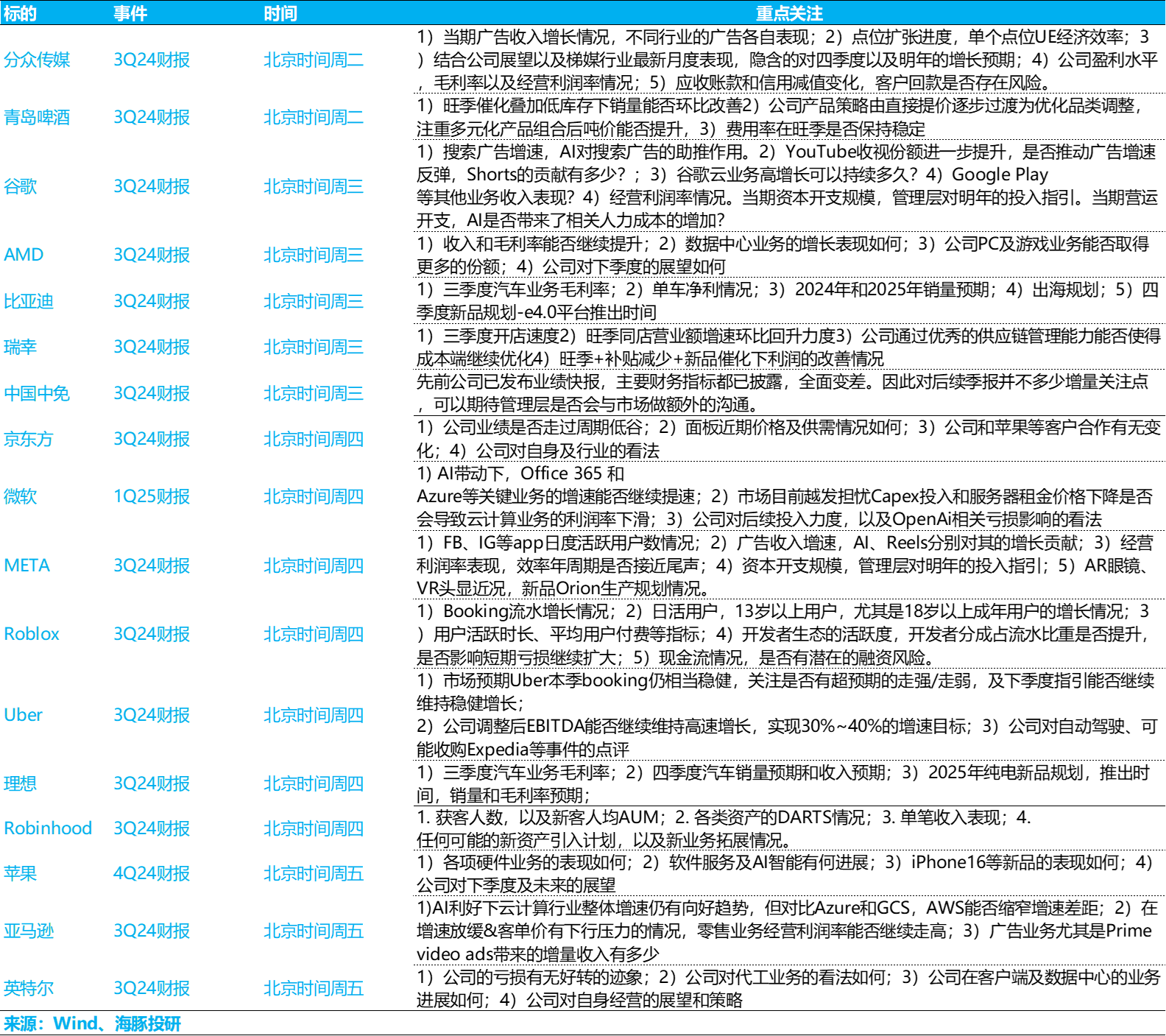

The earnings seasons of the U.S. and A-shares are intertwined, and this week can be described as a crazy onslaught of both macro and micro earnings reports.

Last night, $Focus Media(002027.SZ) released its report. Looking at the revenue, it's clear that consumer goods companies were relatively restrained in their sales expenses in Q3. Low single-digit growth might already be considered good in the advertising industry this quarter.

But at this point in the market, the focus isn't on how bad Q3 was. Even from the perspective of Q4 outlooks for China concept assets, they can't provide particularly clear guidance, at most mentioning how Double Eleven is progressing so far.

So the final battleground will still come down to the speed of fiscal policy implementation in Q4 and how much of a macro deficit ratio the Central Economic Work Conference will set to support the economy by year-end. After all, next year's exports are likely to fall somewhere between bad and worse (especially if Trump gets elected).

In the current environment, any company that can deliver truly outperforming earnings (especially with substantial revenue beats) is a top-tier executor.

Among the five U.S. tech giants, earnings season volatility probably won't be too dramatic, as most companies have relatively stable fundamentals. The major market shifts will depend on the election results.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.