Tesla $Tesla(TSLA.US) will release its earnings tomorrow morning. Recently, the market first thought Tesla's sales were picking up, and then there was its Robotaxi launch event, so the stock price kept rising. But after the event, people started to realize it was basically just a party for various Tesla stakeholders (mutual funds, hedge funds, sell-side analysts, users, etc.) with little substance.

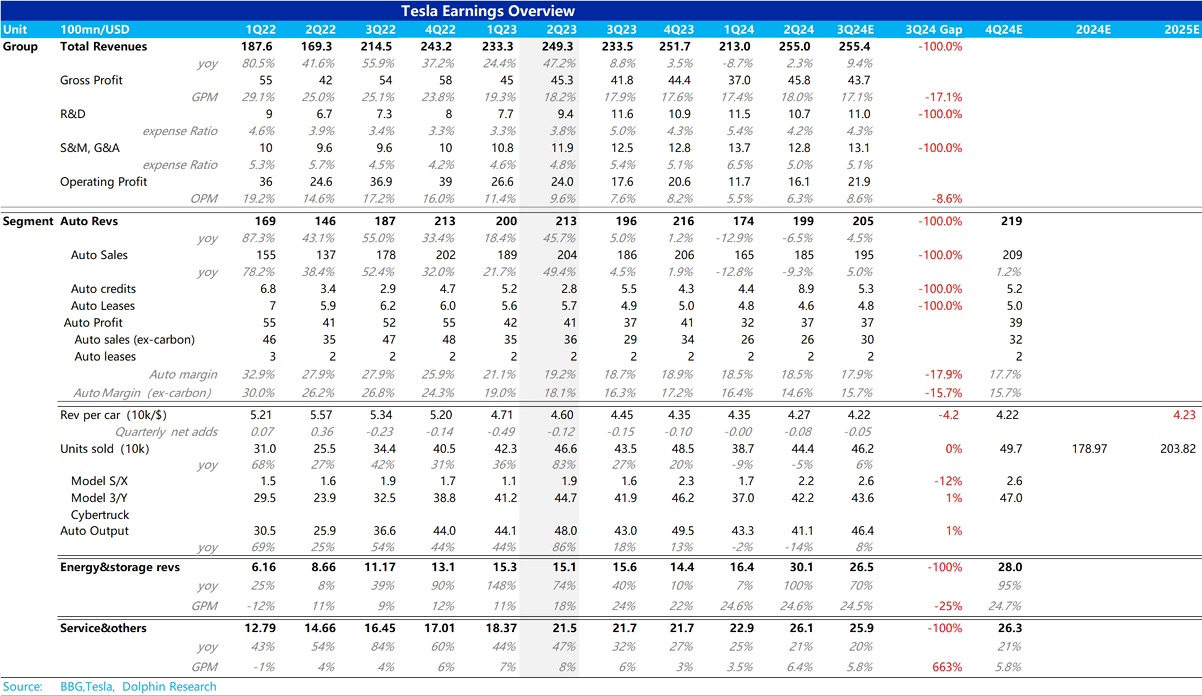

The Q3 sales of 463,000 units were indeed decent, but they were roughly in line with the market's raised expectations. The result is that after buying the expectation, funds have been selling the fact recently.

For the rest of the year, the market has basically priced in an expectation of 500,000 units for Q4. As the peak sales season, achieving this shouldn't be too difficult.

For 2025, the expectation is 2.04 million units, meaning the existing Model 3 and Y sales would hold steady, while the new slightly cheaper car (possibly between Model 3 and the truly affordable Model 2, temporarily dubbed Model 2.5 by Dolphin Research) would bring about 250,000 units of pure incremental sales.

This expectation seems fairly reasonable to Dolphin Research. If Model 2.5 deliveries and Model 2 launch (likely in the second half of the year) happen in 2025, Tesla's real opportunity might only come in the second half of 2025.

But at least the overall environment in 2025 should be better than 2024: a. Interest rates will be lower, reducing financing pressure for car buyers; b. There's actual hope for new car deliveries. Compared to Tesla's neutral bottom around $150 in 2024, 2025 could potentially see a rise to $180-200, with additional valuation upside potential for FSD if Trump gets elected.

The key short-term play is still gross margin. Under intense competition, if auto gross margins remain under pressure (the market expects Q3 auto gross margin to improve slightly from Q2's 14.6% to around 15.5%), Dolphin Research believes it's better to look for opportunities below $180 to build in some safety margin.

Anyway, we'll find out tomorrow! Wonder what the big shots in the community think - anyone placing bets?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.