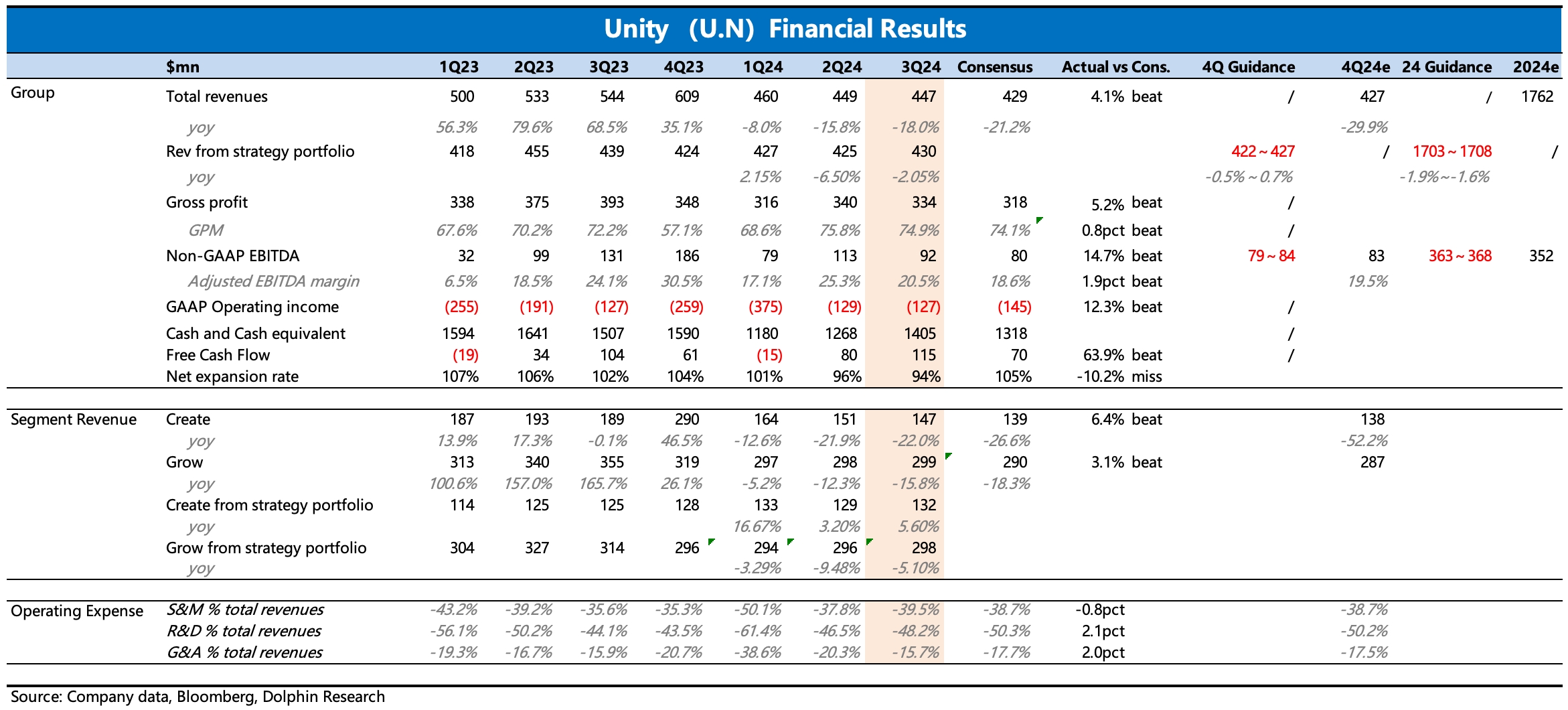

$Unity Software(U.US) first take: The Q3 results generally exceeded expectations, especially in terms of profits. On the revenue side, the Grow segment remains a drag, while the Create segment continues to recover.

The company's Q4 revenue and profit guidance slightly exceeded expectations. Although Unity raised its full-year guidance, the adjustment only reflected the Q3 outperformance, so the market reaction was muted. However, management expressed a relatively cautious stance on the guidance during the earnings call, similar to last quarter. Dolphin Research still believes the Q4 guidance leans conservative.

The forward-looking guidance, which Dolphin Research is particularly focused on, is more mixed—there are both positives and negatives. On the positive side, deferred revenue, both short-term and long-term, showed slight sequential growth. Although the total remaining performance obligations declined sequentially, the calculated new contract signings for the quarter actually increased. On the downside, the number of large clients decreased compared to last quarter, and overall revenue from existing clients continued to decline year-over-year (partly due to the impact of certain business closures).

Overall, Unity's positive trend remains intact, but the pace is still slow. In September, Unity announced the cancellation of Runtime fees, shifting to a direct price increase model for its engine, which the stock price had already reacted positively to in advance. However, Dolphin Research believes there are still unresolved questions regarding the two main businesses: 1) With the release of Unity 6 in October, Dolphin Research is closely monitoring how clients will return after the Runtime fee cancellation and the new engine launch. 2) On the advertising front, there hasn’t been a clear recovery yet. Meanwhile, AppLovin just reported its Q3 results yesterday, showing continued strong growth in marketing revenue, indicating it is still gaining market share.

How is Unity progressing with its ad tech improvements? These issues aren’t fully reflected in the earnings report yet. Dolphin Research will provide a detailed analysis after reviewing the earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.