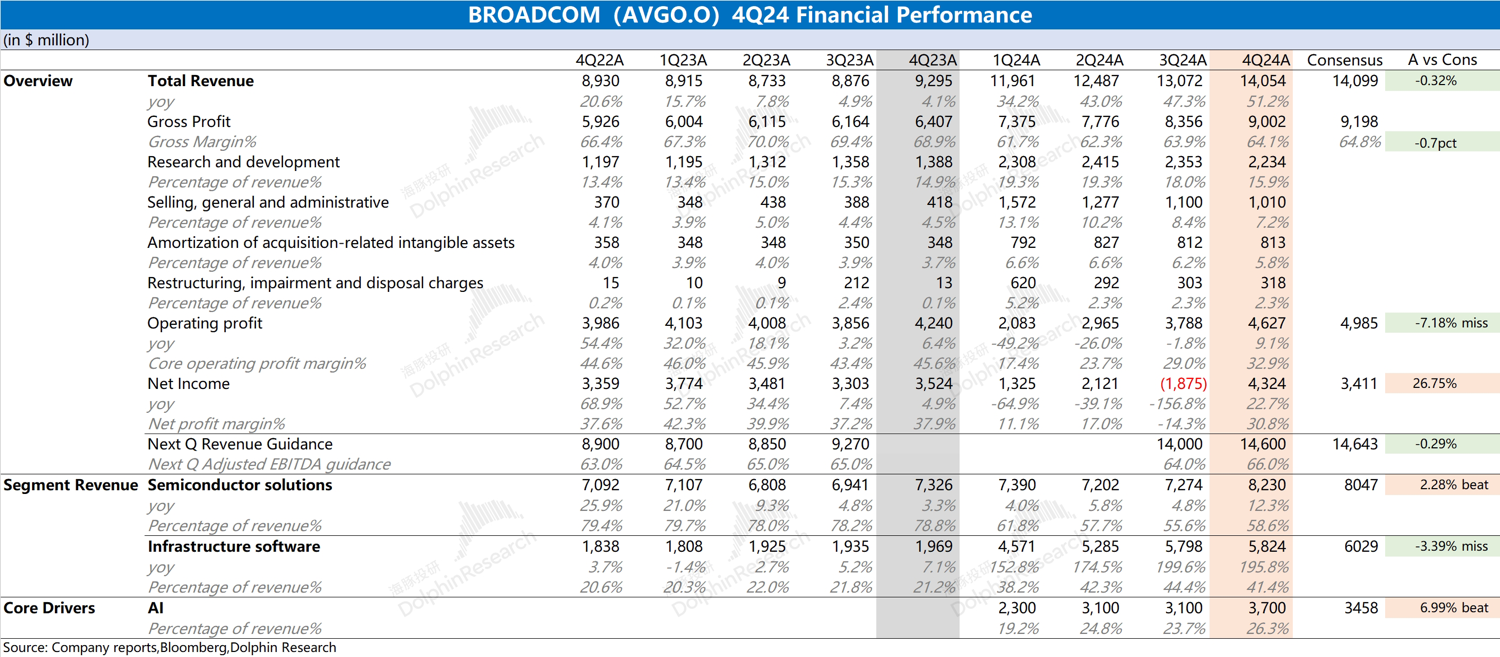

$Broadcom(AVGO.US) Quick Interpretation of earnings report: The company's earnings this quarter were not bad. Driven by AI revenue and VMware integration, the company's revenue and gross margin continued to improve. The growth rate of gross margin slowed down, mainly due to the increased proportion of revenue from the semiconductor business with lower sub-item gross margin this quarter.

In terms of operating expenses, the company continues to control costs. The company's R&D expense ratio and sales and administrative expense ratio this quarter dropped to 15.9% and 7.2%, respectively. The management previously mentioned in communications that they are currently focusing on integrating R&D and related departments during the VMware integration, compressing operating expenses, and thereby improving operational efficiency. Through operational integration, the company's core profit continued to recover this quarter, with adjusted EBITDA% returning to 64.7%.

In this earnings report, Dolphin Research believes there are two main highlights: 1) The company's AI business revenue reached $3.7 billion this quarter, accounting for 26.3% of total revenue, better than the company's previous expectation of $3.5 billion; 2) With the progress of internal integration, while the adjusted EBITDA% improved this quarter, the company's debt repayment ability also recovered, with the relevant ratio (Total Debt/LTM Adjusted EBITDA) dropping to 3.1.

After the release of Broadcom's earnings report, the company's stock price saw a slight increase. The subsequent earnings call further pushed the gain to double digits, mainly driven by the high guidance for AI revenue. The management provided a long-term outlook (by fiscal year 2027, the addressable market for the company's hyperscale customers will reach $60-90 billion), which further strengthened market confidence in the company's AI revenue. For detailed earnings interpretation and call content, please follow Dolphin Research's subsequent updates.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.