direct beneficiary of AI.

Another equally "eye-catching" signal is that the amount of new commercial contracts signed this quarter reportedly surged by 67% year-on-year. In comparison, during the pandemic "dividend" period of fiscal year 2021, the growth rate of new contracts signed by the company did not exceed 40%. Additionally, the company's unfulfilled contract balance reached $298 billion, a year-on-year increase of 34%, which is also higher than the peak during the pandemic. These two indicators seem to point to the fact that although the performance in the short term is not good, the potential performance in the future is quite considerable.

However, overall, the market's reaction focuses more on the actual performance that can be realized this quarter and next quarter, rather than on the "promises" of contracts signed that may not be fulfilled for some time.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.