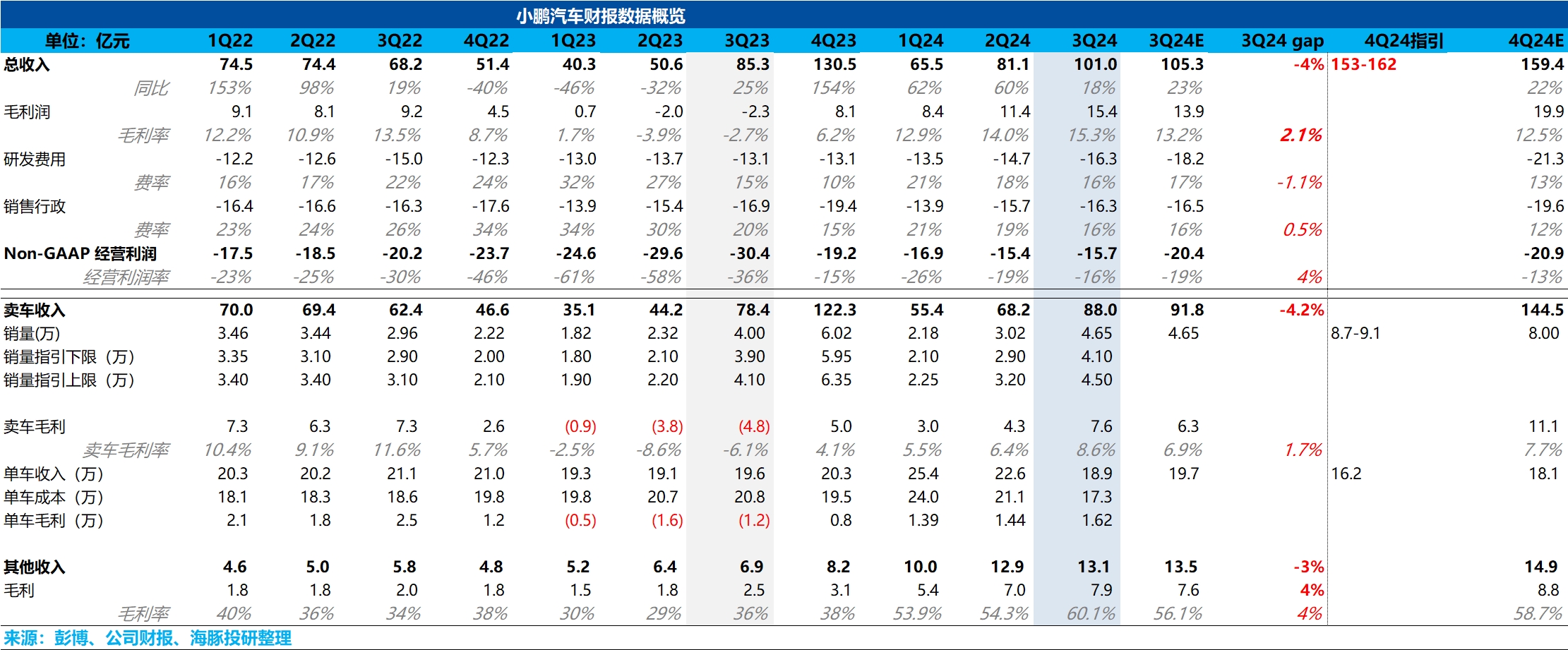

$XPeng(XPEV.US) Quick Interpretation: In one word, not bad. The most crucial info—the company's gross margin rose from 14% in Q2 to 15.3%, while the market originally thought the delivery of the cheaper new model M03 would hardly boost the auto business's gross margin.

The key to this beat lies in the gross margin exceeding market expectations. Breaking it down by segment:

1) Auto business: Although the lower-priced, lower-margin Mona M03 accounted for a higher proportion, the cost reduction this quarter was even greater. On one hand, the P5 impairment (discontinued in Q2) dragged down Q2 auto gross margin by ~3.2 percentage points, but the impairment impact in Q3 is expected to be minimal. On the other hand, it’s likely due to the higher proportion of overseas models this quarter. As a result, while the M03 did drag the average selling price back below 190k, auto gross margin rose by 8.6%, a decent rebound.

2) Other businesses: Besides the Volkswagen tech licensing fees based on the G9 platform, Q3 also saw the recognition of EEA architecture tech licensing fees. Higher-margin tech R&D service revenue further drove the gross margin beat.

For next quarter’s guidance, with current weekly sales known, the max quarterly delivery guidance of 91k units is reasonable. Overall, the auto gross margin improvement is the real positive here.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.