$Uber Tech(UBER.US) 3Q24 first take: As one of the consensus long leaders in U.S. stocks, Dolphin Research has always had strong confidence in Uber. However, after this earnings release, the pre-market drop once exceeded 10%, and the current decline remains around 7%~8%. What triggered the pre-market plunge? Let’s try to dissect it:

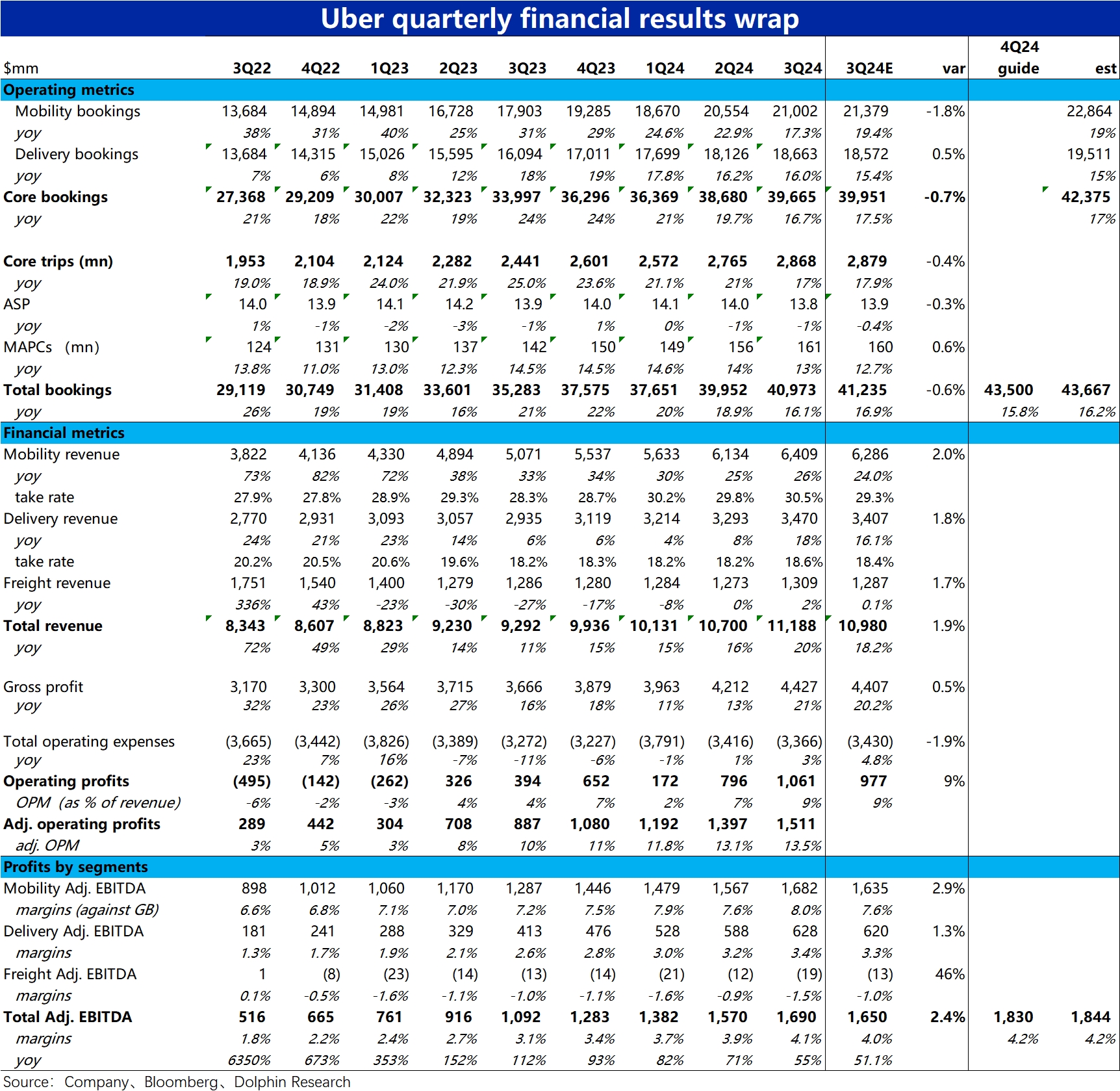

1) Looking at various indicators, the most obvious shortcoming is that the Mobility ride-hailing business's Bookings were slightly 1.8% lower than expected, with actual YoY growth slowing to 17.3% versus the expected 19.4%. Admittedly, Dolphin Research does not deny that the more pronounced slowdown in the company's core business than expected is a negative signal that cannot be ignored. Recently, due to high attention on autonomous driving and the launch of a "Price Lock" low-cost product by its main competitor Lyft, the market has indeed been concerned about Uber's long-term barriers and mid-to-short-term share competition in the ride-hailing business. Therefore, this miss will undoubtedly "add fuel to the fire" of these concerns, making people worry whether Uber is truly losing market share.

2) However, it can also be seen that apart from the miss in Mobility gross bookings, the growth rates, revenues, cost controls, and key profit metrics like adj. EBITDA in other businesses were in line with or slightly exceeded expectations. The guidance for total gross bookings and adj. EBITDA in 4Q also met expectations. So, looking at the earnings report, apart from the "less than 2%" miss in Mobility bookings, there are no fundamental major red flags in Uber's performance. Beyond the expectation gap, the company's core business shows nearly 20% and slightly declining but stable Bookings & revenue growth, coupled with over 50% profit metric growth, undoubtedly reflects a good state of both growth and accelerating profit margin release.

3) Therefore, Dolphin Research does not believe that this earnings report itself deserves a nearly 10% drop as punishment for serious issues. It’s more about "the same source of profit and loss"—the market had already priced in very high expectations for Uber, which was consensus long. Even after the drop, the market cap still corresponds to a slightly over 20x PE valuation based on expected 2026 profits, showing that the market has already priced in Uber's growth for the next two years. Thus, the market’s expectations for Uber are not just in-line performance (which would imply no excess returns in the next two years). For an expected "100"-point top student, a passing grade would be seen as "failing the exam."

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.