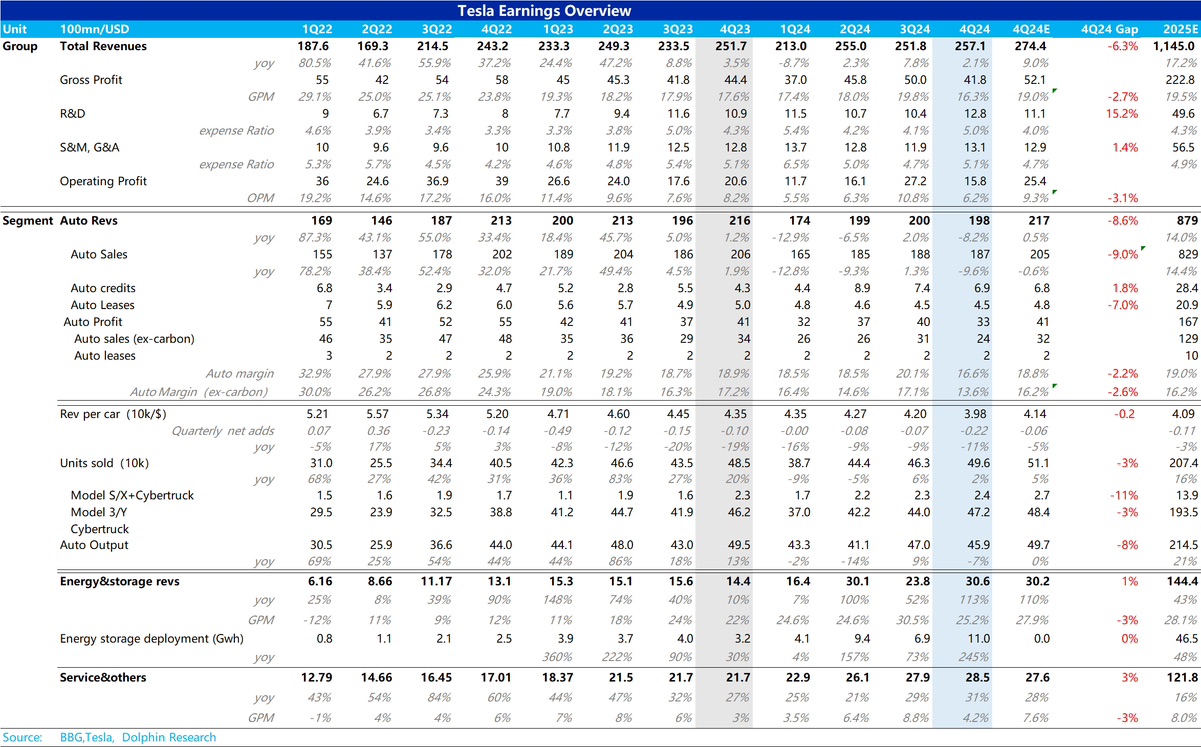

$Tesla(TSLA.US) Flash Interpretation: If we only look at Tesla's performance in the 4Q24 financial report, one word: poor! Overall revenue, gross margin, and operating profit margin are all below expectations!

In the most critical automotive business performance, both automotive revenue and gross margin fell significantly below expectations. The gross margin for the automotive business (excluding carbon credits) has once again dropped to a historical low of 13.6%, even lower than the lowest point of 2Q24's automotive gross margin, and significantly below the BBG consensus expectation of 16.2%.

Upon closer examination of the reasons for the decline, Dolphin found that the main issue lies in the automotive unit price, which experienced the largest month-on-month decline since 2024, dropping from $42,000 in the third quarter to only $39,800 in the fourth quarter! The BBG consensus expectation for the 4Q24 automotive unit price was only a slight month-on-month decline to $41,400.

However, recalling that Tesla did not implement a significant "price-for-volume" strategy in the fourth quarter for its two largest markets (the United States and China) as it did at the end of the previous year, the overall model prices were hardly adjusted, with only an increase in low-interest loan incentives in the U.S. (from a financing rate of 1.99% in the third quarter to a 5-year 0% interest loan rate in the fourth quarter), and a new subsidy of 10,000 yuan for the Model Y starting at the end of November in China.

Although the cost per vehicle was also reduced by $400 month-on-month this quarter, mainly due to savings in variable costs per vehicle (with expected continued month-on-month declines in raw material costs), it still could not save the "collapsed" automotive unit price.

Although the revenue from energy and service businesses slightly exceeded expectations this quarter, it could not compensate for the "big hole" in the automotive business.

However, given that Tesla's fluctuations are already unrelated to the fundamentals of selling cars. For those looking at Tesla's FSD, it doesn't matter how bad it is; at least it can't get worse than this.

Tesla mentioned in the conference call that by 2025, there will be paid, unsupervised full self-driving services in Austin and California, and more cars will be sold. Trump's removal of new energy subsidies is also a positive for Tesla.

In any case, Tesla is the embodiment of AI intelligence and Musk's grand AI dream.

Therefore, after hours, it can be clearly seen that Tesla first fell and then rose, with funds speculating. It seems that those holding long-term dreams do not care at all about how poor Tesla's short-term car sales and deliveries are.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.