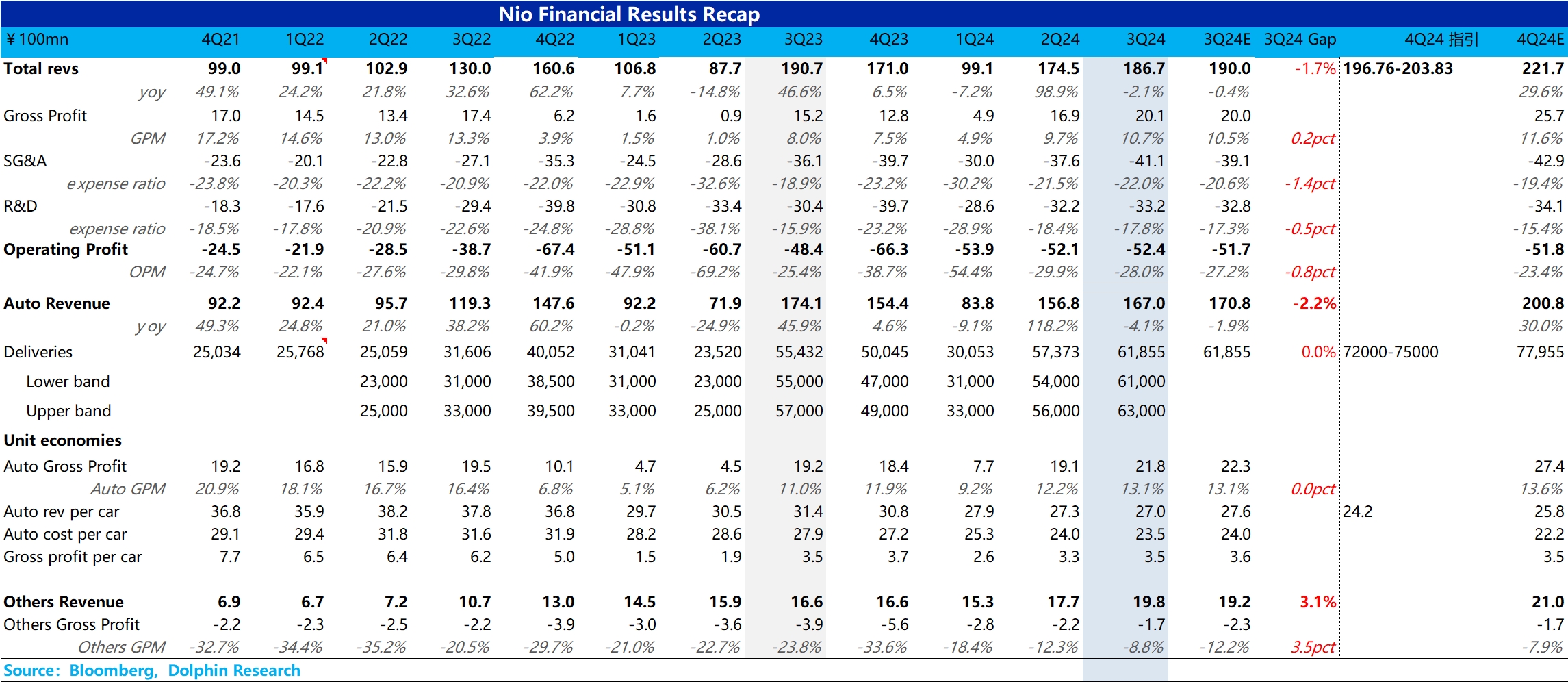

Judging from the third-quarter performance alone, $NIO(NIO.US) fell short of expectations.

Although the automotive gross margin improved due to cost reductions, barely meeting market expectations, the average selling price of vehicles continued to decline this quarter. The low-priced Onvo L60, delivered only at the end of September, had little impact on the third-quarter average price.

However, the final average selling price for the third quarter was only 270,000 yuan, below the market expectation of 276,000 yuan and the implied price of 282,000 yuan in Nio's previous revenue guidance. This reflects Nio's further increase in promotional efforts for its main brand, consistent with Dolphin Research's findings that Nio ramped up promotions for its main brand NIO in September.

Although Nio had previously communicated that third-quarter selling and administrative expenses would continue to rise due to increased store openings and marketing investments for Onvo, the 4.1 billion yuan in selling and administrative expenses still exceeded market expectations by about 200 million yuan, resulting in operating losses higher than anticipated.

Looking at the guidance for the next quarter, the sales guidance of 72,000-75,000 vehicles is also below the market expectation of 78,000 vehicles, implying average monthly sales of 25,500-27,000 units in November and December. With Onvo expected to contribute around 8,000 units per month in the next two months, this implies that monthly sales of the main NIO brand have declined from the previous steady state of 20,000 units to about 17,500-19,000 units.

Even more disappointing is the revenue guidance for the next quarter, which implies a further quarter-on-quarter decline of 28,000 yuan in the average selling price to 242,000 yuan, still below the market expectation of 258,000 yuan. While the market has already factored in the impact of the low-priced Onvo's volume ramp-up in the fourth quarter, the price guidance remains below expectations, reflecting Nio's further increase in promotional efforts for its main NIO brand, consistent with Dolphin Research's findings of intensified promotions in November.

Despite Nio's increased promotional efforts for its main NIO brand, combined with the implied decline in monthly sales of the main brand in the sales guidance, such performance during the traditional peak sales season of November and December is clearly below expectations. On one hand, this reflects a reduction in the backlog of orders for the main NIO brand; on the other hand, it shows that price cuts still fail to boost sales of the main brand.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.