$ZEEKR Intelligent Tech(ZK.US) earnings first take: For ZEEKR, in addition to the Q3 earnings release, there is news that ZEEKR is about to merge with Lynk & Co, with ZEEKR planning to acquire a 51% stake in Lynk & Co.

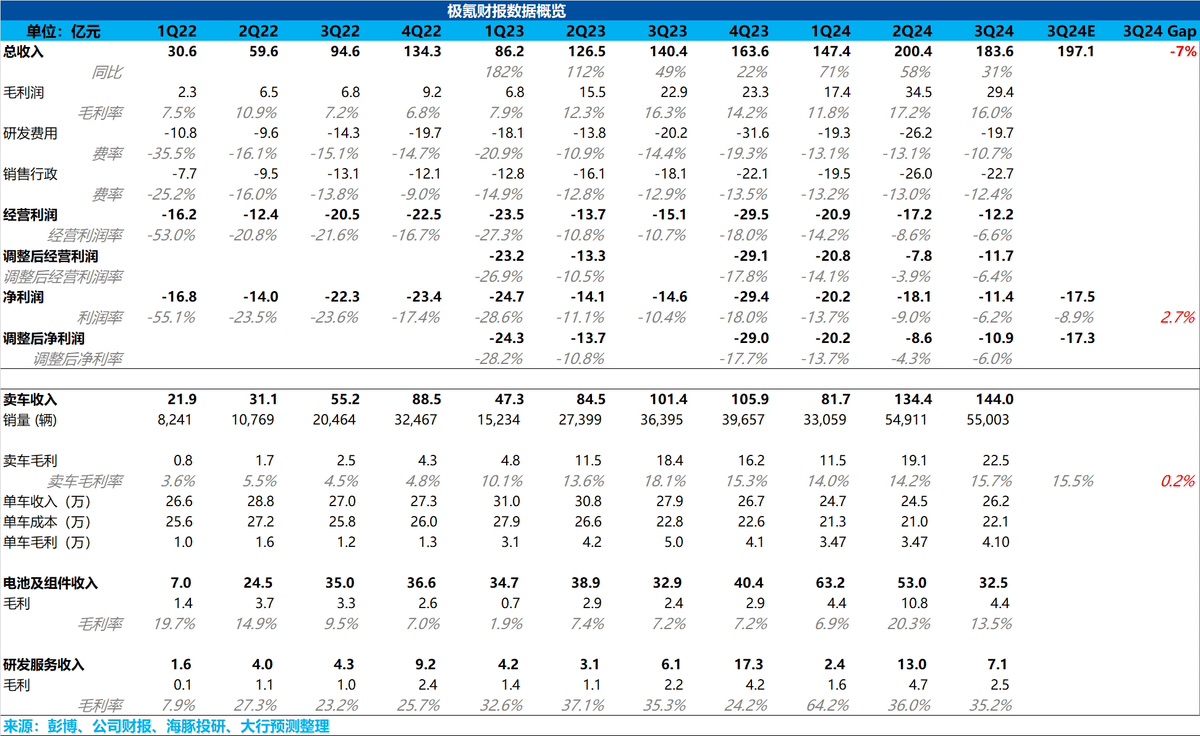

1) Looking solely at Q3 performance, for ZEEKR's most important vehicle manufacturing business, the automotive segment's gross margin was 15.7% in Q3, which is not far from the market expectation of 15.5%. The sequential improvement was mainly due to the increased proportion of the high-priced, high-margin facelifted ZEEKR 009, rising from 2.7% in Q2 to 15.6% in Q3. Overall, the performance was largely in line with market expectations.

2) From the perspective of the planned acquisition news, Dolphin Research believes that ZEEKR's acquisition of Lynk & Co is definitely good news for ZEEKR. Due to the overlapping product positioning, price ranges, and user demographics between ZEEKR and Lynk & Co in the past, the brands were in competition, leading to mutual erosion of sales.

After the acquisition, since ZEEKR is more adept at building pure electric vehicles while Lynk & Co excels in hybrid models, the merger is intended to create synergies between the businesses and avoid potential sales erosion. The specific collaboration approach may require further explanation from management during the earnings call.

However, judging by today's stock price surge, ZEEKR has already rallied by 12 points, indicating that the merger news has been communicated to the market in advance. ZEEKR's transaction values Lynk & Co at approximately $2.5 billion. Since ZEEKR is acquiring a 51% stake, the transaction price accounts for about 20% of ZEEKR's pre-rally market cap. The 7-point gap may be due to: ① the merger news being priced in earlier by the market, and ② differing market valuations of the Lynk & Co brand.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.