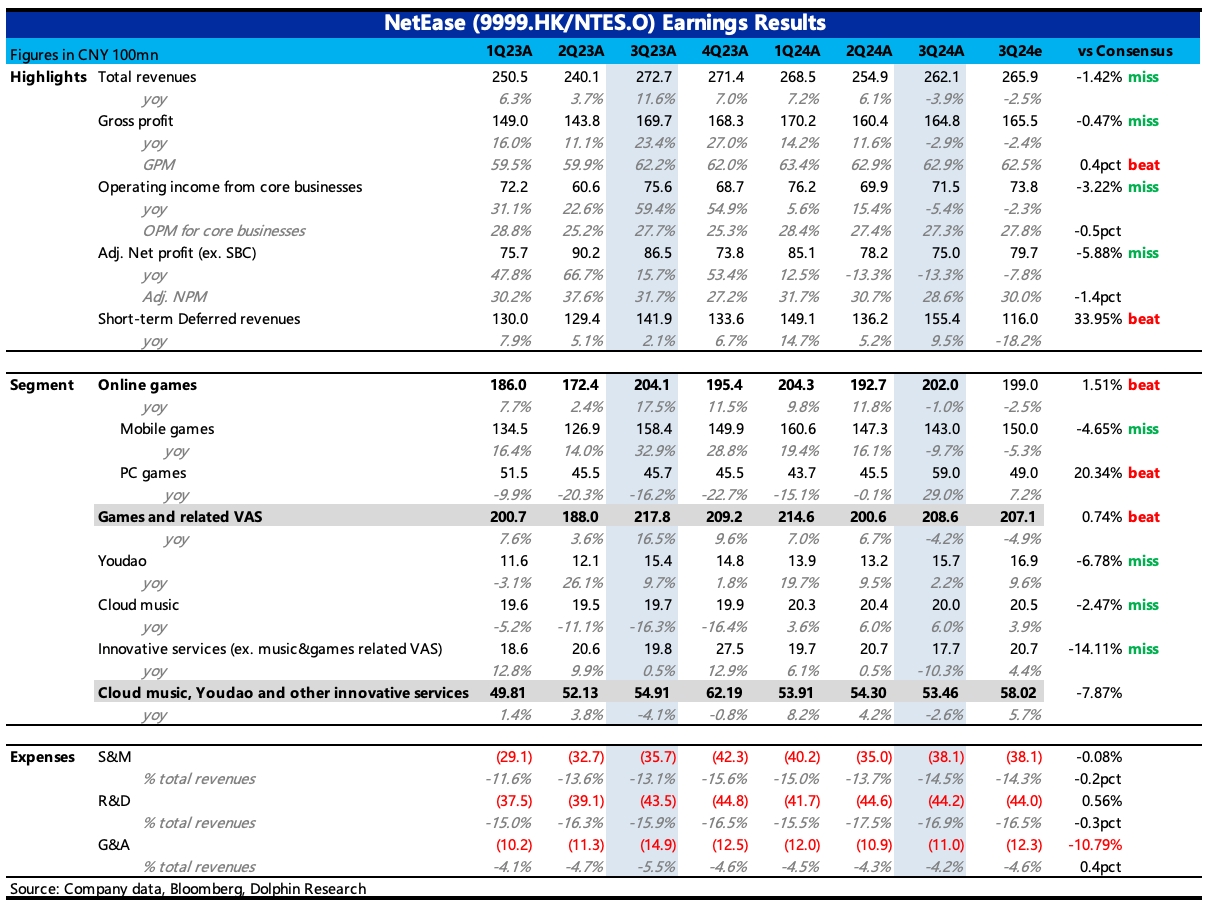

$NTES-S(09999.HK) first take: The Q3 performance looks quite poor from the financial report, mainly due to the lack of new products we've been talking about and the drag from old games affected by regulation and natural decline. These two major factors contributed to the results. Additionally, last year's base was also very high, and the market had some expectations for Q3 pressure, but the actual impact was slightly worse than expected. Fortunately, the release of "Naraka: Bladepoint Mobile" and the return of "World of Warcraft" and "Hearthstone" helped recover some revenue, driving a 14% quarter-on-quarter increase in deferred revenue for Q3.

On the bright side, NetEase accelerated its share buybacks in Q3, doubling the amount from the previous quarter, with the single-quarter buyback intensity reaching a historical high. Dolphin Research had previously made a related judgment in last quarter's review: NetEase usually controls the pace of buybacks based on market value changes. Therefore, when foreseeing pressure on H2 performance, it may increase buybacks to support market value. If optimistically, the buyback intensity remains at Q3 levels, the full-year shareholder return could exceed Dolphin Research's previous estimate of 18 billion RMB. Based on yesterday's closing market cap of $49.1 billion, the return rate could be as high as 6%.

Facing revenue pressure, NetEase chose to cut costs for self-rescue. In Q3, apart from a 6% year-on-year increase in sales expenses due to promotions for new products like "Naraka: Bladepoint Mobile," administrative expenses directly dropped by 26%. R&D expenses grew by 2%, and judging from the year-on-year increase in SBC, personnel costs are still rising, possibly related to overseas team expansion. With its stock performance significantly lagging behind peers in Chinese concept stocks, NetEase's valuation has also reached a relatively low historical level. Besides the cyclical bottom of the pipeline, this may partly reflect market doubts about NetEase's game output capability due to multiple events this year.

Dolphin Research is not worried about NetEase's product capabilities but focuses more on when the short-term pipeline will be replenished. The financial report has already revealed upcoming new games, including "Marvel Rivals," "Destiny: Rising," "Marvel Duel," and "Where Winds Meet" (December). Among them, few can truly drive major growth. "Where Winds Meet" has been highly anticipated, and after its July delay, the release date is now confirmed.

With the lack of new games, NetEase must rely on its strong operational capabilities to revitalize revenue from old games, as seen with "Identity V" and "Infinite Lagrange" blooming again in recent years. However, this is highly uncertain. What are the new operational plans for old games? What’s the outlook for Q4 revenue? And are there any undisclosed new game plans for next year? It’s recommended to pay attention to the earnings call, as it’s crucial for judging the actual turning point of short-term performance.

$NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.