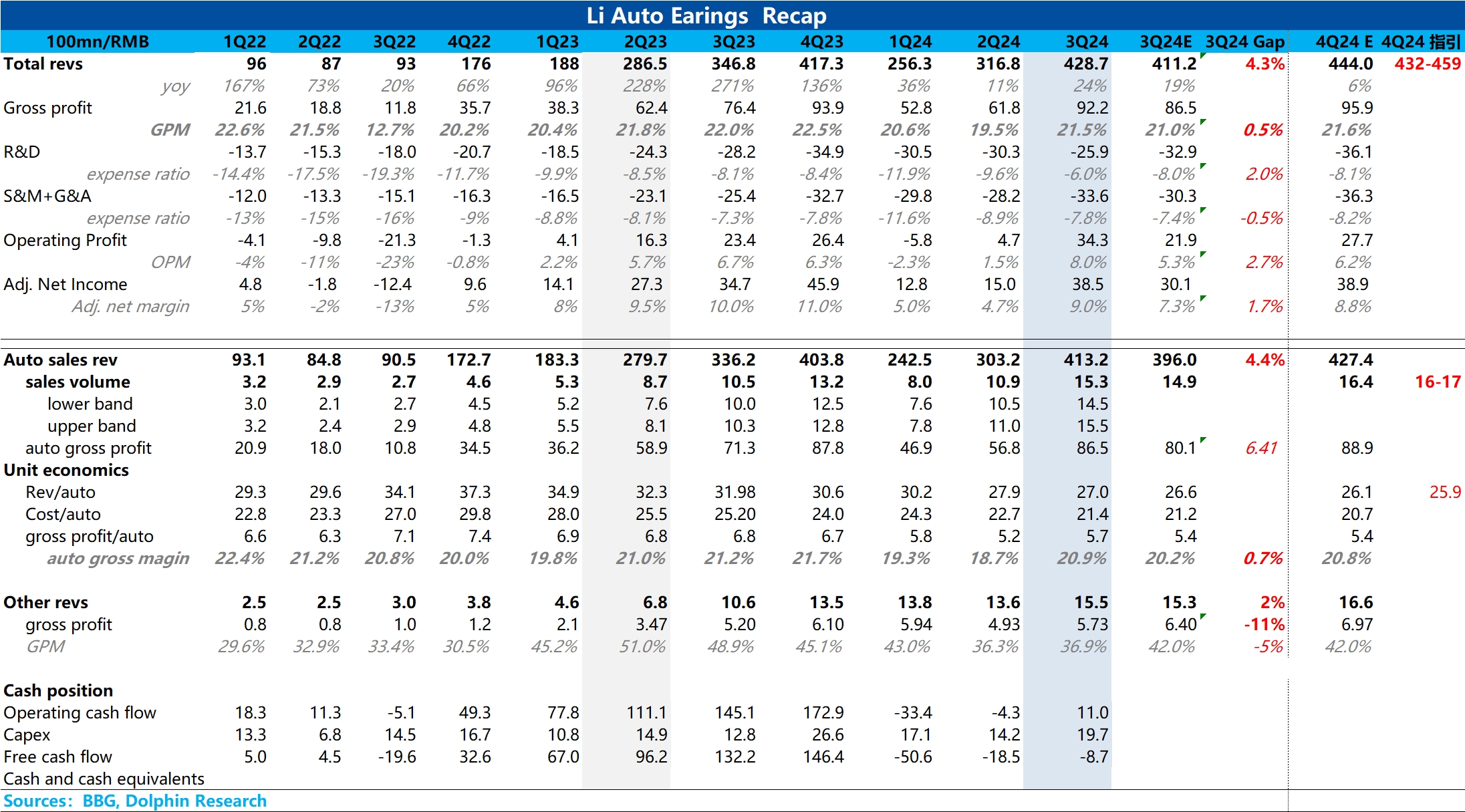

Overall, $Li Auto(LI.US) $LI AUTO-W(02015.HK) delivered a solid performance this quarter, with both automotive gross margin and revenue exceeding market expectations.

In terms of the most critical automotive gross margin, this quarter's automotive gross margin reached 20.9%, surpassing the market expectation of 20.2% and exceeding Li Auto's previous guidance of 19%+ for Q3 automotive gross margin. The key to exceeding expectations lies in the smaller-than-expected decline in average selling price (ASP) of vehicles.

This quarter, as the proportion of the lower-priced L6 continued to rise, the market's expectation for ASP had dropped to 266,000 yuan. However, Dolphin Research speculated that the breakthrough in Li Auto's autonomous driving technology might have led to an increase in the selection ratio of higher-priced Max and Ultra versions, offsetting some of the impact of the rising L6 proportion, ultimately driving both automotive revenue and gross margin above expectations.

In terms of the three major expenses, the unexpected difference this quarter was the significantly lower-than-expected R&D expenses, mainly due to layoffs in Q2, which reduced overall employee compensation, and the absence of new product launches in Q3, leading to lower design and R&D costs. As a result, operating profit reached 3.4 billion yuan, exceeding the market expectation of 2.2 billion yuan. However, since Q3 has already passed, the market is also closely watching Q4 progress. The Q4 delivery guidance is 160,000-170,000 vehicles. Based on current weekly sales, October deliveries are estimated at around 51,000 vehicles, implying average monthly deliveries of 55,000-60,000 vehicles in November/December, which is largely in line with expectations.

However, in terms of ASP, the implied ASP for Q4 revenue has dropped to less than 260,000 yuan. This continued decline in ASP implies two things: ① The proportion of L6 will continue to increase; ② Due to the lack of new models in Q4, there is a possibility of further price wars to boost sales. The launch timing of the Aito M8 remains uncertain, and if it is launched before the end of the year, it could also negatively impact sales of the direct competitor L8.

With just so-so delivery expectations and ASP below market expectations in Q4 amid the lack of new products, the product roadmap and expectations for the pure electric models to be launched next year become particularly important. Dolphin Research will pay attention to whether Li Auto discloses any details during its earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.