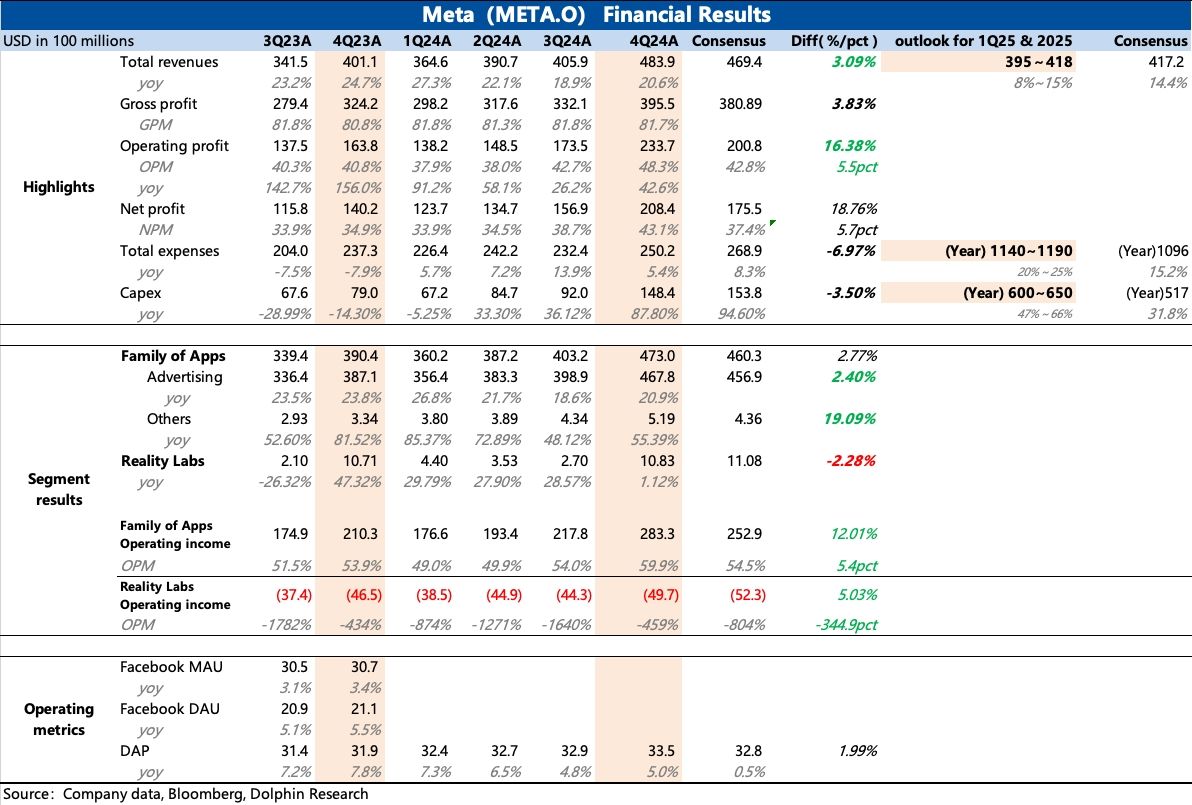

$Meta Platforms(META.US) 4Q24 Quick Interpretation: The current performance in the fourth quarter exceeded expectations, with revenue slightly better than the previously subdued market expectations, while profits exceeded expectations more due to the reversal of some legal expenses. Even excluding the impact of legal expenses, the operating profit margin still increased by nearly 3 percentage points quarter-on-quarter, and the profit margins for each business segment were better than the market anticipated.

The point of contention may lie in the guidance. At first glance, the guidance provided by the company seems to indicate a potential disaster, especially for Q1 revenue (USD 39.5 billion to USD 41.8 billion), which is clearly weaker than Bloomberg's consensus expectation (USD 41.7 billion). However, there are some disruptive factors involved; while it is not a surprise, it certainly cannot be called a disaster:

On one hand, due to channel research from advertisers, Meta's performance in the fourth quarter was average, coupled with the impact of policies on medical advertising, thus market expectations have already adjusted downward somewhat since early January, but Bloomberg's consensus expectation has not fully reflected these short-term changes. For instance, some investment banks actually expect Q1 revenue to be in the range of USD 40 billion to USD 41 billion.

On the other hand, for Meta, which derives half of its revenue from regions outside North America, it is difficult to avoid the impact of the dollar's appreciation this year, but the market may not have fully anticipated this. Excluding the impact of exchange rate fluctuations, the company actually expects Q1 revenue to be in the range of USD 40.5 billion to USD 43 billion, with the median already meeting some leading investment banks' growth expectations under constant exchange rates.

Moreover, the guidance for Opex and Capex also reflects the impact of Bloomberg's consensus expectation adjustments not being timely. The significantly increased Capex, although higher than most investment banks' expectations, is actually within the range of expectations from buyers with more pricing power.

This year, the market's focus remains on whether, with so much investment, in addition to continuing to improve advertising efficiency and increasing new inventory such as Message, Threads, and Marketplace, AI can generate more direct value, such as the application of Meta AI and other AI tools. Additionally, aside from the investment in AI infrastructure, whether the operating expenses of other traditional departments can bring about more effective optimization.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.