$Vipshops(VIPS.US)3Q24 Quick Interpretation: At first glance, Vipshop's performance this quarter was as bad as expected, which the market had already fully anticipated. At the current price and fundamentals, investment funds are more focused on shareholder returns.

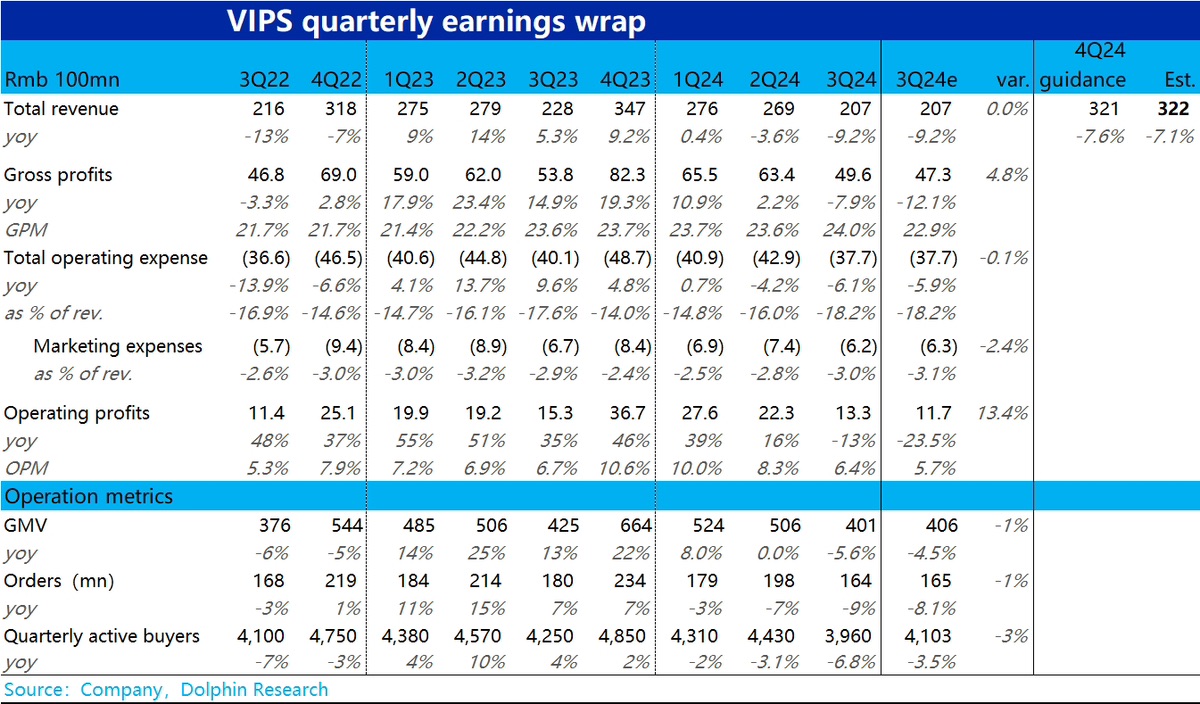

1) Core operating metrics—user count, order volume, and GMV—all showed mid-to-high single-digit negative growth. Facing a tough competitive environment, Vipshop, as the "little brother" in the industry, is under pressure from user attrition.

2) Due to the decline in operating metrics, revenue fell by approximately 9% YoY, nearing the lower end of the previously guided -5%~-10% revenue decline range. This is clearly weak performance, but the market had already priced it in. The company also guided a -5%~-10% revenue decline for 4Q, with the midpoint of the guidance fully in line with expectations, indicating the market has already anticipated continued pressure on Vipshop's revenue in 4Q.

3) The only silver lining is that Vipshop's gross margin this quarter did not decline YoY as widely expected due to lower average order value or subsidies. Instead, it actually increased slightly by 0.4pct. As a result, actual gross profit was over 200 million higher than expected, translating to operating profit being 160 million higher than expected. However, YoY, operating profit still declined by 13%.

4) This quarter, Vipshop repurchased $275 million, slightly higher than the previous quarter. If 4Q maintains a repurchase volume of over $200 million, the annual repurchase would yield at least a 9% return relative to the current market cap, placing it among the top tier of direct shareholder returns among Chinese concept assets.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.