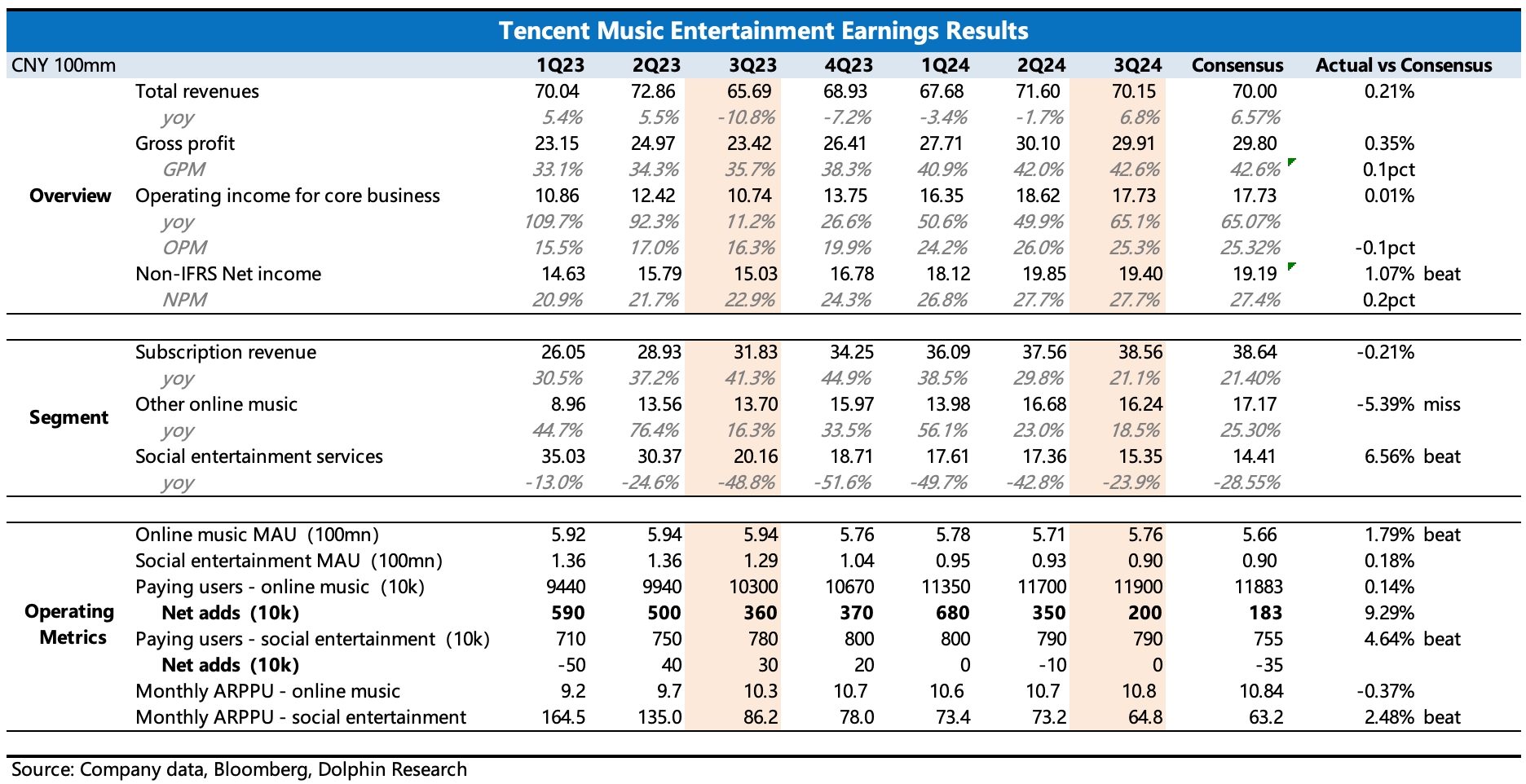

$TME-SW(01698.HK) first take: Q3 results basically met the lowered expectations after guidance adjustment. In terms of actual performance:

(1) Subscription user growth is under pressure, with a net addition of 2 million users quarter-over-quarter, significantly slower than the previous two quarters.

(2) Social entertainment is slowly emerging from the adjustment haze, slightly better than market expectations. However, Tencent Music's core logic has long shifted to music subscriptions, so the beat in social entertainment is unlikely to bring much positive feedback to the market. Therefore, the more critical factor lies in how the management guides for next year, especially after changes in the policy environment. If there is any unexpected growth in subscription users, it will quickly reflect positively on the stock price in the short term.

(3) Under revenue pressure, profit margins improved through strict cost control, with core operating profit growth maintaining at 65%. By the way, although overall profitability was inline, considering the better-than-expected performance of low-margin social music revenue, Dolphin Research roughly estimates that the gross margin of online music continued to improve quarter-over-quarter. Although the improvement is modest, the direction still reflects Dolphin Research's previous point that Tencent Music can leverage its bargaining power in the industry chain to steadily optimize upstream costs.

Last quarter's user guidance crushed valuations, pulling Tencent Music down from the "pedestal" of Forward P/E above 20x. Essentially, the market remains skeptical about the management's growth strategy of "raising ARPU" against the environment. In Q3, we did not see much "better-than-expected" pull from ARPU. The company disclosed that as of the end of September, SVIP users reached 10 million, accounting for 8% of total subscribers. Although the current penetration rate is not high, the pace and method of further conversion will depend on the management's explanation. It is recommended to pay attention to the earnings call. $Tencent Music(TME.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.