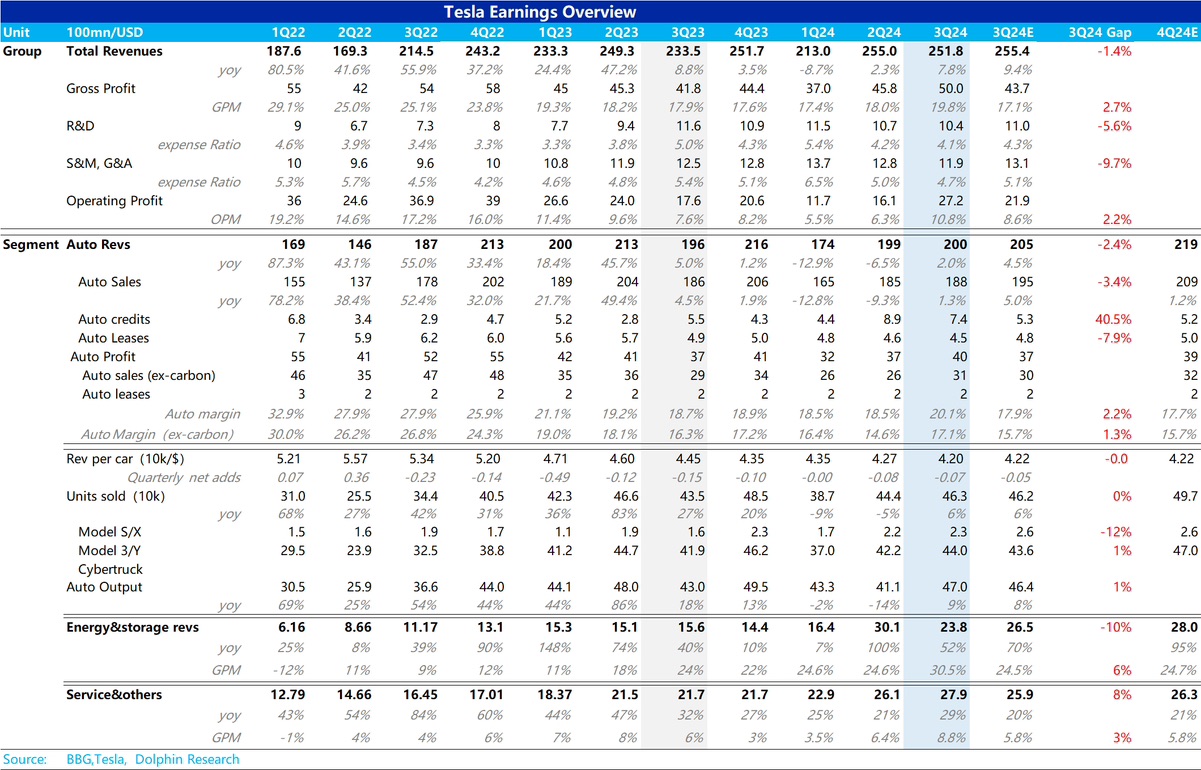

$Tesla(TSLA.US) released its Q3 earnings report, with the automotive business being the core focus as usual:

① The average selling price of vehicles was slightly below market expectations, but this is not a major issue. Although Tesla did not adjust the prices of its main models, the Model 3 and Model Y, in China and the U.S. during Q3, it even raised the price of the Model 3 in Europe by 1,500 euros due to tariff issues. However, the following factors contributed to a sequential decline of approximately $730 in the average vehicle price:

a. The impact of Q2 price cuts did not cover the entire quarter, but the effect was fully reflected in Q3;

b. Model mix influence: The proportion of the lower-priced Model 3 in the product mix increased by 2 percentage points sequentially;

c. Incentive measures: Tesla offered low-interest loans throughout Q3 in the U.S., whereas in Q2, this was only available for a few weeks.

② The standout performance this quarter was the automotive gross margin, which finally rebounded from the Q2 low. Excluding the impact of carbon credits, the automotive gross margin increased by 2.4% sequentially to 17.1%! This significantly exceeded the buy-side expectations of 15.3% and 15.7% observed by Dolphin Research.

Despite the continued decline in average selling prices, the improvement in gross margin was primarily driven by a substantial reduction in costs this quarter.

The cost reduction was partly due to economies of scale from increased production, but the main driver this quarter was lower variable costs. Dolphin Research attributes this to:

a. The full impact of Tesla's renegotiation of raw material procurement contracts, which led to lower material costs;

b. Improved gross margin for the Cybertruck, which achieved positive gross profit for the first time.

Beyond the earnings report itself, another major positive development was Elon Musk's announcement of a timeline for the new affordable model. Production of the next-generation affordable vehicle is set to begin in the first half of 2025, initially using existing production lines (Tesla's current maximum capacity is approximately 3 million units). Musk expects vehicle growth to reach 20%-30% next year, driven by this new model, providing a new growth engine for the automotive business's valuation.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.