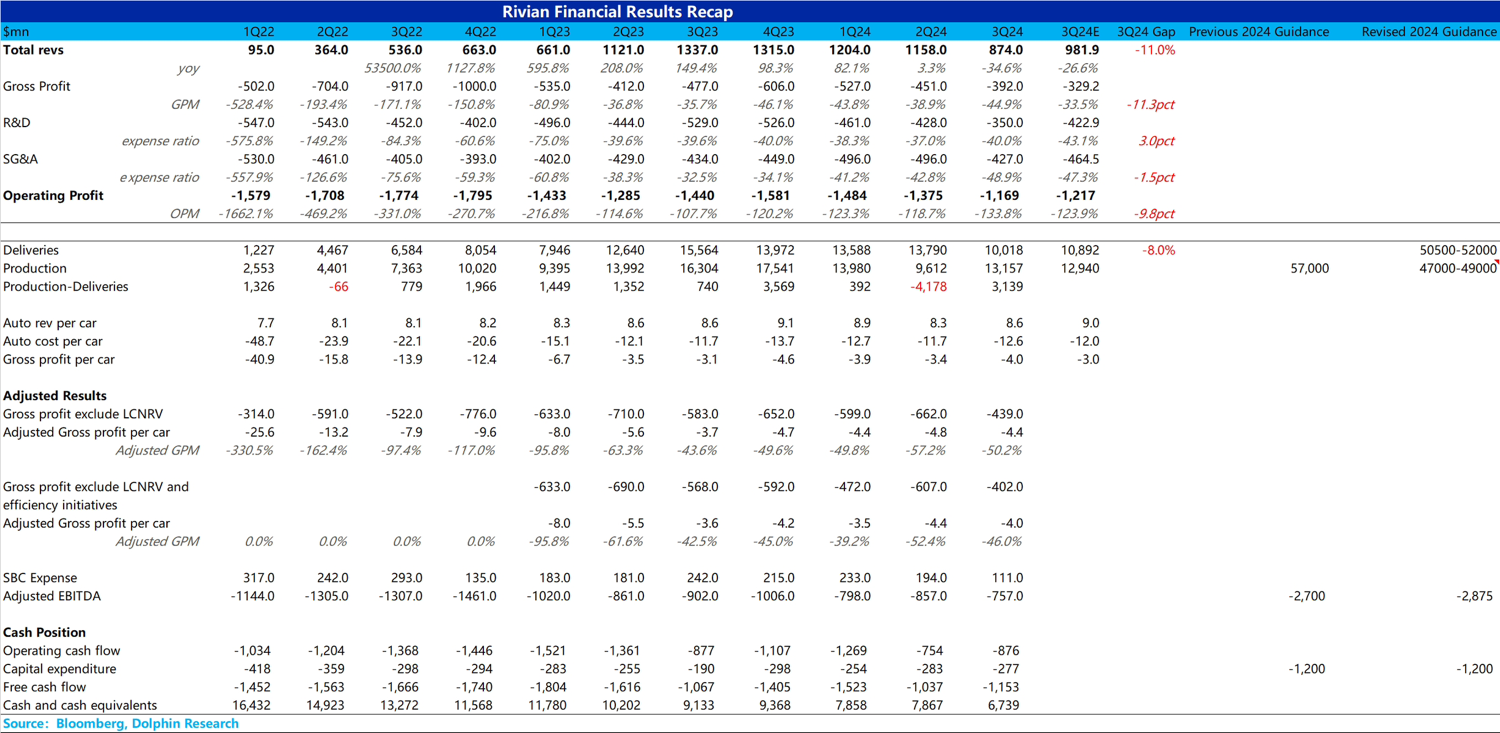

Overall, $Rivian Automotive(RIVN.US) delivered a disappointing performance in the third quarter, with both revenue and gross margin falling short of market expectations.

In terms of revenue, the average selling price (ASP) per vehicle increased slightly quarter-over-quarter, but the rise was modest, with ASP per vehicle only rising by $3,000 to $86,000, below the market expectation of $90,000.

The market had anticipated the increase to come mainly from the delivery of the 2025 R1 series, which began this quarter:

① The starting price of the 2025 R1 series is higher (e.g., the R1S);

② In Q2, discounts were offered on the first-generation R1 to clear inventory. In Q3, inventory sales were expected to decline as the 2025 R1 began selling.

③ The 2025 R1 series introduced max/large battery versions and a tri-motor version, improving the sales mix.

However, according to Dolphin Research, the production sequence for the second-generation R1 prioritizes the standard version (lower-priced LFP version), followed by the large battery version, with the tri-motor version not starting production until late Q3 or early Q4. As a result, the proportion of higher-priced R1 models this quarter was relatively low.

Gross margin this quarter also fell short of expectations. The market had expected gross margin to improve to -33.5% quarter-over-quarter due to cost reductions from the upgraded R1, but the actual gross margin was only -45%.

Excluding LCNRV adjustments and one-time impacts, the actual gross margin improved by 6% from -52% in Q3 to -46% this quarter. The improvement was mainly driven by higher ASP and lower variable costs. However, even after delivering the cost-reducing 2025 R1, the decline in variable costs was still smaller than Dolphin Research had anticipated.

What raises doubts for Dolphin Research is that Rivian still insists on its plan to achieve positive gross margin in Q4 2024. Despite delivering some 2025 R1 models in Q3, the actual gross margin remains at -46%. Given that Rivian has already lowered its full-year production expectations due to supply chain issues, Dolphin Research believes it will be very difficult for Rivian to achieve breakeven gross margin in Q4. This also casts doubt on the execution capabilities of Rivian's management.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.