$Amazon(AMZN.US) 3Q24 first take: Amazon's stock price surged nearly 6% after the earnings release, so what were the highlights of this quarter's performance?

In short, the market's focus before the earnings was mainly on two points: 1. Could AWS cloud services achieve better-than-expected acceleration, reflecting improved competitive dynamics amid the AI wave? 2. Could the company (especially the retail segment) continue the previously interrupted trend of margin expansion?

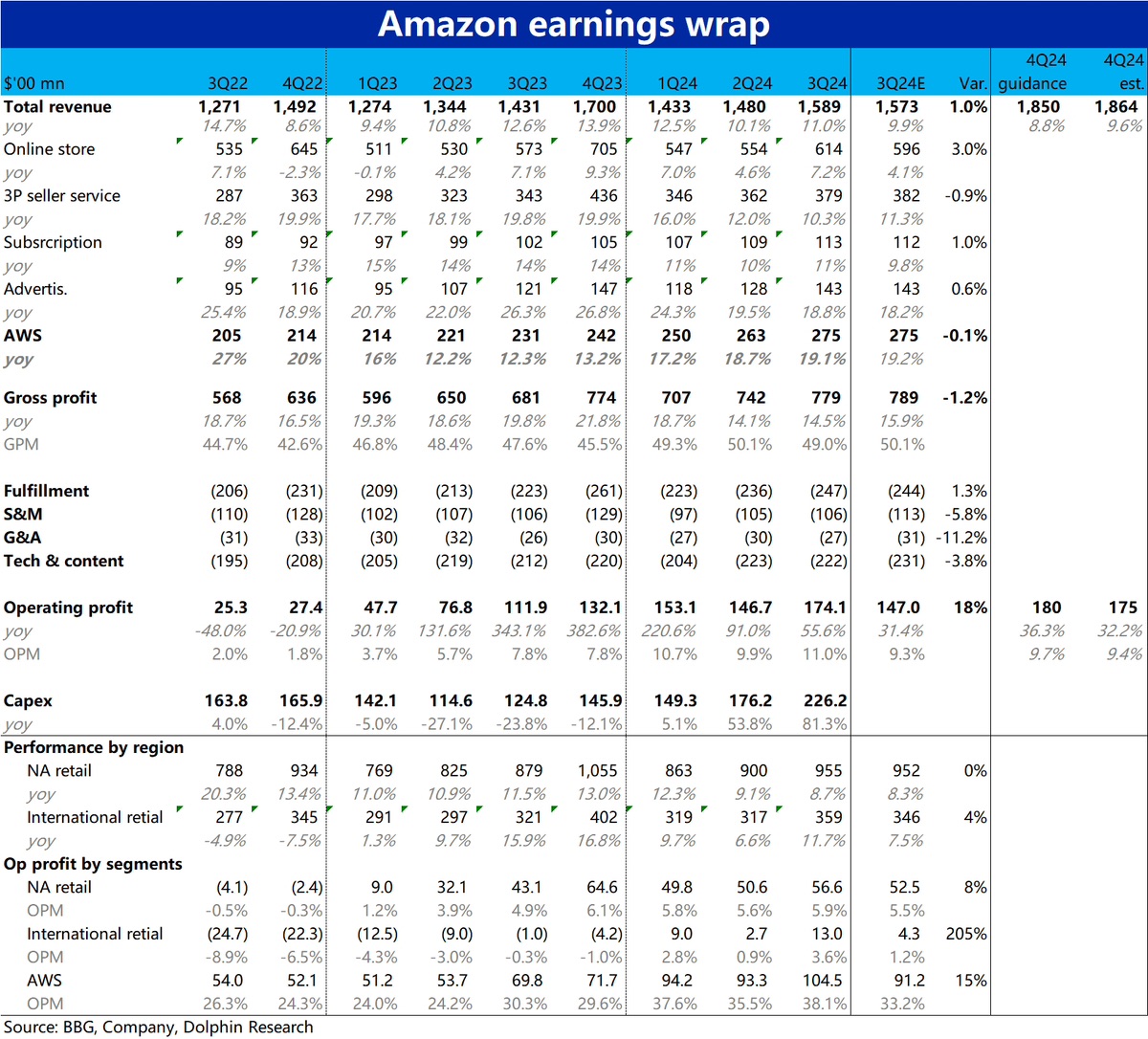

Here's what we observed: 1) AWS did not achieve the expected acceleration, with a 19.1% YoY growth this quarter, only a slight 0.4pct increase from the previous quarter. According to Dolphin Research, top sell-side and buy-side analysts were expecting growth of 20% or higher. However, no clear signs of acceleration were evident.

2) On the other hand, Amazon delivered impressive results in operating margin expansion. This quarter's operating profit reached $17.4 billion, significantly exceeding market expectations and the upper guidance limit by over $2 billion. The operating margin rose by 1.1pct to 11%, confirming that the profit expansion trend continues.

Breaking it down, the North American retail segment—a key focus for the market—was not the primary source of the outperformance. The highlight was the international retail segment, which achieved $1.3 billion in operating profit, double the expected amount and now accounting for 23% of the North American segment's profits.

Additionally, AWS's operating margin climbed further to 38.1%, far surpassing the market's expectation of 33.2%. Despite concerns about increased investments and the fading benefits of extended depreciation periods, the margin continued to expand. It's crucial to pay attention to management's explanation for this margin improvement.

Delivering on just one of these two points would have justified a post-earnings rally. However, after offsetting the previous day's decline, the gains were relatively modest.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.