$Alibaba(BABA.US)2Q25 first take: Alibaba's performance this time can be said to be not good:

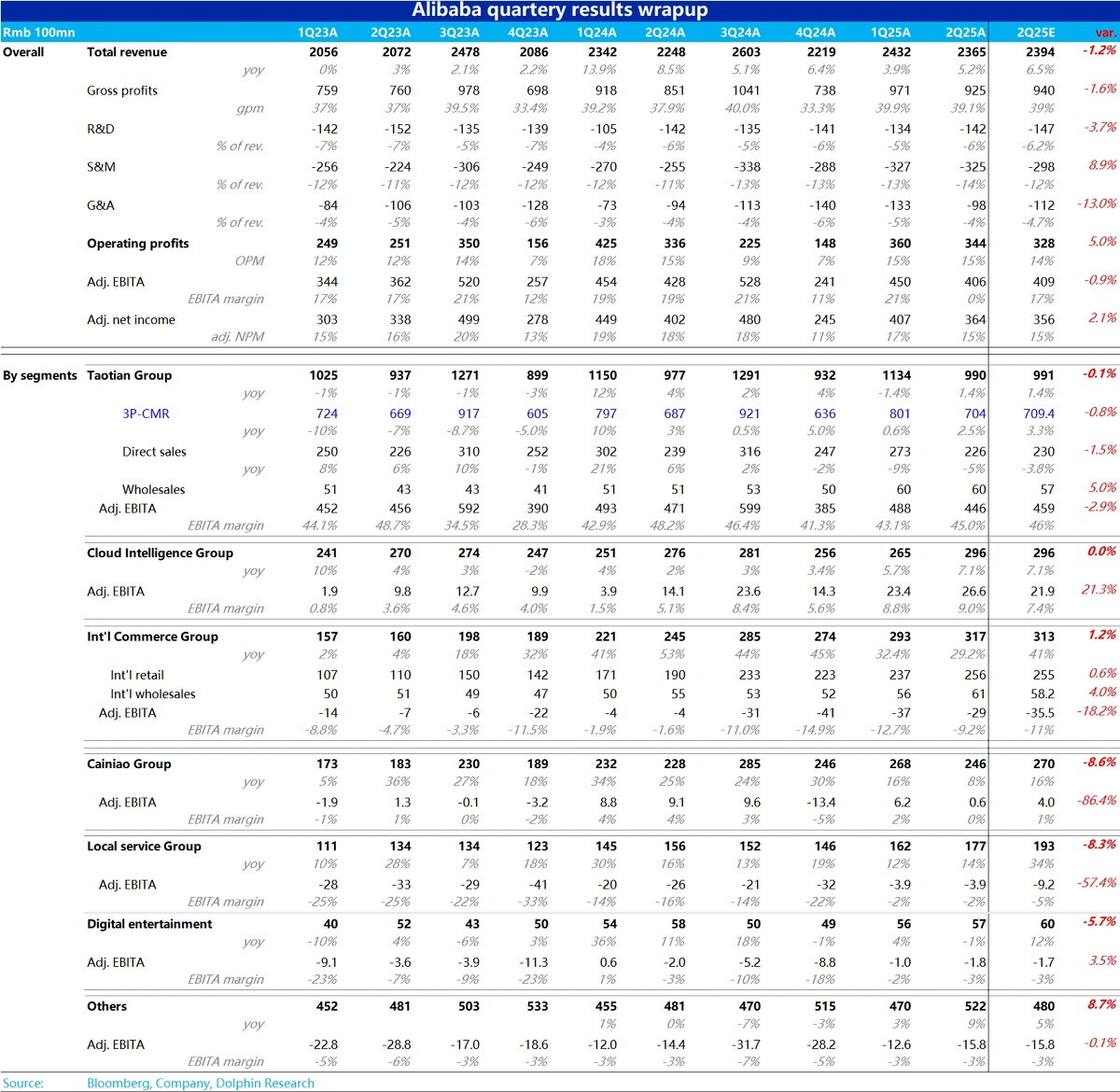

1) For the core Taotian business, CMR increased by 2.5% YoY, which improved compared to the previous quarter but slightly missed the expectation of around 3%. Taotian Group's adj. EBITA fell by 5.3% YoY, with the decline widening compared to the previous quarter. The actual figure was also nearly 3% lower than the market consensus. It can be seen that the core Taotian business was comprehensively below expectations.

2) For the second most important business, Alibaba Cloud's revenue increased by 7.1% YoY, continuing to accelerate, but it was completely in line with expectations, with no surprises. The adj. EBITA margin improved by 0.2 pct QoQ, showing continued margin improvement. The performance was good but not outstanding.

3) The performance of international e-commerce was similar, with revenue growth and progress in reducing losses slightly better than expected, but the beat was not significant. The remaining businesses generally missed revenue expectations.

Therefore, with the core Taotian business missing expectations in both revenue and profit, and the second and third most important businesses—cloud and international e-commerce—performing decently but without major surprises, the group's overall revenue underperformed expectations, and the profit side could at best be described as in-line. However, the market's pre-market reaction was an increase. One reason is that currently, there is a clear trend in Chinese stocks where stock prices move opposite to earnings performance after positive/negative news is priced in. Another perspective is that Alibaba has basically returned to the price level before the significant rebound in Chinese assets at the end of September, unlike JD.com or Bilibili, which still had considerable profit-taking potential before earnings. Therefore, the pre-market rise can only be described as another typical case of "expectation gaming."$BABA-W(09988.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.