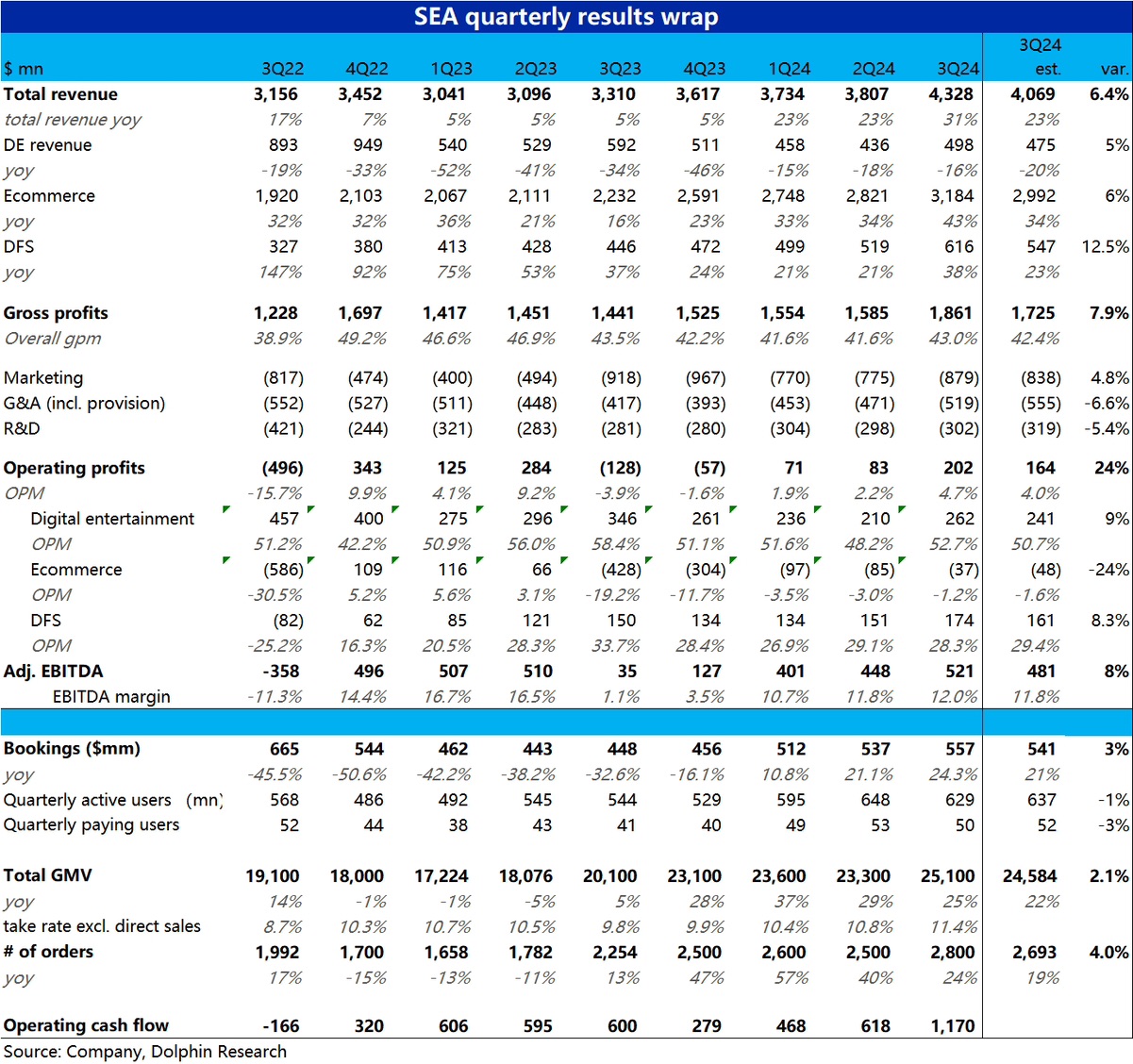

$Sea(SE.US)3Q24 first take: Preliminary results show that Sea delivered another quarter of comprehensive outperformance. Key highlights:

1) At the group level, total revenue grew 31% YoY, accelerating and beating expectations by 6%. Gross margin improved slightly YoY, with profits exceeding expectations by 7.9%. Core profit guidance (adj. EBITDA) surpassed expectations by 8.4%. All key metrics exceeded expectations, with the beat margin widening progressively. The company achieved both accelerating growth and improving margins.

2) The most surprising outperformance came from the DFS financial services segment, with revenue beating expectations by nearly 13%. Disclosed data shows the company's outstanding loan balance reached $4.6 billion, surging 73% YoY (compared to less than 40% growth last quarter). The explosive growth in lending scale drove significant revenue outperformance.

3) For the core Shopee e-commerce business, GMV grew 25% YoY, 3 percentage points above expectations. Revenue growth accelerated by 9 percentage points QoQ, exceeding expectations by a larger margin, indicating better-than-expected monetization rates. Losses narrowed to $37 million, better than expected. All metrics showed solid performance.

4) Although gaming performance was less stellar, with MAU and paying users slightly missing expectations by 1%-3%, the most crucial quarterly bookings grew 24.3% YoY, accelerating by about 3 percentage points QoQ, also better than expected.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.