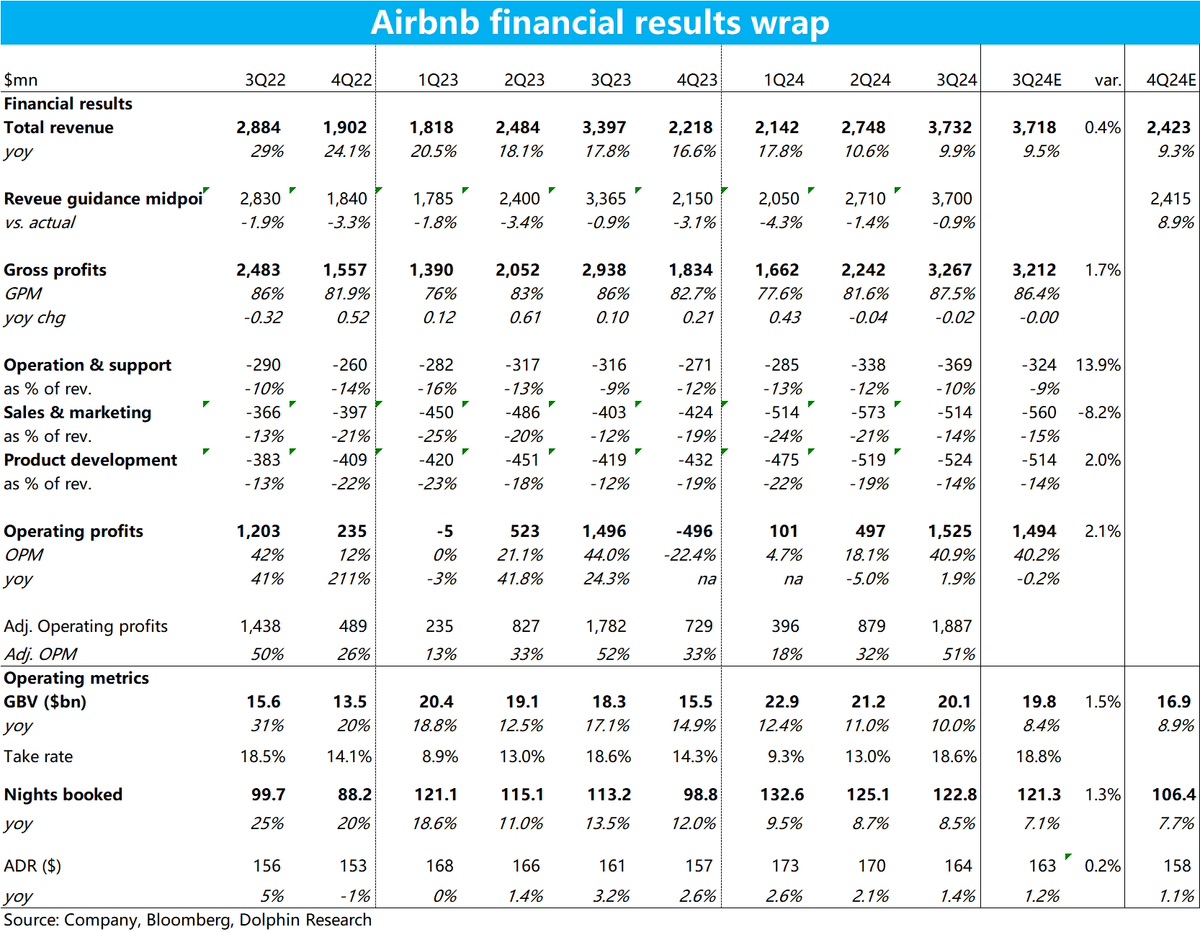

$Airbnb(ABNB.US)3Q24 first take: From the perspective of expectation gap, Airbnb's quarterly earnings slightly outperformed market expectations, with most financial indicators exceeding forecasts, though the margin was limited (mostly within 2%).

Beyond the narrow expectation gap, judging from the performance trend itself: 1) Growth-wise, as both the growth rate of nights booked and the increase in average daily rate continued to slow slightly compared to the previous quarter, the core metric Gross Booking Value (GBV) growth rate declined by 1 percentage point to 10%, already at the edge of single-digit growth.

2) Regionally, North America's revenue growth rate dropped sharply to 6.4% this quarter, a 3.3 percentage point decline sequentially, indicating significantly weakened and deteriorating demand. Europe, Asia-Pacific, and Latin America grew around 12%~13%, slightly accelerating overall compared to last quarter. However, with all major regions hovering near single-digit growth, Airbnb no longer has any strongly growing markets globally.

3) From a cost and profit perspective, as pre-announced by the company regarding increased investments, operating expenses as a percentage of revenue rose by 4.3 percentage points this quarter. Under high investment pressure, operating profit grew only 2% year-over-year. While this marks a slight improvement from the 5% decline last quarter, it still reflects an embarrassing situation of narrowing margins and stagnant profit growth.

4) For next quarter's guidance, the company expects nights booked growth to improve slightly sequentially (in line with market expectations), though likely still below 10%. Revenue guidance of $2.39~2.44 billion slightly exceeds the market's $2.42 billion expectation at the upper end, appearing neutral overall.

Thus, while Airbnb's actual performance this quarter was marginally better than expected, the core market concerns—continuously slowing growth and narrowing margins—were not fundamentally addressed this quarter.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.