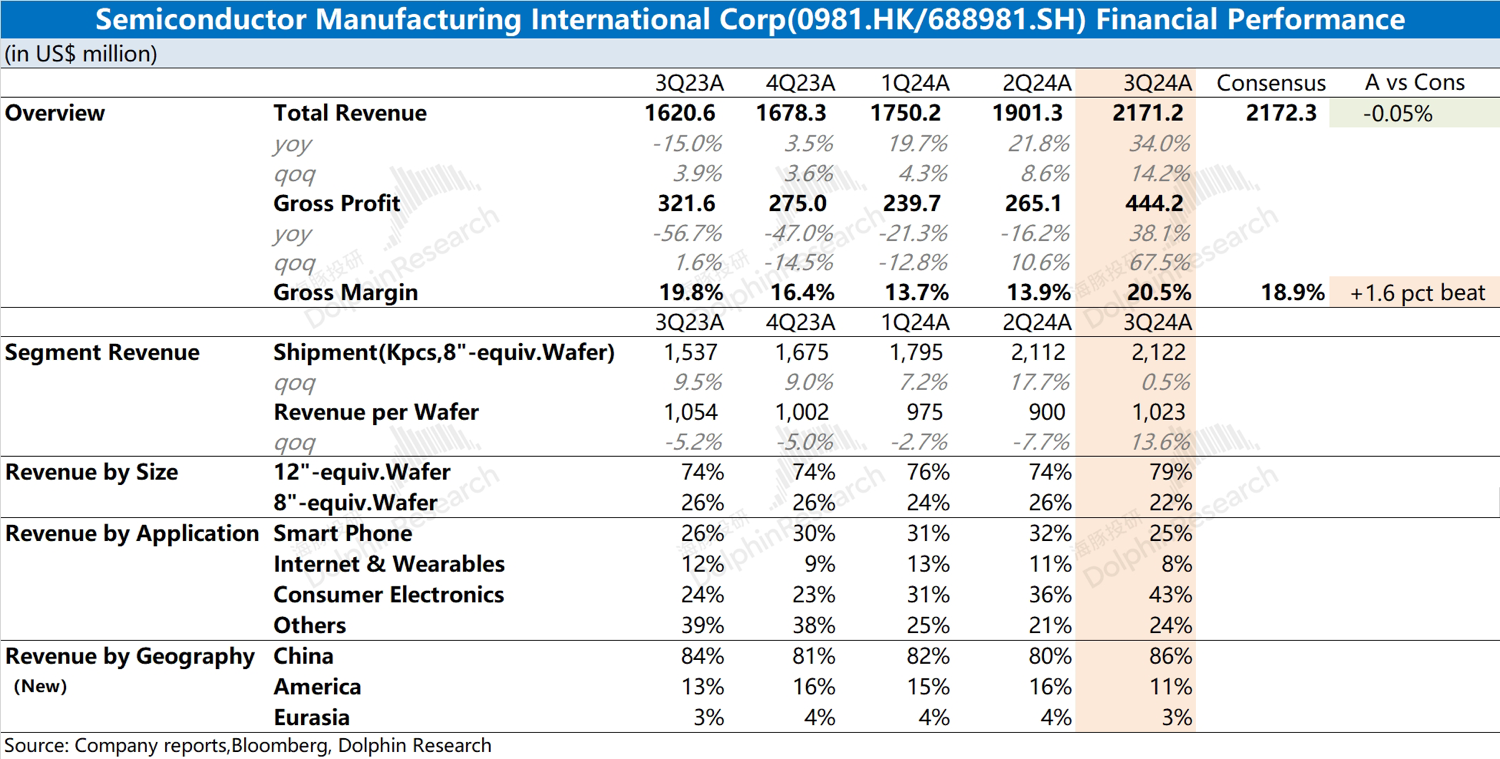

$SMIC(00981.HK)First take: The company's revenue met expectations, while gross margin once again exceeded market expectations. From the perspective of volume and price structure, the company's quarter-on-quarter double-digit revenue growth this quarter was mainly driven by an increase in average selling price. Shipments increased by +0.5% quarter-on-quarter, while the average product price rose by 13.6%. Driven by the structural improvement in 12-inch product shipments, the company's overall gross margin rebounded significantly this quarter.

From the perspective of the company's downstream shipment structure, the mobile phone business declined slightly quarter-on-quarter, while consumer electronics was the segment with the largest incremental growth this quarter. Combined with Qualcomm's disclosed IoT business, some products in the consumer electronics category are currently in the stage of inventory replenishment in the supply chain. The localization of chips continues to advance, and the proportion of the company's revenue from China further increased to 86% this quarter.

As for the company's operating expenses, they remained relatively stable, with R&D and sales-related expenses slightly decreasing this quarter but staying within a reasonable range. The company's depreciation and amortization this quarter remained relatively high, with most of it included in the cost items. Affected by the tightening of export restrictions by Western countries, the company's capital expenditure this quarter fell to $1.179 billion.

Based on the company's guidance for the next quarter, SMIC expects Q4 2024 revenue to grow by 0-2% quarter-on-quarter, corresponding to $2.17-2.21 billion, slightly better than the market consensus ($2.13 billion); gross margin is expected to be 18-20%, in line with market expectations (18.97%). Dolphin Research believes the overall performance is decent. Q4 is typically not the company's peak shipment season, with slight revenue growth and gross margin pressured by costs such as depreciation and amortization, remaining around 20%. Going forward, more details can be followed through the company's earnings call, including the sustainability of the recovery in China's consumer electronics and smartphone sectors, government support for domestic AI chips, and the company's progress in advanced nodes.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.