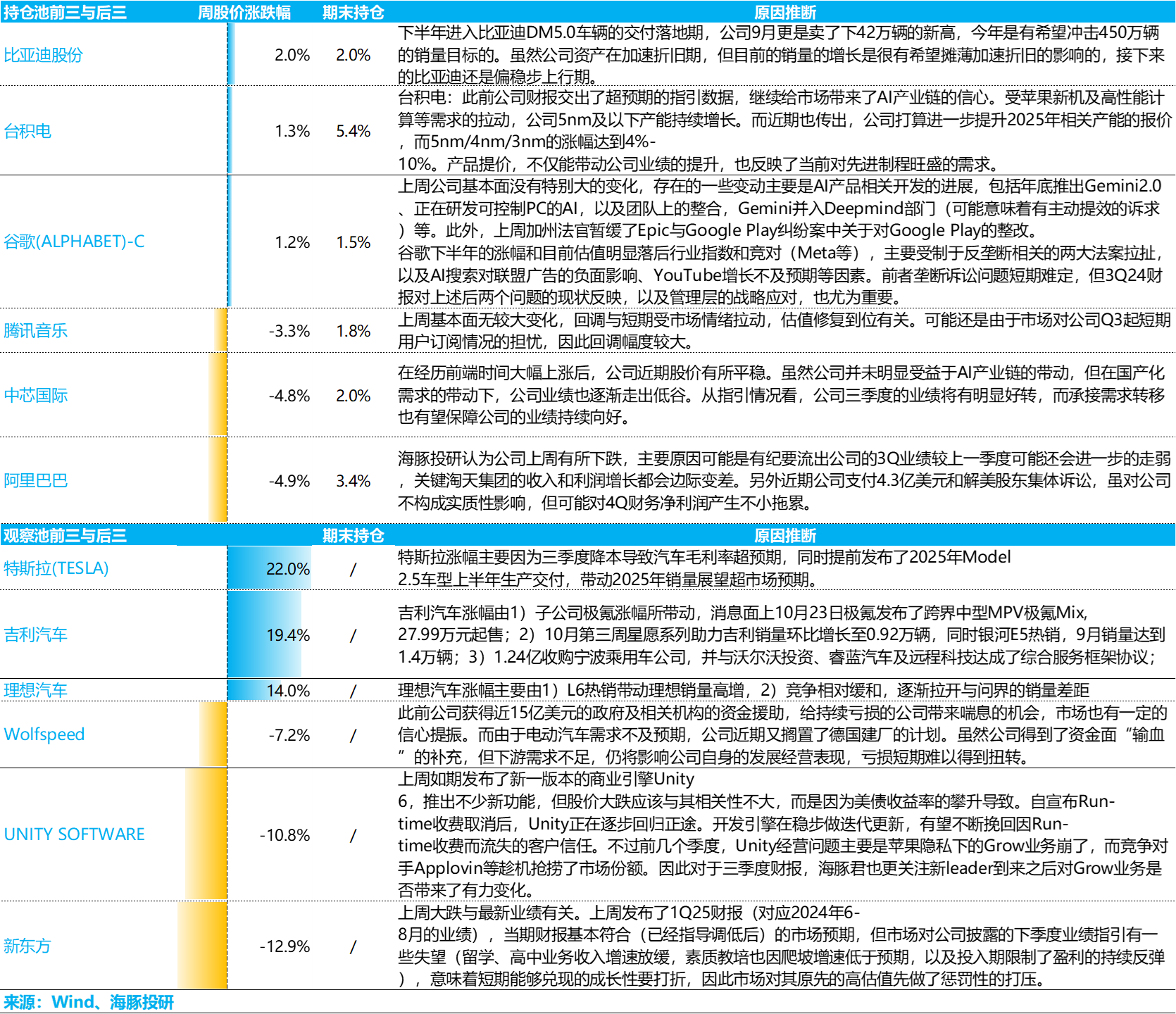

Last week, among the companies covered by Dolphin Research, we compiled a list of those with significant price fluctuations. It's evident that despite the increasing probability of Trump winning the election, the equity market hasn't fully priced in this scenario, with only a few Trump-related concept stocks seeing a rise.

Additionally, among the quirky small-cap stocks in the U.S. market, such as $Unity Software(U.US) and $Wolfspeed(WOLF.US), the continuous rise in U.S. Treasury yields has put pressure on their stock prices. However, tech giants remain unaffected, showing no signs of being impacted by the prospect of Trump's return.

The real movers last week were primarily in the new energy vehicle sector. On one hand, the leader $Tesla(TSLA.US) reported solid gross margins, driving the sector upward. On the other hand, the car sales business itself entered the peak season for Q4 sales, with companies like $Li Auto(LI.US) and $BYD(002594.SZ) showing gradual sales growth.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.