Tencent Music: What's the progress of SVIP as the next growth driver? (3Q24 Earnings Call Minutes)

Below is the $Tencent Music(TME.US) 2024 Q3 Earnings Call Minutes. For earnings analysis, please refer to《Tencent Music Entertainment: How Far Can the Price Hike Logic Go?》

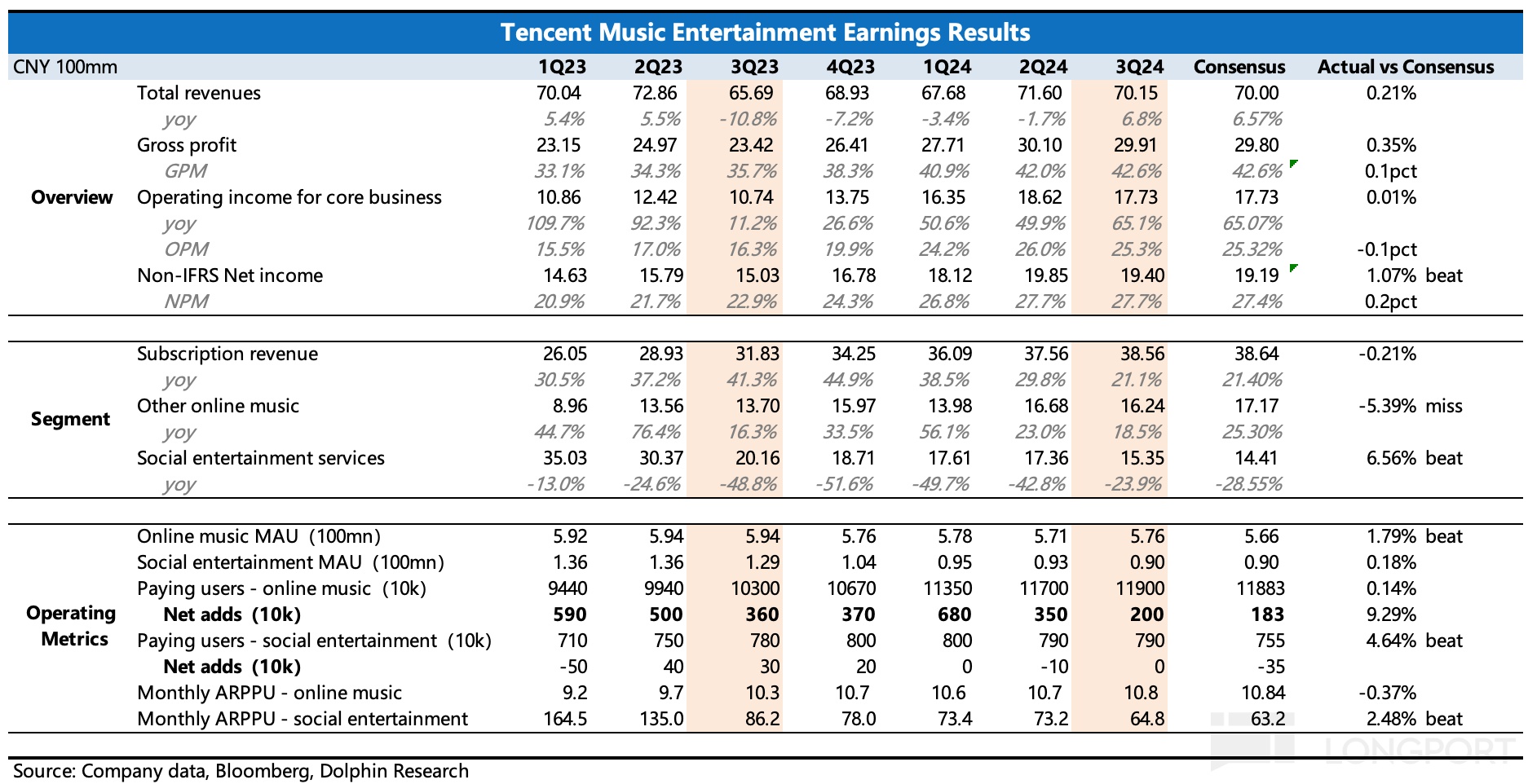

I. Key Earnings Highlights:

II. Detailed Earnings Call Content

2.1. Management Presentation Highlights:

2.1.1 Business Progress

1) Product Integration: Synergy between dual-engine platforms and content ecosystem has become a key driver for user growth and ARPU.

a. Enhanced partnerships with domestic and international record labels, enriching music content and supply.

b. Strategic collaborations with global music giants like Galaxy Corporation, bringing more international music content, digital albums, and merchandise.

c. Hosted the GNE Zebra Music Festival, attracting over 500k fans and boosting brand influence.

d. Partnered with Tencent Games to release theme songs for games like League of Legends and Peacekeeper Elite, strengthening music-gaming community interactions.

2) Membership Service Optimization: Expanded SVIP-exclusive benefits for diverse user segments.

a. SVIP members gained priority access to digital albums by top artists, with new K-pop resources added in Q3.

b. Enhanced SVIP perks (e.g., fan events like presale tickets for concerts) effectively drove SVIP growth.

3) ESG: Released first ESG report in Q3, showcasing environmental, social, and governance practices.

4) Tencent Musician Platform was recognized as a national copyright model case, highlighting contributions to music IP protection.

5) Product & Operational Updates:

a. Launched industry-first landscape player UI and real-time interactive comments to boost community engagement.

b. Leveraged LLMs and AI singing tech to improve content production efficiency/quality.

c. Optimized marketing strategies to acquire new users and grow paying users.

d. Partnered with ICONIC IPS to offer personalized interfaces, attracting more paying users.

6) SVIP: Surpassed 10 million SVIPs by Q3-end, a key milestone.

7) Subscribers: Total subs reached 119M, up 16% YoY (+2M QoQ).

2.2.2 Financial Performance

1) Revenue:

a. Total Revenue: Q3 revenue hit RMB 7B, up 7% YoY.

b. Online Music: RMB 5.5B, up 20% YoY, driven by strong subscription growth.

c. Music Subscriptions: RMB 3.8B, up 20% YoY (+3% QoQ).

d. ARPU: Monthly ARPU rose to RMB 10.85 from RMB 10.3 YoY, up 5%.

e. Other: Social entertainment revenue fell 24% YoY to RMB 1.5B.

2) Net Profit: IFRS net profit up 35% YoY to RMB 1.7B; non-IFRS up 29% to RMB 1.9B.

3) Gross Margin: 42.6% in Q3, +6.9pp YoY.

4) Expenses:

a. OpEx: RMB 1.2B (17.4% of revenue vs. 19.3% YoY).

b. S&M: RMB 220M, flat YoY.

c. G&A: RMB 998M, -5% YoY due to reduced biz costs.

5) EPS: Diluted ADS EPS at RMB 1.01, up 36% YoY; non-diluted at RMB 1.16, up 30%.

a. Tax Rate: 17.7% in Q3 vs. 12.2% YoY.

b. Buybacks: Repurchased 2.1M ADS for $335M total ($100M in Q3).

c. Liquidity: Cash + equivalents at RMB 36B, up from RMB 35B in Q2.

2.2. Q&A with Analysts

Q1: Outlook for Q4 2024 and Q1 2025? Can SVIP sustain growth amid macro/competitive pressures?

A: We expect accelerated revenue/profit growth in 2025. Q3 demonstrated our high-quality growth strategy via balanced gains in revenue, profit, users, and ARPU. Focus remains on expanding paying users and ARPU.

SVIPs exceeded 10M; more music scenarios/content/privileges will deepen loyalty.

Q2: Better-than-expected member growth in Q3—key drivers? Any new marketing plans for retention?

A: Q3 success stemmed from stable ops + expanded subscriber perks (e.g., Mid-Autumn campaigns). For Q4/Q1, we’ll control marketing spend, focus on retention by highlighting subscription value (especially content).

Enhancing audio quality (e.g., DTS 3D tech trials) and blending traditional + SVIP strategies to boost monetization. SVIP base remains small but poised for healthy growth.

Q3: What % of SVIPs upgraded from regular members vs. new users?

A: Most SVIPs upgraded from basic tiers, but we also track new user engagement.

SVIPs skew young; we’re exploring cross-device perks and fan economy tie-ins (e.g., "Starlight Cards") to fuel future growth.

Q4: SVIP user profile? Future growth focus areas?

A: SVIPs split evenly between QQ Music and KuGou.

Current perks: long-form audio, Hi-Res, early album access, multi-device use. Testing karaoke/ringtone editing perks and family plans.

Q5: Social entertainment revenue beat—optimization measures? Q4/2025 growth outlook?

A: Driven by WeSing ads/VIP + KuGou Live tipping.

Expect steady growth as we migrate features between platforms via livestreaming backend upgrades.

Q6: MAU grew this quarter after stability—growth strategy?

A: MAU tied to content. Boosting retention via exclusive content + playback/UI optimizations. Replicating QQ Music’s ROC marketing on KuGou. Eyeing IoT/car audio and new apps like KuGou Concept.

Q7: OpEx/margin trends? 2025/long-term core profit + Capex outlook?

A: Gross margin hit 42.6% with multi-quarter gains from music growth, cost control, and social biz optimization.

2025 OpEx to grow slower than revenue. Adjusted net profit/margin to expand. Tax rate stable but may rise slightly due to dividend withholding.

Disclosures & Disclaimers:Dolphin Research Disclaimer