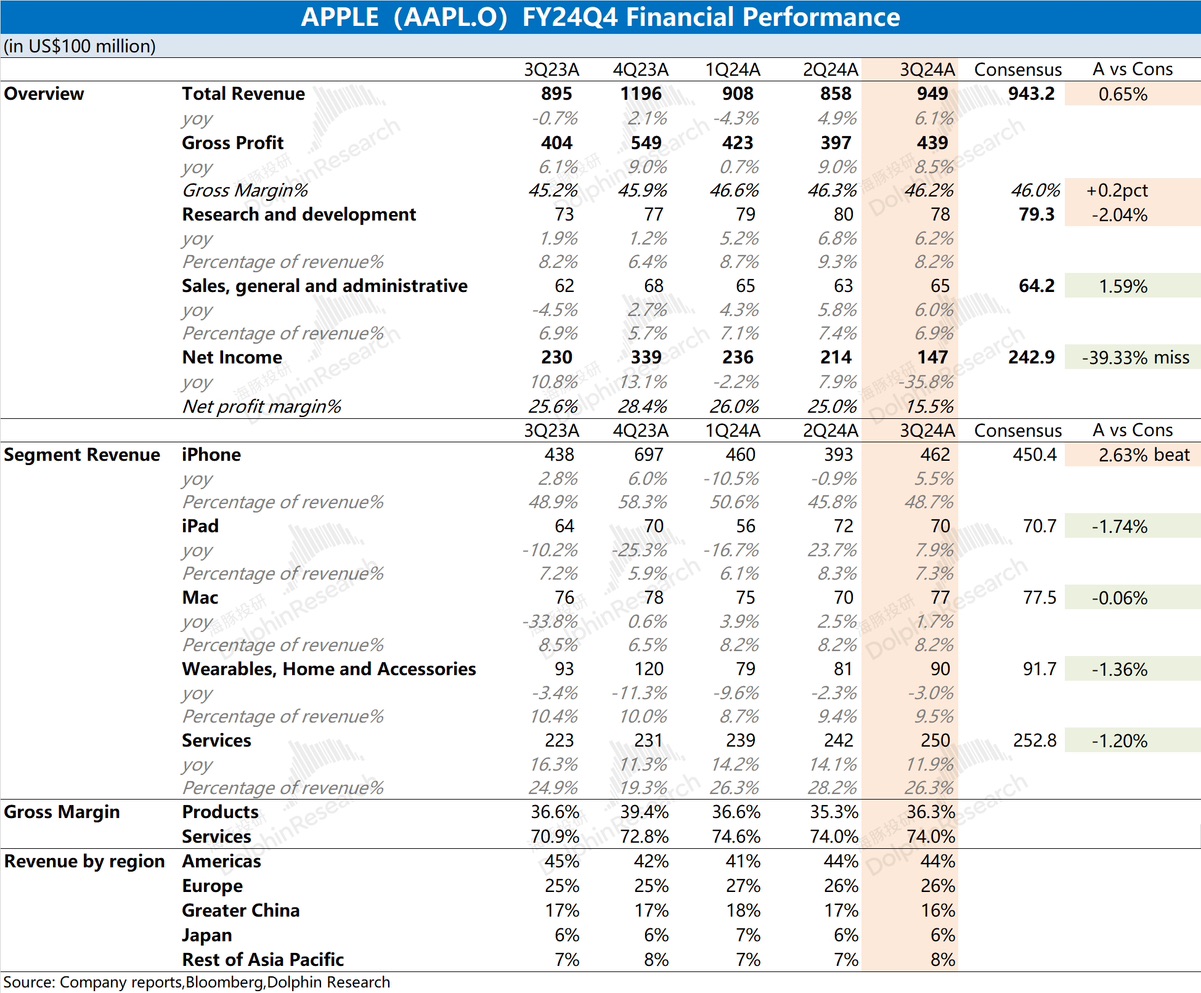

$Apple(AAPL.US)First take: The company's operational performance this quarter basically met market expectations. The growth in revenue was mainly driven by the improvement in businesses such as iPhone, iPad, and smart wearables. As for the significant decline in net profit, it was primarily affected by the one-time tax payment to the EU. Excluding the impact of this $10.2 billion payment, the company's operational net profit this quarter returned to $24.9 billion, slightly better than market expectations ($24.3 billion).

Looking at each business segment: 1) The company's core hardware segments (iPhone, iPad, and Mac) all saw varying degrees of growth this quarter, with the largest segment, iPhone, experiencing slight increases in both shipment volume and average price; 2) The company's wearables and other businesses continued to decline this quarter, with market demand remaining relatively sluggish; 3) The company's software services business maintained double-digit growth, making it the most stable part of the company's growth.

This quarter, the company's gross margin increased year-over-year, with the gross margin for software services already standing at a high of 74%. The company's R&D expenses and sales expenses steadily increased, with the overall operating expense ratio remaining around 15%. Additionally, the company's capital expenditures increased this quarter, with quarterly spending rebounding to $2.9 billion, but it remains relatively small compared to the company's operational profits. Overall, the company's operational performance this quarter basically met market expectations. In the subsequent management exchange meeting, continued attention will be paid to the company's outlook for future operations and its related plans in areas such as AI.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.