AMD first take: The company's quarterly results were decent, but failed to provide guidance exceeding expectations.

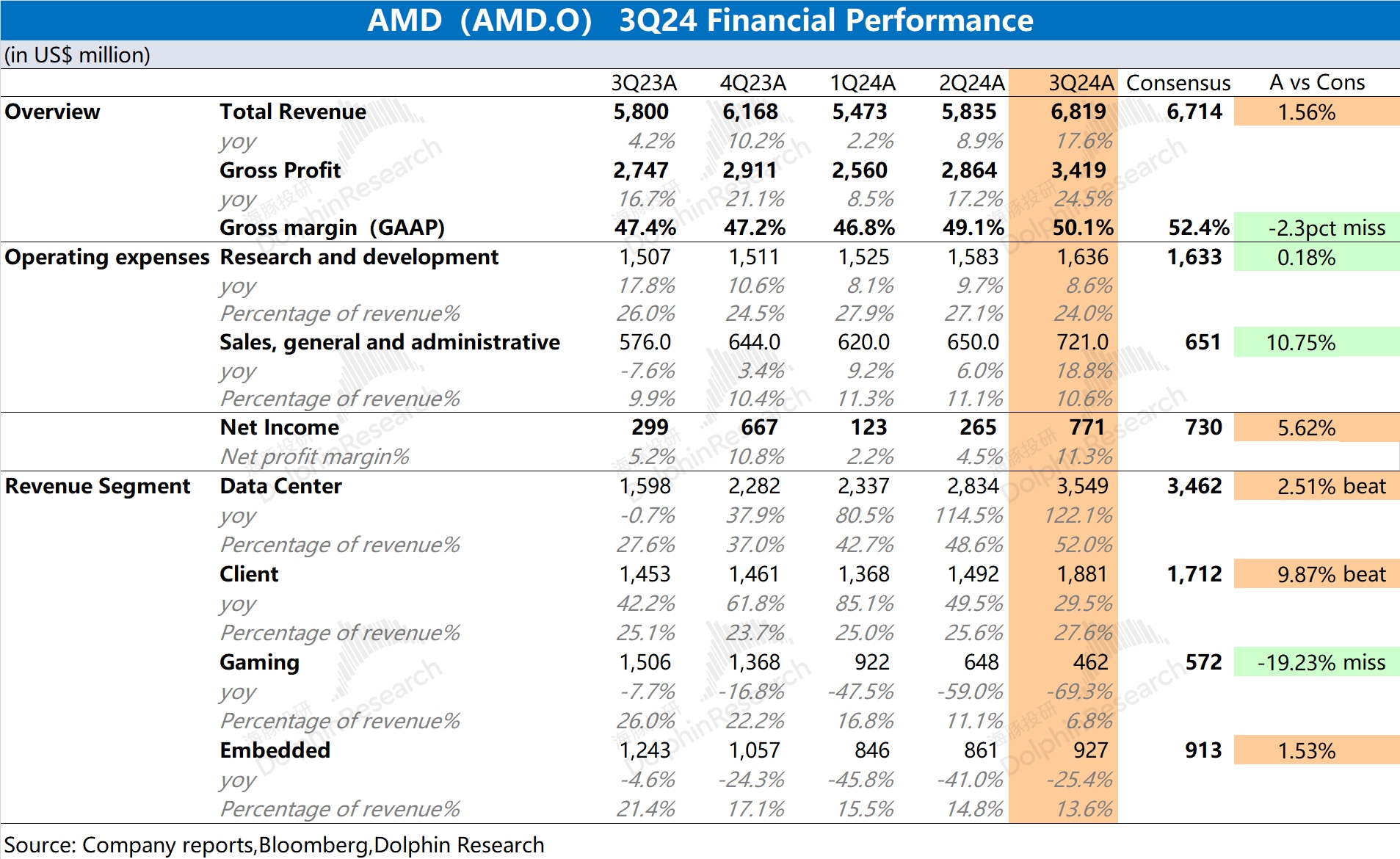

AMD saw growth in both revenue and gross margin this quarter, primarily driven by recovery in its Data Center and Client businesses. Operating expenses remained relatively stable, with R&D and SG&A costs holding steady. The company's core operating profit rebounded to over $1 billion, indicating overall performance has emerged from its trough.

Breaking down the two core businesses: 1) Client business: Revenue reached 18.81 billion yuan, up 29.5%. Given single-digit growth in the PC industry, Dolphin Research believes AMD further squeezed Intel's market share this quarter; 2) Data Center business: Hit a new record of 35.5 billion yuan, mainly fueled by strong sales of Instinct GPUs and EPYC CPUs, suggesting core cloud providers maintained high capital expenditures this quarter.

Despite decent revenue and profit figures, the company's guidance fell short of expectations. For Q4 2024, AMD projects revenue of $7.2-7.8 billion (vs. market consensus of $7.55 billion) and non-GAAP gross margin around 54% (vs. market expectation of 54.21%). Both metrics largely matched market expectations, dampening confidence in the company and the AI supply chain to some extent. For details on business performance and AI outlook, refer to the company's earnings call commentary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.