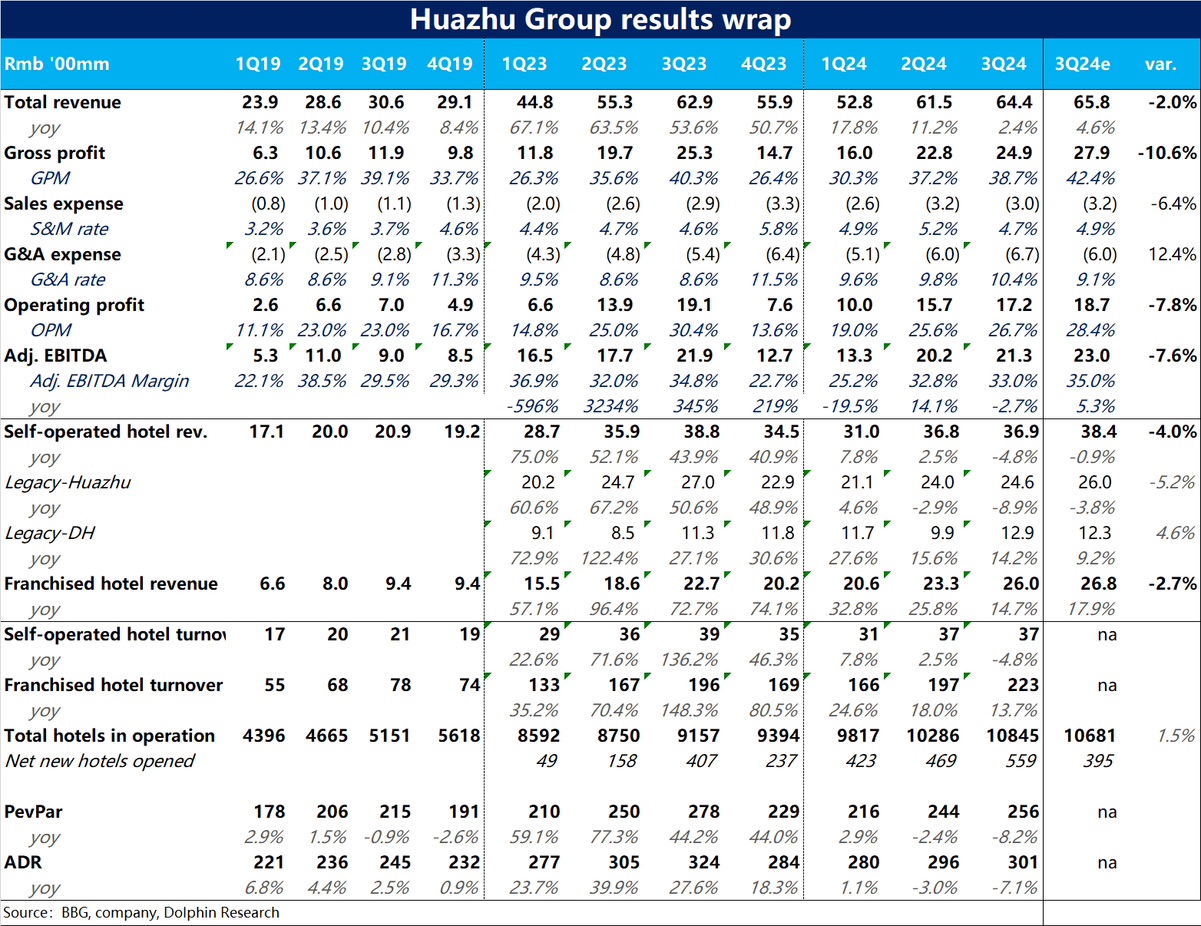

$H World(HTHT.US)3Q24 Quick Interpretation: At first glance, the performance & operational trends shown in Huazhu's financial report are quite poor. Overall, both revenue and profit fell short of expectations.

1) On the revenue side, Huazhu's total revenue this quarter only increased by 2.4% year-on-year, at the bottom of the previous guidance range of 2%~5%, showing a clear slowdown in trend. Although this was dragged down by the closure of Huazhu's self-operated hotels (a net closure of 22 stores), the relatively narrow revenue scope of the accelerated expansion of franchised stores amplified the impact of the self-operated business. In any case, it was a clear underperformance compared to the expected growth of 4.6%.

2) On the profit side, with the increasing proportion of franchise business revenue, gross margin should have shown an upward trend. The market expected this quarter's gross margin to increase by about 2pct year-on-year, but it actually fell by 1.6pct. This resulted in gross profit being about 10% lower than expected. Cost control was also not outstanding compared to expectations, leading to profits falling short of expectations and showing negative year-on-year growth.

This quarter's performance was disappointing on both fronts. The company's revenue guidance for the next quarter is 1%~5%, also below the current consensus sell-side expectation of about 6% growth. If the poor performance in 3Q was due to the high base from last year's summer vacation and the unfavorable macro environment this year, for 4Q, the market mainly believes that demand during the National Day holiday has recovered somewhat, so growth was expected to improve. However, the company's guidance indicates further decline in growth, which is obviously another piece of bad news.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.