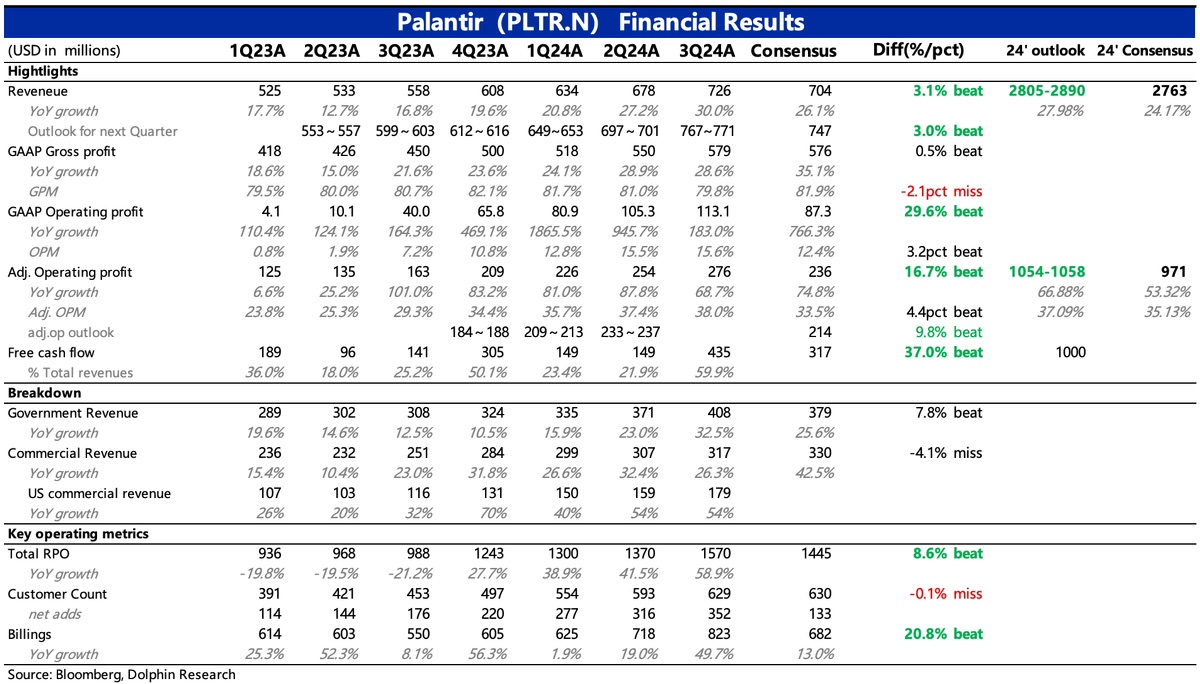

$Palantir Tech(PLTR.US)first take: Palantir delivered another near-perfect report card for the third quarter. Similar to last quarter's script, not only did current profits far exceed expectations, but the company also raised its full-year guidance to further validate the growth logic of AI. The forward-looking indicators consistently tracked by Dolphin Research also show strong short-to-medium-term high-growth trends, with overall sequential acceleration. Management stated that the market demand for AI is sustainable, and the AI revolution led by the U.S. has fully arrived.

Compared to many AI companies currently experiencing widening losses, Palantir has not seen its profitability dragged down by the cost recognition of AI investments. While this is partly due to the cost recognition cycle (though Q3 gross margins reflected some cost increases, these were offset by expense control), capital expenditures indicate that Palantir has not significantly increased Capex during this AI revolution. Therefore, even if costs are gradually recognized later, the impact on profits may be limited.

Dolphin Research believes this is due to Palantir's inherent positioning advantage (its original products already included AI-related technologies, with most foundational tech pre-invested or directly leveraging existing large models for refinement). Additionally, the commercial strategy of AIP Bootcamp has compensated for some shortcomings of customized products, relatively improving scalability. Thus, compared to companies starting from scratch, Palantir can drive AI monetization more efficiently.

However, despite valuation deviations from the norm, the vast AI market and the uniqueness of Palantir's customized solutions make it difficult for institutions to accurately predict PLTR's medium-to-long-term growth potential. Essentially, they can only follow the company's guidance and assess the likelihood of earnings beats by comparing marginal changes in AIP Bootcamp.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.