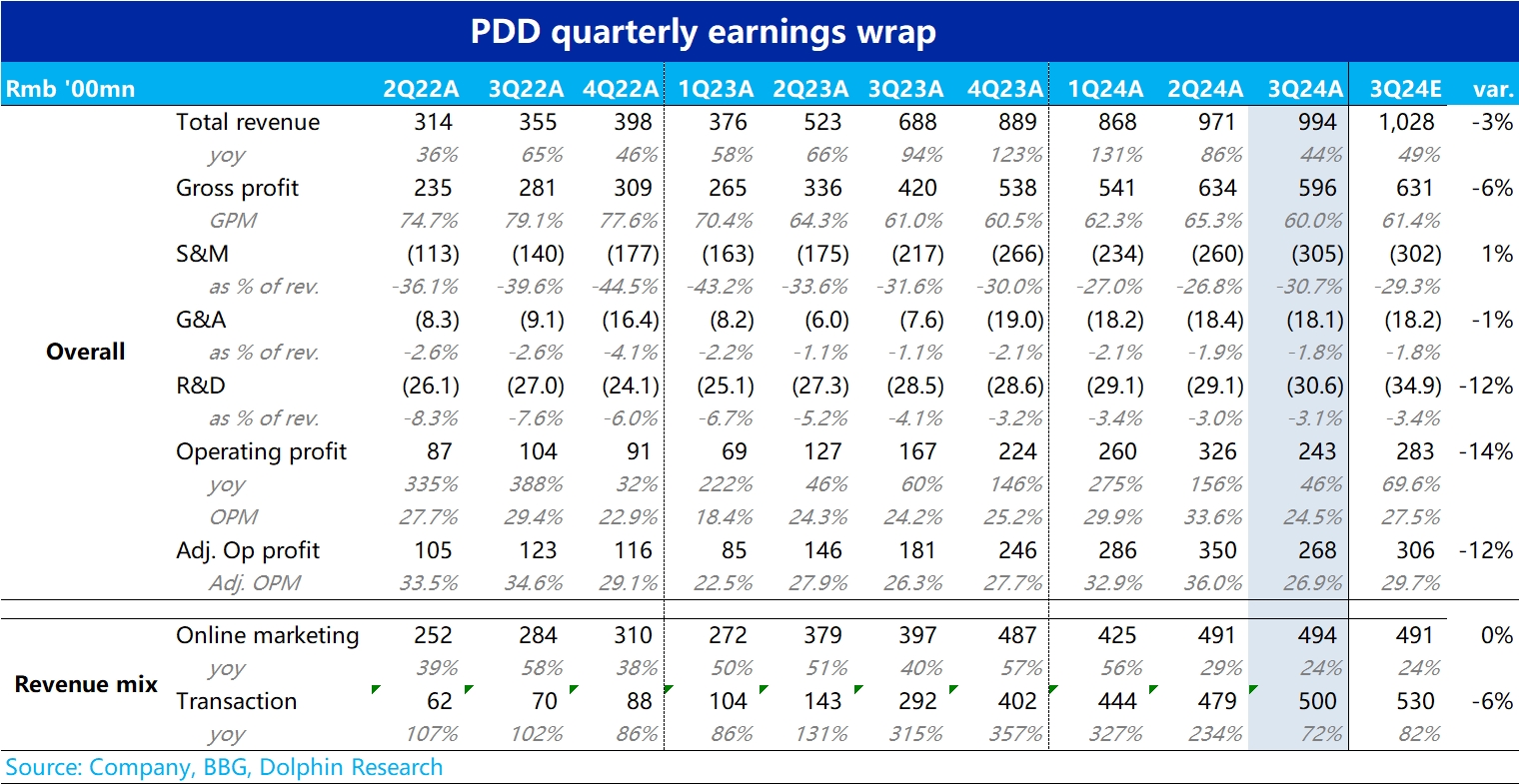

$PDD(PDD.US) 3Q24 earnings Quick Interpretation: At first glance, Pinduoduo's earnings report this time can be described as a double miss in both revenue and profit, comparable to the last bomb.

1) Specifically, the growth rate of the most critical core advertising revenue was 24%, completely in line with market expectations, and there was no bomb, which is crucial. However, the trend still indicates that the company's take rate improvement is quite limited. The advertising growth rate is rapidly converging with the GMV growth rate.

2) The miss in revenue came entirely from commission income, which was actually 50 billion, 3 billion less than expected. Dolphin Research's first reaction was that it might still be caused by the Temu business, where revenue is difficult to accurately grasp. However, considering that gross profit was also about 3 billion less than expected, we believe the actual miss was in the commission income of the main platform. Recent promotions of "subsidies" for merchants may have been reflected in the decline of the main platform's commission income through reduced commission rates or rebates. Since the marginal cost of this part is almost unrelated to revenue, the marginally reduced revenue was entirely converted into marginally declining gross profit.

3) In terms of operating expenses, marketing spending increased significantly to 30.5 billion, but it was roughly in line with expectations. Although the growth was not as expected, the acceleration in marketing spending is obviously not good news, but at least it was within expectations and cannot be called a "bomb".

4) Ultimately, the extent to which commission income fell short of expectations was fully transmitted to gross profit and then to the miss in operating profit.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.