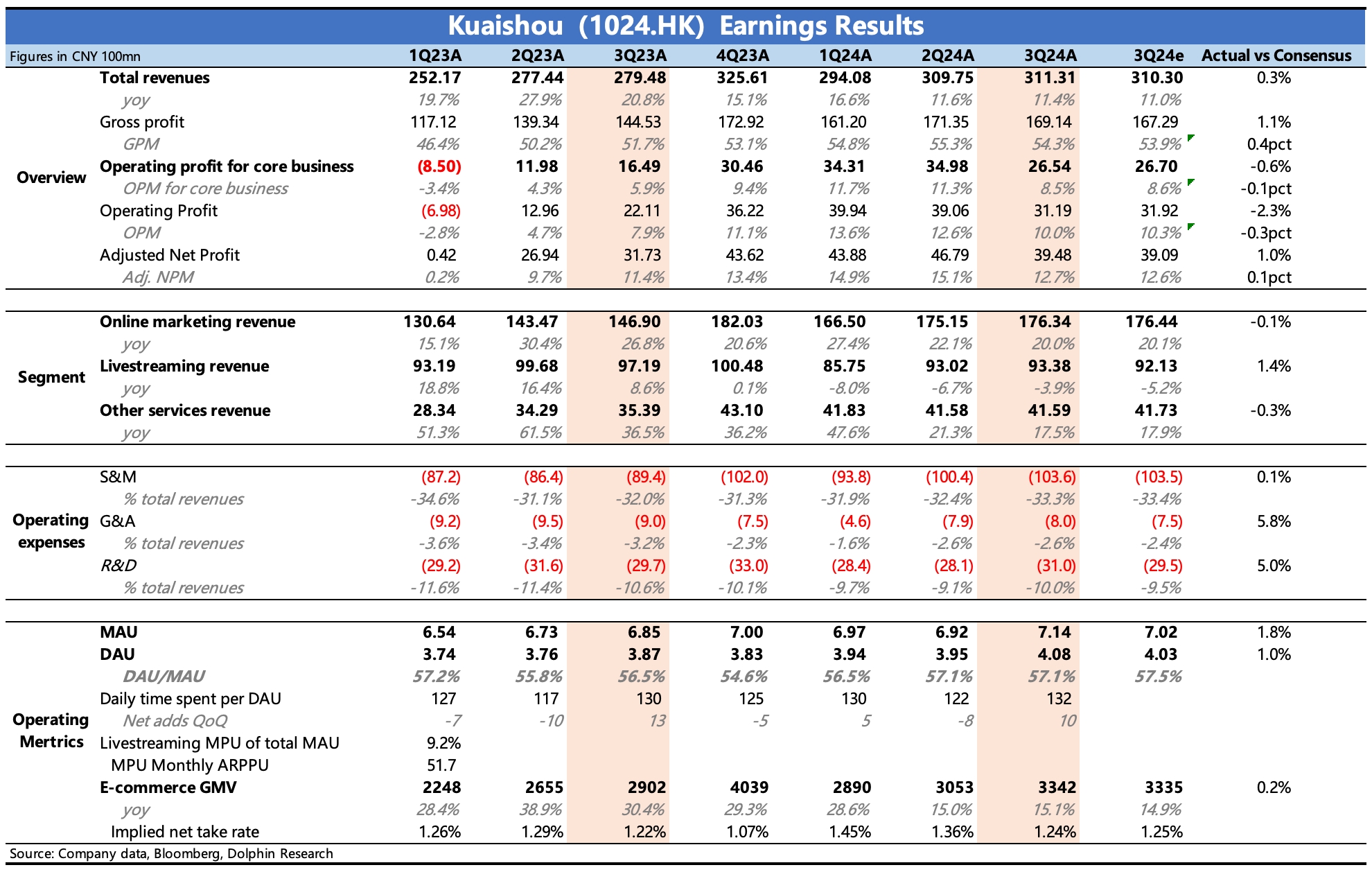

$KUAISHOU-W(01024.HK) Q3 earnings Quick Interpretation: The Q3 financial report was smoothly released. As the company's guidance was quite clear and communication had been made during the September Investor Day, the final performance was largely in line with expectations.

(1)The Olympics + peak customer acquisition season contributed to strong user metrics in Q3. This differs somewhat from external third-party tracking trends, making it a small positive surprise.

(2)Outer-loop advertising continued to recover as expected, with incremental growth mainly in high-demand sectors like short dramas, competitive e-commerce, and local services.

(3)E-commerce off-season + competition from traditional shelf-based e-commerce impacting live-streaming e-commerce led to a marginal slowdown in the growth of e-commerce and inner-loop advertising.

(4)Due to Olympics-related content inclusion, increased marketing expenses in customer acquisition and local services, as well as AI-related cost recognition pushing up R&D expenses, Q3 profit margins and absolute profit figures declined sequentially.

Overall, although Kuaishou is a short-video platform and actively exploring multiple growth avenues—local services, short dramas, gaming, online recruitment, etc.—its short-term performance remains heavily tied to e-commerce, particularly trends in KOL live-streaming e-commerce. With Q3 earnings already fully anticipated, management guidance becomes crucial. It is recommended to focus on the management's discussion of Double 11 performance and next year's e-commerce outlook during the upcoming conference call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.