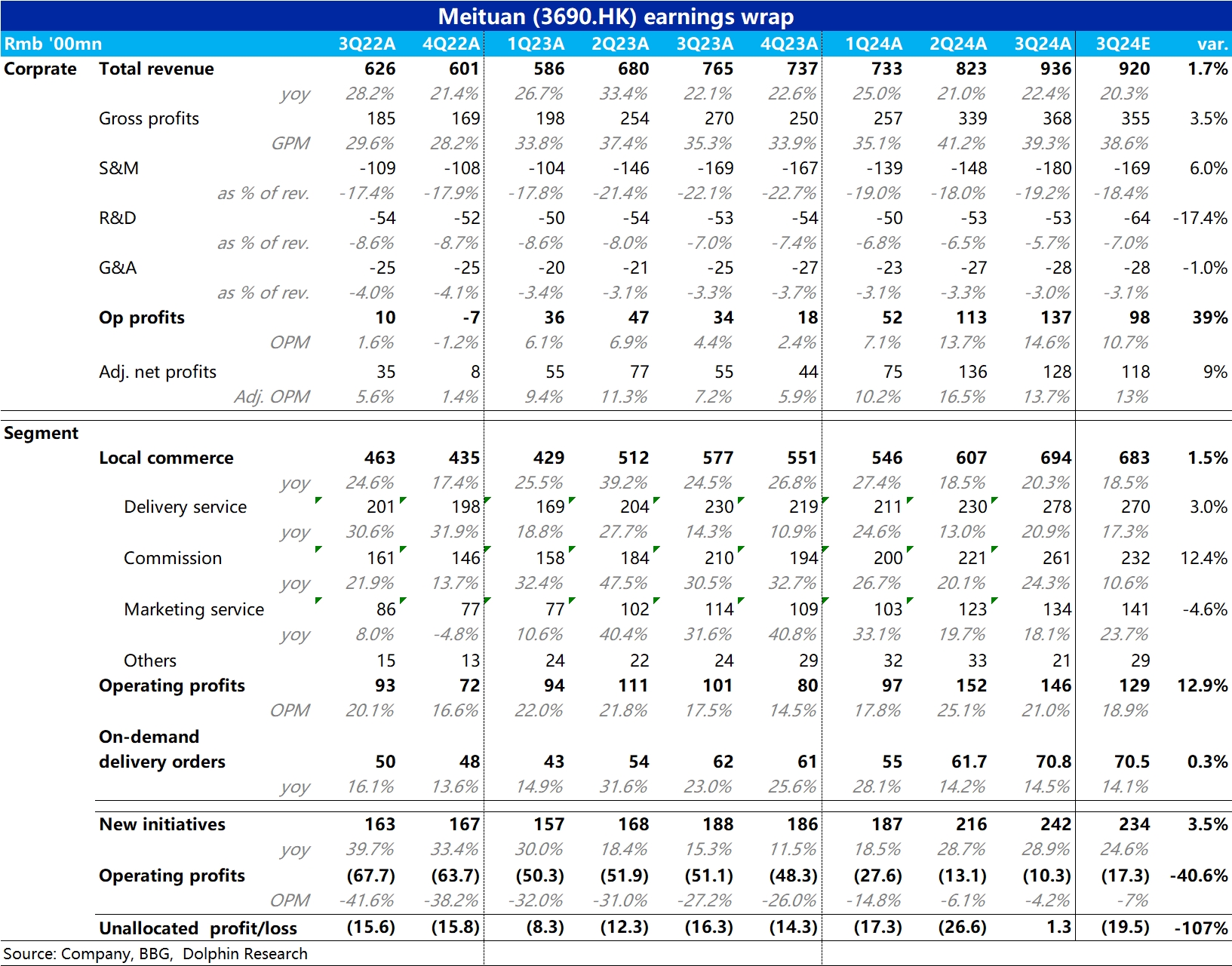

$MEITUAN(03690.HK) 3Q24 Quick Interpretation: At first glance, Meituan's performance this quarter is obviously quite good. Both revenue and operating profit exceeded expectations by nearly 2 billion and 4 billion respectively. Specifically:

1) The core local commerce business saw both revenue and operating profit exceed expectations by approximately 1 billion. Combined with the 14.5% YoY growth in instant delivery orders, which only roughly met expectations, the delivery business revenue accelerated by about 8% QoQ, and the average delivery price stopped falling and rebounded, which should be the main source of the beat. The improvement in delivery UE drove the profit beat. The 18% YoY growth in advertising revenue suggests that the in-store business did not perform particularly better than expected (details still require management's communication in the earnings call).

2) Other innovation businesses also contributed nearly 1 billion in unexpected revenue and reduced losses. According to management, this was mainly due to better-than-expected growth and reduced losses in community retail, led by Meituan Select. However, Dolphin Research learned that buyers' expectations for the losses of new businesses this quarter were not as high as the sell-side expectations shown on Bloomberg.

3) Another major contributor to the group's overall ~4 billion profit beat was the group-level unallocated items, which turned a profit of 130 million this quarter, compared to a sell-side expectation of a 1.95 billion loss, resulting in a ~2 billion expectation gap. However, this was due to Meituan recognizing over 1.5 billion in exchange gains and over 500 million in investment gains this quarter. Such non-recurring benefits need not be taken seriously.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.