The University of Sichuan is back. As for domestic policies, there are two key points:

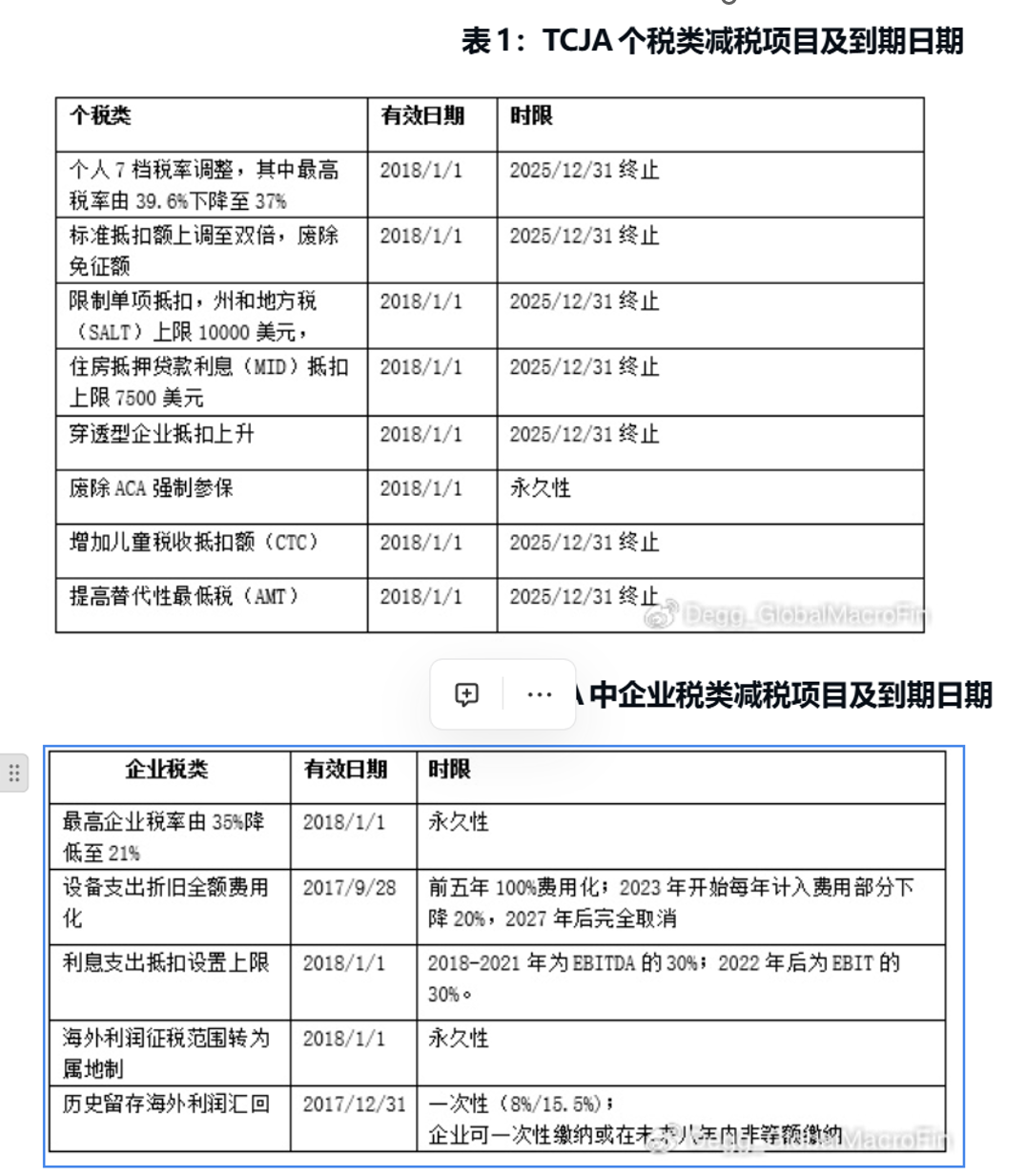

a. Economically, industrial stimulus may weaken (but since much of the industrial stimulus from anti-inflation bills has gone to Republican-leaning states, how much can actually be reduced is questionable). Then there's tax cuts, with the core being the 2025 Tax Cuts and Jobs Act, which is likely to become permanent. This is very bad for the U.S. fiscal deficit outlook. Higher deficits mean more bond issuance, and increased bond supply could easily push bond yields up, which is why the 10-year Treasury yield has been rising.

$Tesla(TSLA.US)

$Occidental Petroleum(OXY.US)

b. Immigration policy: In addition to the border wall from the first term, this time there's an added measure—deporting illegal immigrants already in the country. The U.S. job market is already in a delicate balance, and tightening immigration could lead to a rebound in inflation, which is worth watching.

$Vanguard Total Bond Market ETF(BND.US)

$Trump Media & Tech(DJT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.