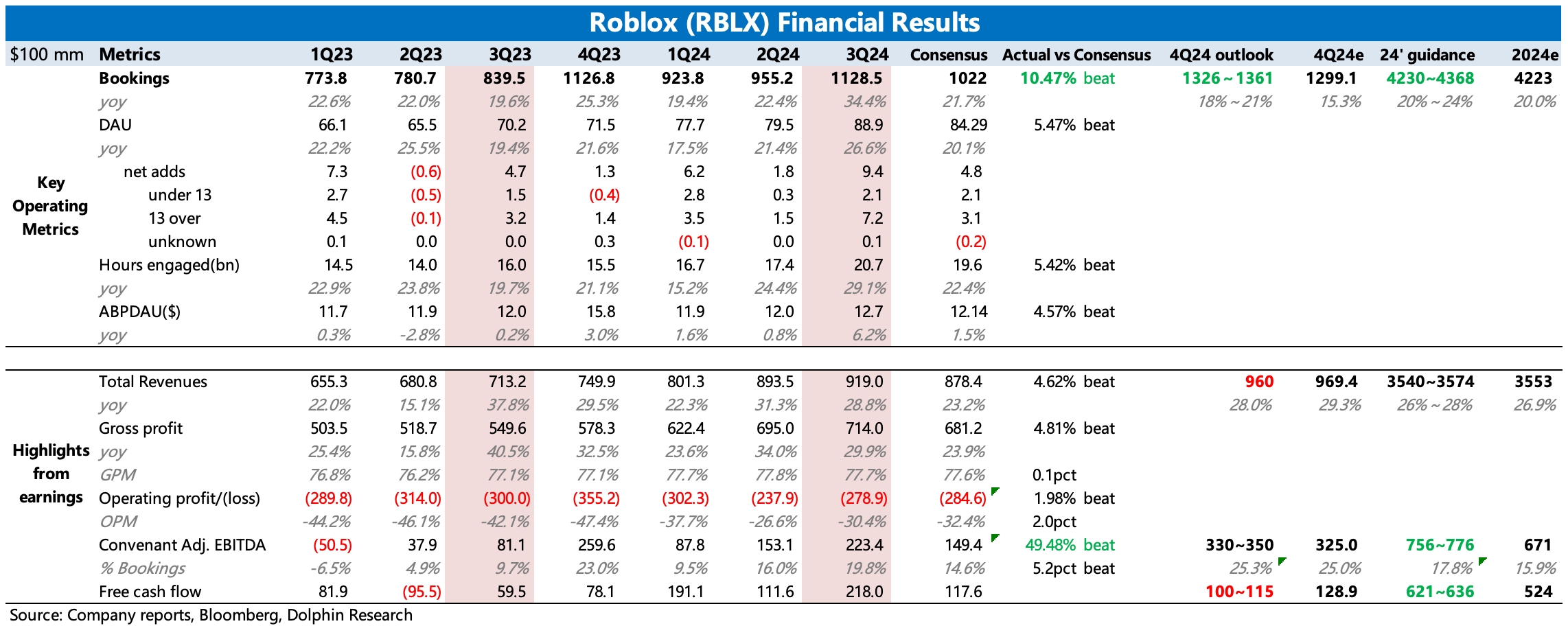

$Roblox(RBLX.US) first take: The Q3 performance was good, in line with Dolphin Research's expectations in the Q2 earnings review. The Olympic-themed "The Games" event, combined with the peak season effect, significantly boosted platform traffic and user engagement (27% DAU growth, 29% increase in total user time), driving subscription revenue and income above expectations. The company is rolling out video ads, but they are not yet a significant contributor. This area will be worth watching starting next year.

However, while revenue expanded rapidly, platform costs also rose, including developer revenue sharing tied to revenue growth, basic trust and safety expenses, and accelerated sales expenses. Management and R&D expenses were relatively restrained. The operating loss was still lower than market expectations, while the Covenant EBITDA metric, which accounts for net revenue changes, significantly exceeded market expectations due to higher revenue/deferred income.

The clear recovery in subscription revenue trends ensures solid Q4 performance. The company's Q4 revenue guidance slightly exceeded market expectations, while its profit guidance was significantly more optimistic than expected. This implies stricter cost controls next quarter, such as slower hiring. Both the return to accelerated growth and cost discipline are trends the market welcomes.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.