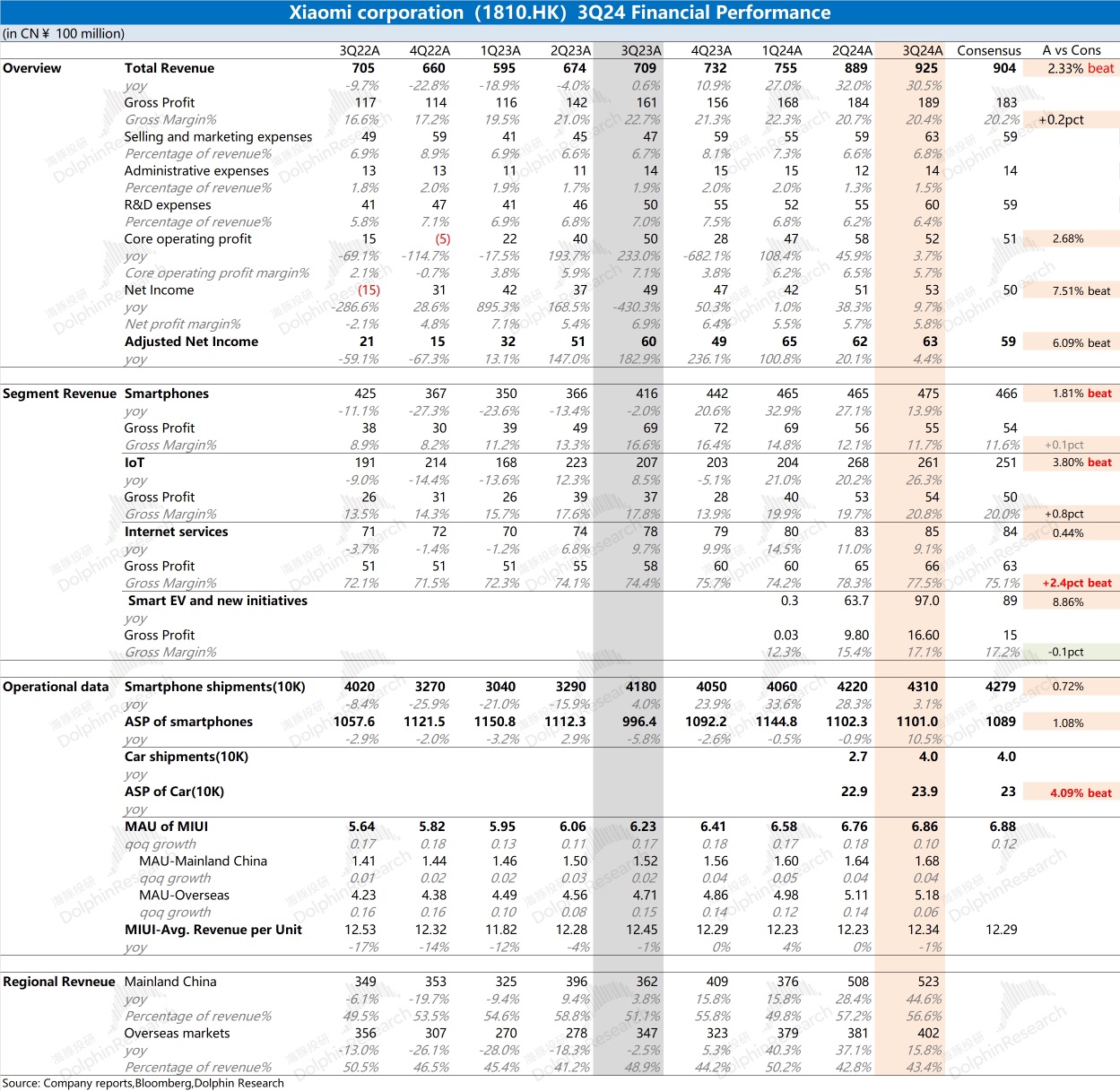

$XIAOMI-W(01810.HK)First take: The Q3 performance was quite good. Especially, the company's revenue performance exceeded market expectations, with a year-on-year growth rate reaching 30% again.

Traditional hardware business showed significant improvement: Both volume and price of smartphones increased this quarter, with the company's average selling price stabilizing around RMB 1,100. The IoT business has improved markedly this year, achieving 20% year-on-year growth for three consecutive quarters. Driven by subsidies like "trade-in programs," the growth rate of Xiaomi's IoT business is expected to remain above 20%.

Xiaomi's EV business: After ramping up, the company's current monthly delivery volume has exceeded 20,000 units. Although the delivery data was already digested by the market, the average selling price per vehicle this quarter still significantly outperformed market expectations. The average selling price this quarter reached RMB 239,000, better than the previous expectation of RMB 230,000.

Internet services business: Although the growth rate has slowed, the gross margin remains around 78%, mainly due to the increased proportion of advertising revenue. The company's global MAU has now grown to 686 million, and under the influence of scale effects, advertising revenue continues to rise.

With the growth in sales of EVs and related products, the company's sales and administrative expenses have increased, but the overall operating expense ratio remains relatively stable. Dolphin Research believes that with the steady recovery of the smartphone business and the boost from subsidies in the IoT segment, along with the increase in EV deliveries, Xiaomi's performance growth next quarter is relatively certain. Based on the company's past performance, even impressive earnings reports may lead to a "high-open, low-close" trend. However, given the current strong certainty of performance growth, if the stock price experiences another significant pullback amid the momentum in IoT and EV businesses, it might present a better investment opportunity.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.