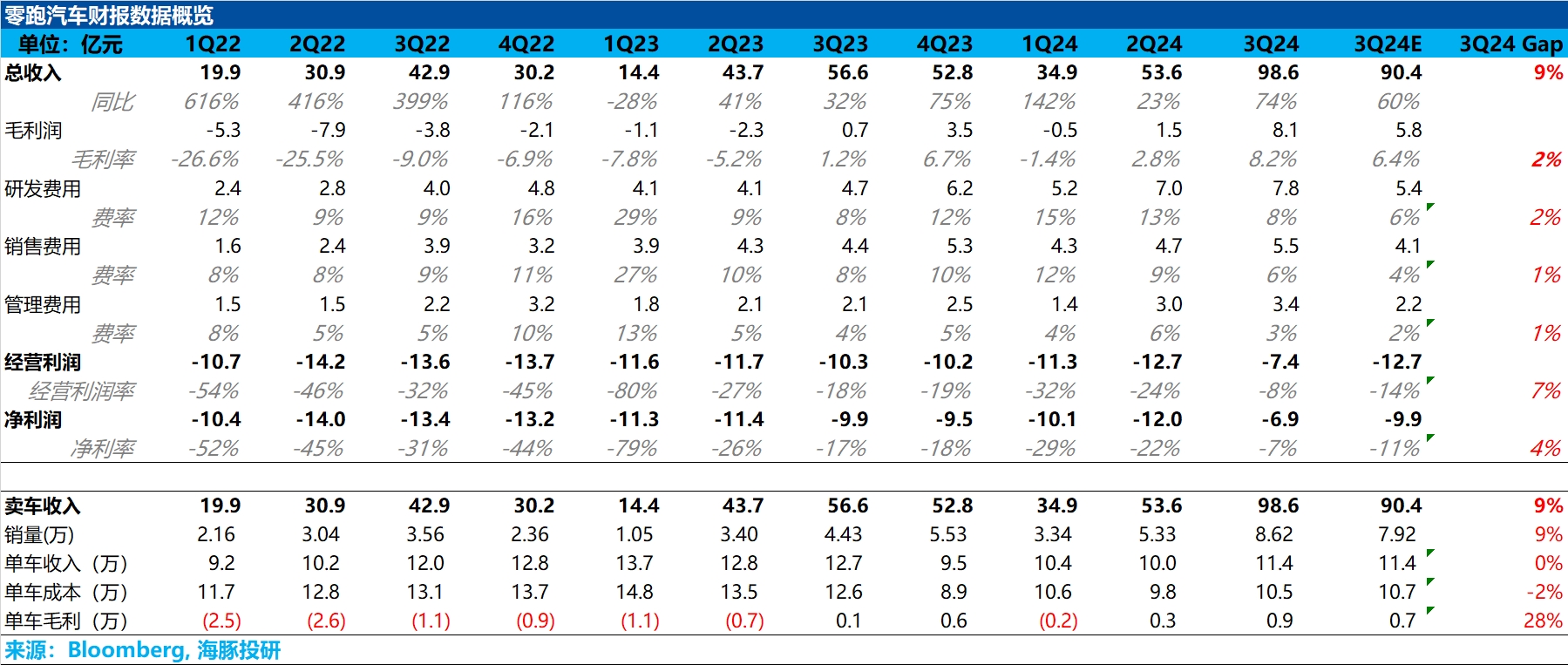

From the Q3 performance, $LEAPMOTOR(09863.HK) delivered a solid report card, with both revenue and gross margin exceeding market expectations. However, the revenue beat was mainly due to better-than-expected sales volume, which was already known. The real surprise this quarter was the automotive business gross margin.

The automotive business gross margin rebounded by 5.5% QoQ to 8.2% this quarter, surpassing market expectations of 6.4% and Dolphin Research's observed sell-side consensus of 6.7%. The significant improvement in gross margin was primarily driven by:

1. Recovery in average selling price (ASP): The sales mix improved this quarter—the C16, a higher-priced model in the product lineup, started deliveries in June. Its share in the model mix rose 19.4% QoQ to 21% in Q3, driving the ASP up by RMB 14,000 QoQ to RMB 114,000 this quarter.

2. Continued cost reduction: Benefits from ongoing cost management efforts, scale effects from higher sales volume, and further declines in battery costs due to falling upstream lithium carbonate prices.

Looking ahead to Q4, Leapmotor's order momentum remains strong, with net new orders exceeding 40,000 units in October. It is expected that in Q4: ① The share of C-series models will further increase to 80%, driving ASP higher; ② The peak sales season + overseas expansion will further boost deliveries, exceeding the company's original sales target of 250,000 units and amplifying scale effects. The gross margin is expected to maintain the steady upward trend seen in Q3, while net losses will continue to narrow.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.