$NVIDIA(NVDA.US)Quick Interpretation: The company's earnings report was quite good this time.

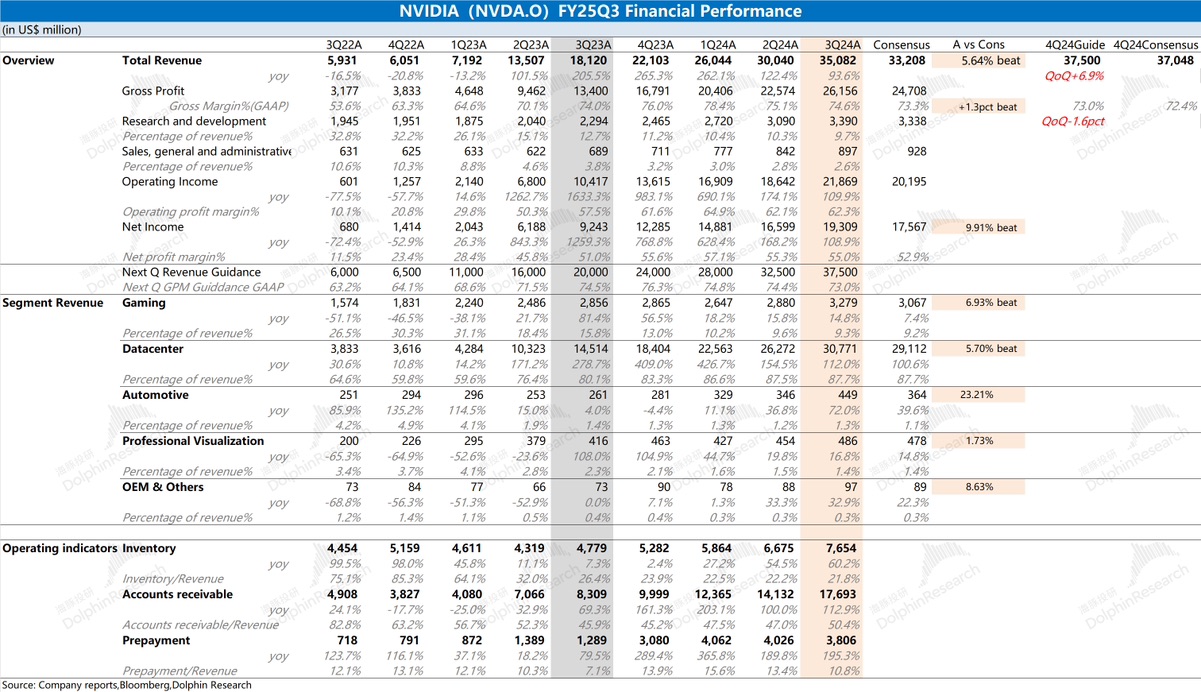

Revenue continued to beat guidance by +$2 billion, and gross margin also met expectations. All of the company's businesses showed varying degrees of growth this quarter, with data center and gaming contributing significantly to the incremental growth. As downstream cloud providers continue to increase capital expenditures, the company's data center business has grown to over $30 billion, accounting for nearly 90% of total revenue. Despite the absolute increase in R&D and sales expenses due to business expansion, the expense ratio continues to decline. Overall operating expenses remain healthy.

After achieving the usual guidance beat of +$2 billion, the market is more focused on the company's next-quarter guidance. For the next quarter, the company expects revenue of $37.5 billion and a gross margin of 73%. The performance will be primarily driven by the mass production of Blackwell, though the initial ramp-up may have some impact on gross margins. The overall guidance and pace are in line with market expectations.

In summary, Nvidia's current performance is mainly focused on its data center business, which is heavily influenced by procurement from downstream cloud providers. Based on the capital expenditure expectations of the four major cloud providers, combined capital expenditures are still expected to grow next quarter. The company remains unaffected by its main competitors—AMD's guidance for its related products is weak, while Nvidia has raised its guidance again this quarter, demonstrating its leading product capabilities. With the shipment of Blackwell, the company is expected to further widen its gap with competitors. Going forward, it is recommended to pay attention to the conference call for updates on Blackwell's shipment expectations, progress in the PC segment, and the company's outlook for the data center business.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.