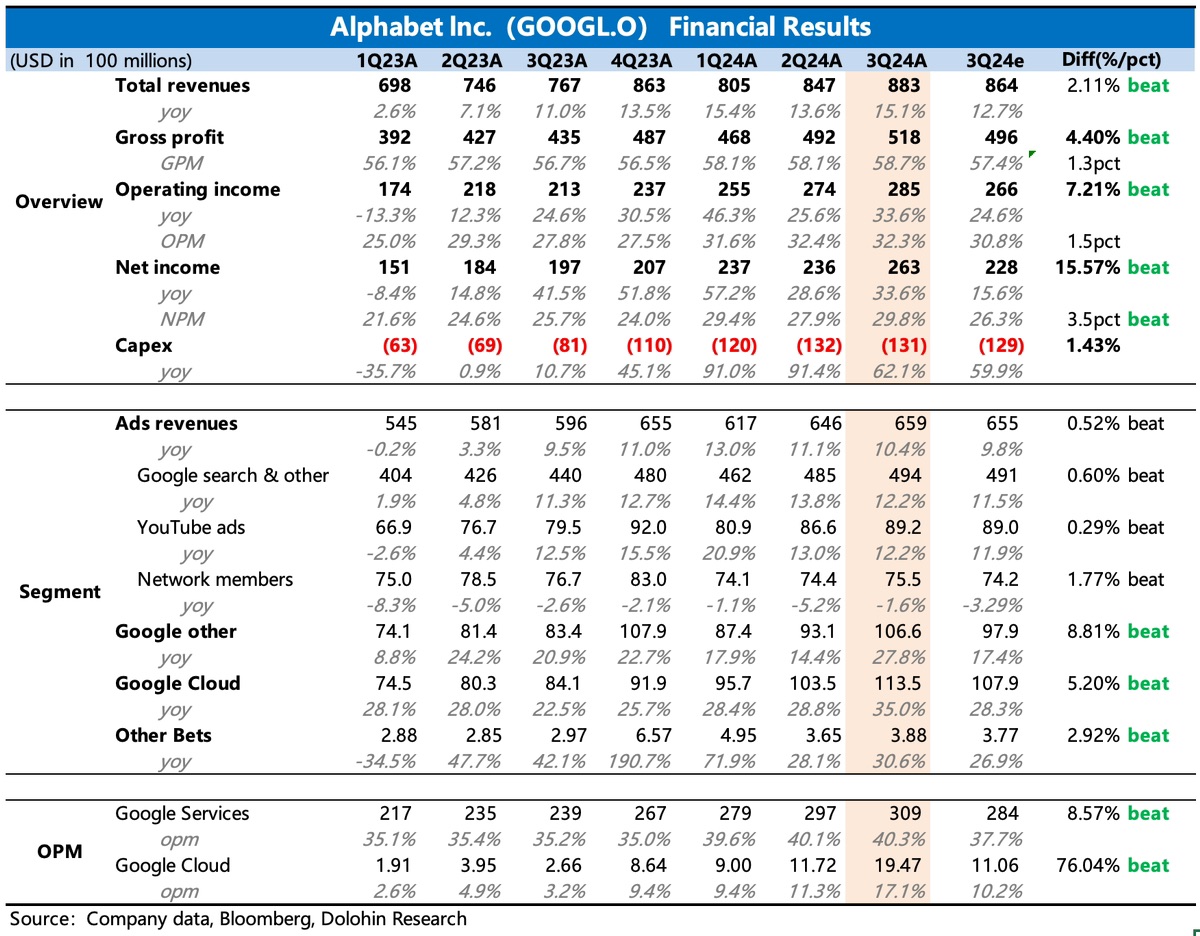

$Alphabet(GOOGL.US)first take: The Q3 performance was not bad, with both revenue and profit exceeding market expectations, and the profit was even more impressive.

(1) In terms of revenue, cloud services and Google Other revenue were the main areas that exceeded expectations.

The former benefited from AI, while the latter was likely driven by YouTube subscription business. The earnings report specifically disclosed that over the past four quarters, YouTube's combined advertising and subscription revenue exceeded $50 billion, meaning subscription revenue surpassed $15 billion, accounting for nearly 40% of Google Other revenue.

In comparison, the market had relatively full expectations for the strong growth in advertising. Search advertising slightly exceeded expectations, and affiliate advertising was also better than expected, but this was mainly due to conservative market expectations and the company's adjustment last quarter to temporarily delay abandoning third-party cookies. YouTube advertising performance was largely in line with expectations.

(2) Q3 operating profit significantly exceeded expectations, benefiting from both revenue scale and margin performance.

The market had initially expected that, based on the recognition of incremental costs related to AI investments and the company's guidance last quarter for sequential growth in employee headcount, Q3 operating margin would decline by 2 percentage points sequentially to 30%.

However, the actual situation was: Alphabet did increase its headcount in Q3, but the growth was modest, and the total number of employees still decreased year-over-year. R&D expense growth slowed slightly, sales expenses increased modestly, and administrative expenses continued to decline by nearly 10% year-over-year. This ultimately kept the operating margin at 32%, with Alphabet services margin also maintained at 40%, while cloud services operating margin improved significantly to 17%, up 6 percentage points sequentially, whereas the market had expected it to remain flat.

The unexpected improvement in cloud services profitability in the short term and the high maintenance of services margin, Dolphin Research believes, to some extent concretizes how Alphabet is benefiting from the AI transformation. However, it is also worth noting that the recognition of AI-related infrastructure costs in Q3 may not yet fully reflect the investment peak that began in Q4 2022. Behind the margin improvement, cloud business's total operating expense growth slowed from 20% in Q2 to 15% in Q3, and the company's overall depreciation cost growth also slowed sequentially, which seems somewhat inconsistent with the high growth trend in capital expenditures this year: Q3 capital expenditures remained at $13.1 billion, up 62% year-over-year, slightly exceeding market expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.