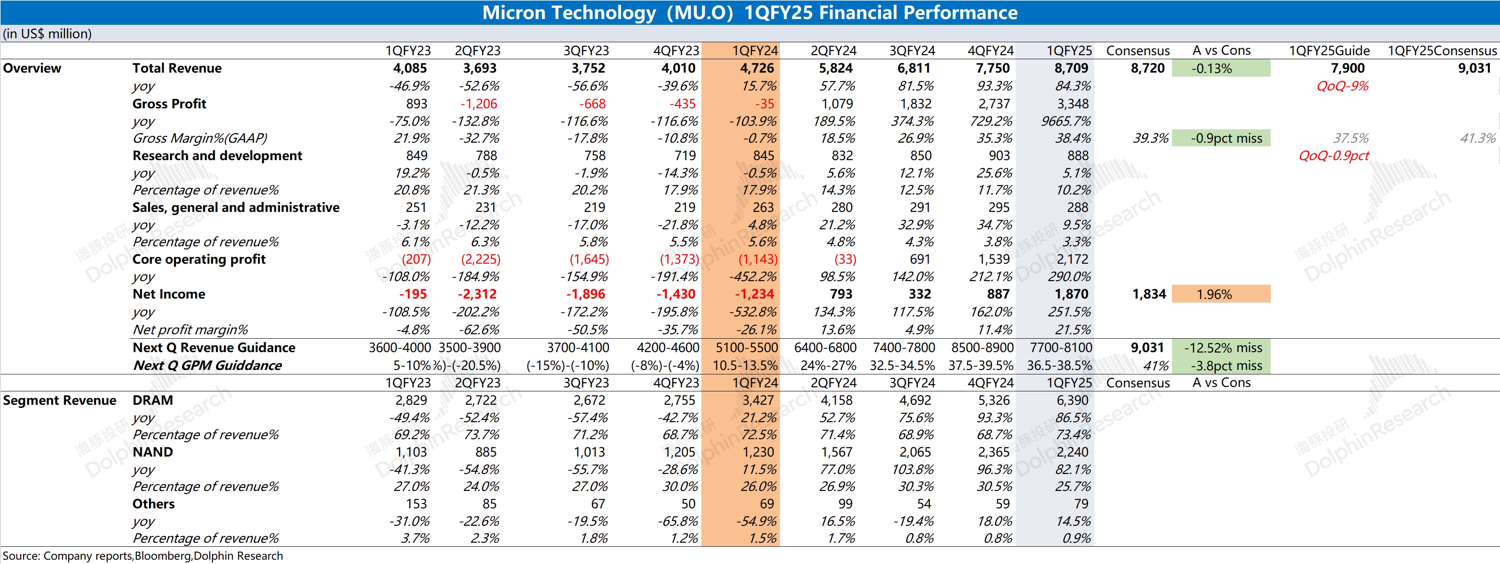

$Micron Tech(MU.US)Quick Interpretation: The company's revenue and gross margin continued to grow this quarter, with the gross margin slightly below market expectations. Although HBM still contributes incremental growth, the company was affected by traditional downstream markets such as smartphones, leading to price declines for some products, which in turn impacted gross margin performance.

By business segment, the company's DRAM business still achieved a 20% quarter-on-quarter growth, with both volume and prices rising driven by HBM. However, the NAND business was significantly impacted by inventory adjustments in downstream markets such as smartphones, automotive, and industrial sectors, resulting in slight quarter-on-quarter declines in both shipment volume and average prices.

Compared to this quarter's earnings report, the company's outlook for the next quarter is more pessimistic. The company expects next quarter's revenue to be between $7.9 billion and $8.1 billion (a 9% quarter-on-quarter decline), below the market consensus of $9 billion. The quarterly gross margin (GAAP) is projected to be between 36.5% and 38.5% (a quarter-on-quarter decline), also below the market consensus of 41.3%. Such guidance will directly affect market confidence in the company's continued recovery in this earnings cycle. For detailed earnings analysis and conference call highlights, stay tuned for follow-up content from Dolphin Research.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.