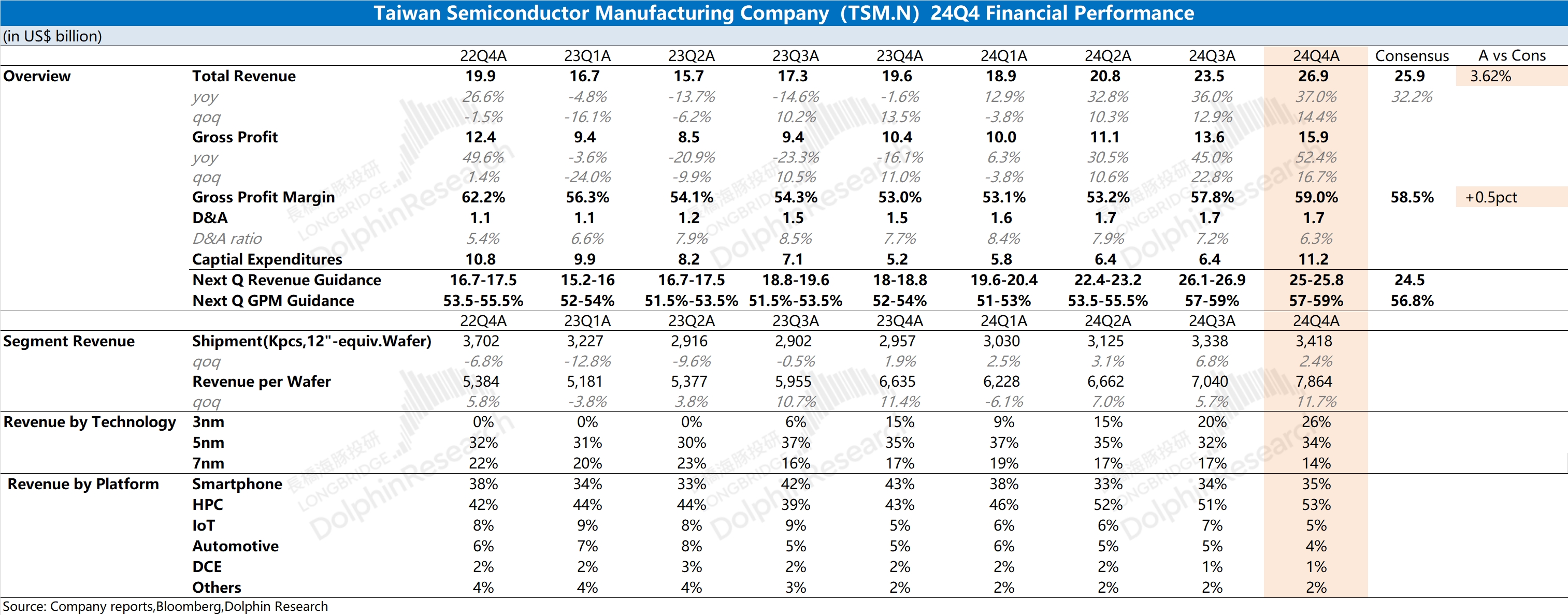

$Taiwan Semiconductor(TSM.US) First take: The company's overall performance this quarter is quite good. Both revenue and gross margin reached the upper limit of the company's previous guidance, mainly benefiting from the shipment of new Apple devices this quarter and the continued demand for computing power chips, which drove the company's chip products to see both volume and price increases this quarter.

In terms of segmented products, the company's 7nm and below process accounted for further increased to 74% this quarter, especially with strong demand for 3nm and 5nm. With Intel transitioning from a competitor to a customer and Samsung struggling to catch up, TSMC currently holds a dominant position in the 5nm and below market.

The first quarter is traditionally the company's off-season, and the company has provided a revenue guidance of $25-25.8 billion and a gross margin guidance of 57-59%, which is actually quite good. Although the company is affected by the seasonal decline in demand for Apple products, the revenue decline is not significant due to the continued demand for computing power chips, and the gross margin can also be maintained at a relatively high level.

Overall, the company's performance is improving as expected, and there are currently no obvious competitors in sight, with the company still maintaining an absolute lead in the advanced process market. For specific financial report commentary and conference call content, please continue to follow Dolphin Jun's subsequent updates.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.