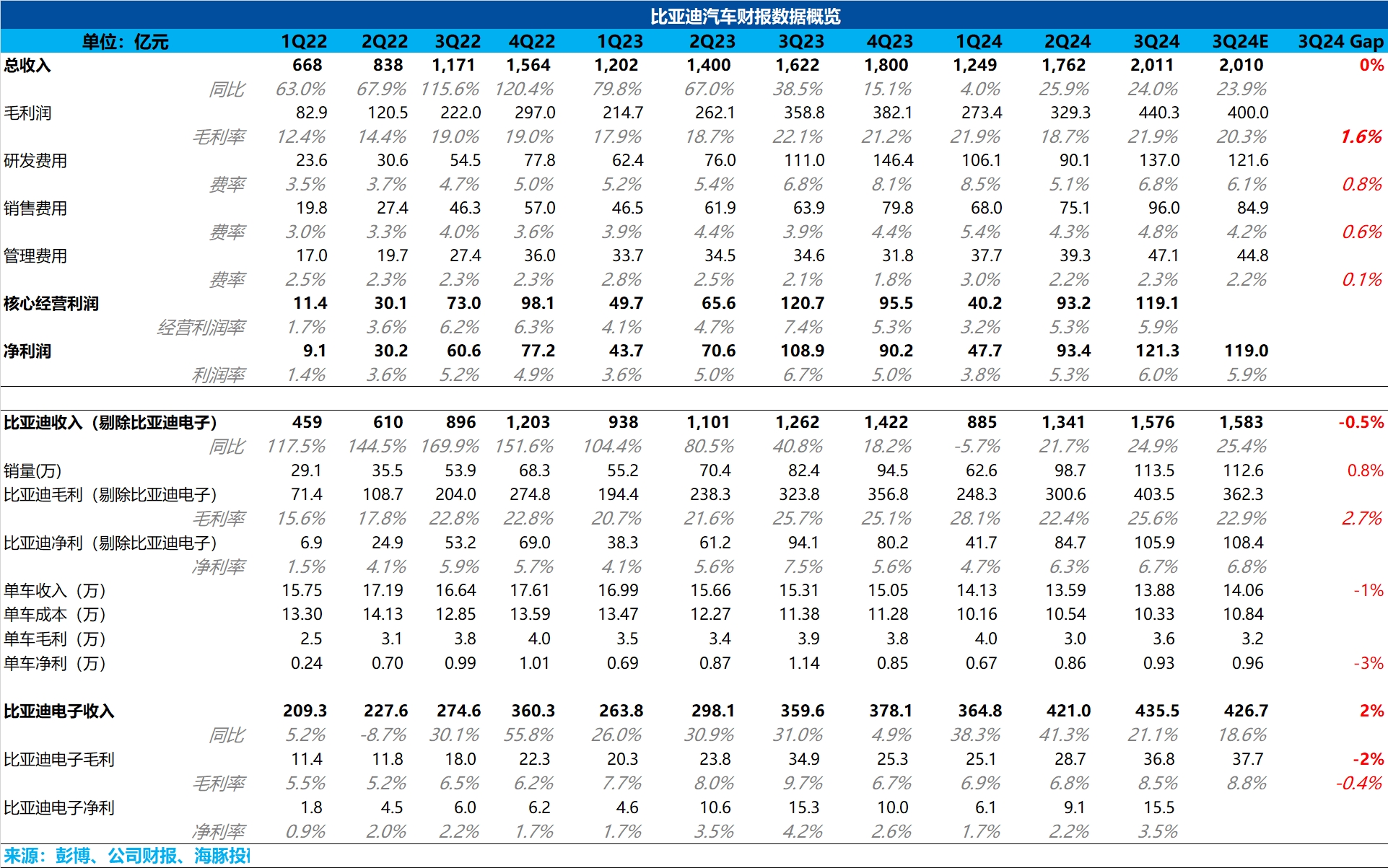

Overall, $BYD(002594.SZ) delivered another solid performance in the third quarter, with the gross margin of its core automotive business (including battery operations) rising by 3.2 percentage points quarter-over-quarter to 25.6%, once again exceeding market expectations.

The sequential improvement in automotive gross margin was primarily driven by:

① Volume ramp-up of DMI 5.0 models (Qin L/Seal 06) starting in Q3, lifting average selling prices (ASP): The plug-in hybrid flagship models shifted from Honor Edition Qin Plus/Corvette 05 to DMI 5.0-based Qin L/Seal 06, which are priced ¥14k-20k higher.

② Scale effects from strong sales in Q3 further reduced per-unit depreciation costs, lowering overall unit costs - consistent with Dolphin Research's earlier analysis.

Regarding net profit per vehicle (a key investor focus), Q3 reached ¥9.3k, slightly below the consensus estimate of ¥9.6k due to larger-than-expected sequential growth in BYD's operating expenses.

R&D spending surged by approximately ¥4.7 billion to a record high. Dolphin Research attributes this to: ① Preparations for premium model launches (e.g., DENZA's debut Yi-Sanfang platform); ② Accelerated intelligent driving investments (BYD plans mass production of its in-house advanced ADAS system in November) - a justifiable expenditure.

Notably, while capital expenditures remained low, $BYD COMPANY(01211.HK) accelerated the transfer of construction-in-progress to fixed assets (dropping ¥25.7 billion QoQ to ¥17.6 billion), causing fixed asset value to rise (up ¥33 billion to ¥263 billion). This may raise concerns about higher Q4 depreciation impacting profit margins - Dolphin Research will provide preliminary estimates in subsequent commentary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.