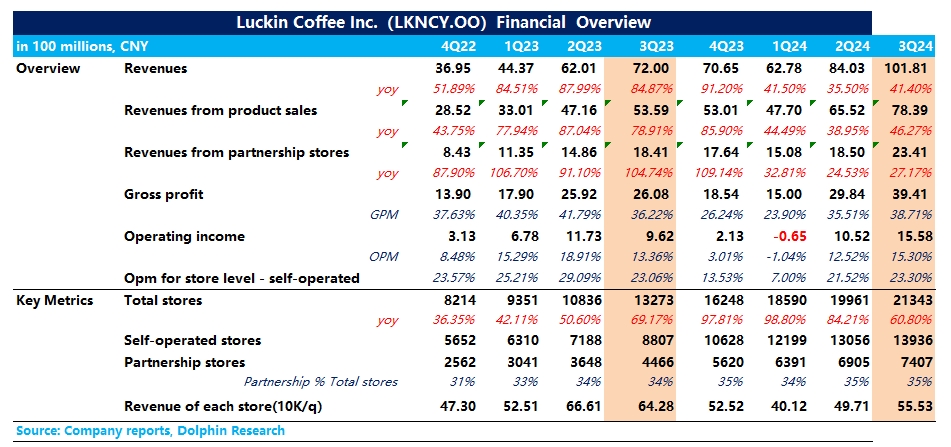

$Luckin Coffee(LKNCY.US) First take: Overall, the company's profitability continued to improve in Q3 driven by peak season and reduced subsidies, delivering a very strong performance.

1) In terms of store openings, the net increase in Q3 was 1,382 stores, bringing the total to 21,343 stores, up 60.8% YoY. Although the growth rate slowed compared to Q2, Dolphin Research believes the deceleration is expected given the high base of over 20,000 stores.

2) Same-store sales in Q3 declined 13.1% YoY, narrowing from Q2 (-20.9%), as the impact of new store cannibalization weakened. This is mainly attributed to the strong performance of the light milk tea product and high growth in coffee sales during the peak season.

3) In terms of profitability, the single-store operating margin reached 23.3%. While this is still below the pre-price war peak (close to 30%), it showed significant improvement compared to Q1 and Q2, indicating that the impact of Cotti's price war on Luckin is gradually fading. The company has proactively reduced subsidies, and higher-margin products like light milk tea have boosted the average cup price.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.