$TRIP.COM-S(09961.HK)3Q24 first take: This quarter, Trip.com continued to deliver solid performance,

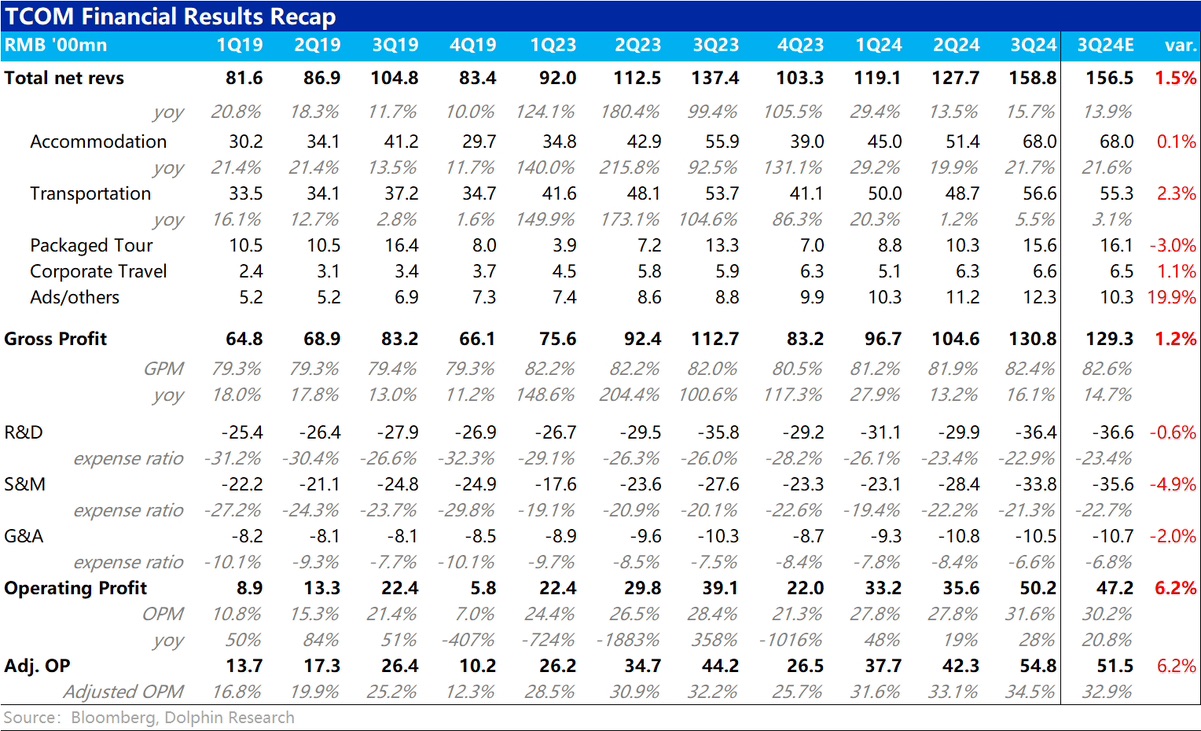

1) Driven by the rapid recovery of outbound and inbound travel business (order volume rebounded to 120% of 2019 levels) and pure overseas business (air and hotel bookings increased 60% YoY), Trip.com's revenue grew 15.7% this quarter, accelerating from the previous quarter and exceeding the company's guidance and market expectations of around 13%~14% growth.

2) From a profit perspective, Trip.com's operating profit excluding SBC was 5.48 billion yuan this quarter, with a profit margin of 34.5%, up from 33% last quarter. Dolphin Research believes that the increasing proportion of high-value, high-conversion-rate, and high-margin overseas business should be the main contributor to the improved profitability. Compared to the company's guidance of approximately 5.3 billion yuan in profit and a 33% profit margin, the actual results slightly beat expectations.

Overall, the trend shows that revenue growth is accelerating and profit margins are further expanding, driven by outbound & overseas business, indicating that the company is still in its best "times." However, we can also see that compared to the company's guidance after the last earnings report, the magnitude of this quarter's actual performance beating expectations is not significant.

Trip.com is one of the few stocks that has seen almost no pullback since the major rebound at the end of September. According to Dolphin Research's estimates, the market capitalization at that time corresponded to about 15x PE for 2025 GAAP net profit. In the medium to long term, we believe that Trip.com achieving around 10% revenue CAGR and 15% profit CAGR is already a fairly good expectation, and the current valuation is at least neutral. Therefore, for the stock price to continue rising, significantly better-than-expected performance or guidance is needed to drive the market to further raise future profit expectations. Looking solely at the 3Q results, the effect on driving the market to raise expectations is relatively limited, and more attention should be paid to the company's guidance for 4Q, especially for outbound & pure overseas business.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.