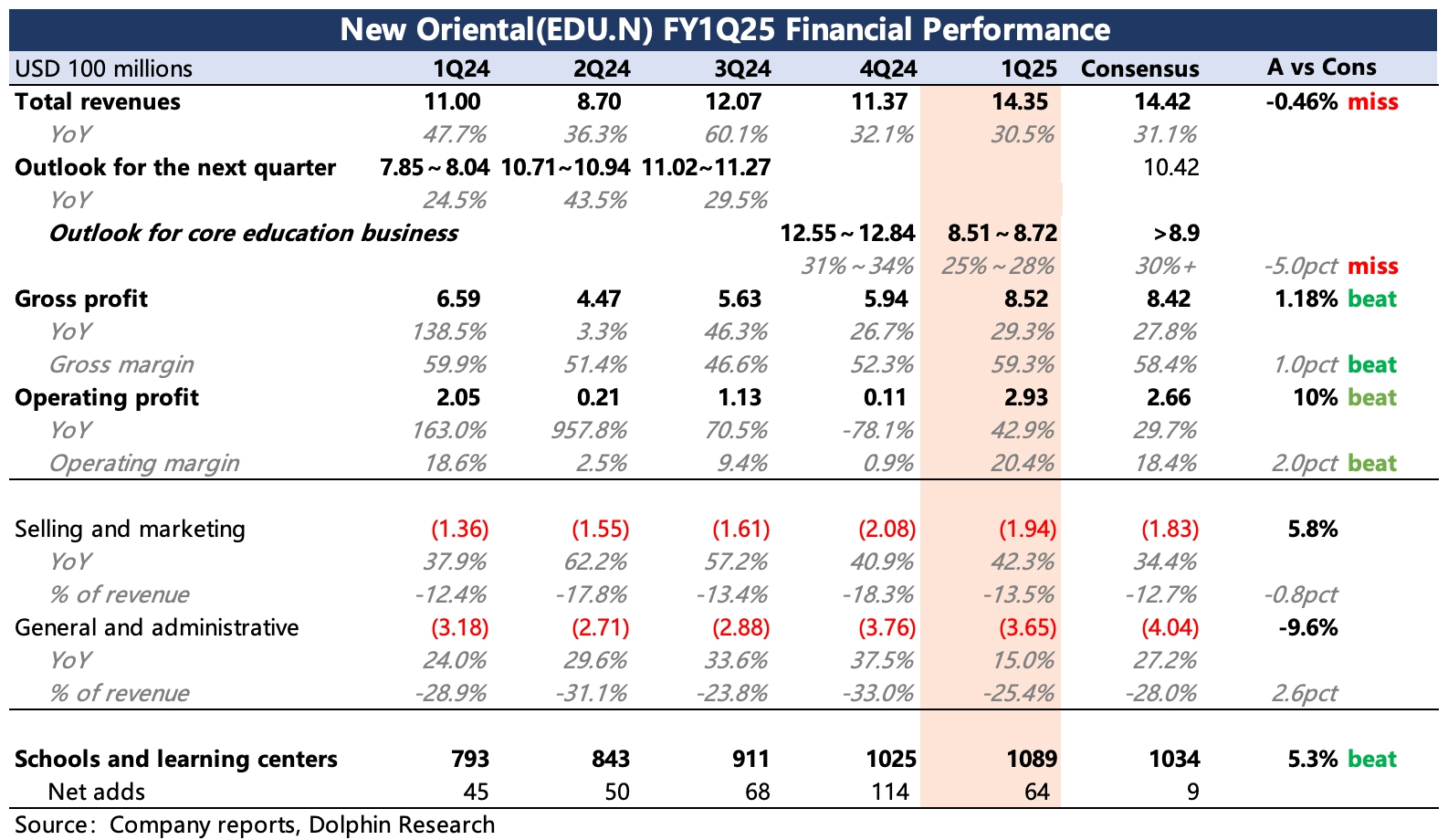

$New Oriental EDU & Tech(EDU.US) first take: Dolphin Research's feedback on Q1 performance was not positive. Although the current profit slightly exceeded expectations due to improved gross margin and controlled management expenses, the Q2 education revenue growth guidance of 25% to 28% was lower than the market's expectation of 30%+.

Looking at the performance of each segment in Q1, half of the growth miss can be attributed to the overseas study business, but the fatal issue lies in the other half—there may also be hidden concerns about a slowdown in demand for quality education and training:

(1) At the end of September, the company proactively communicated that the overseas study and exam preparation business was affected by declining consumer spending power, with weakened demand for high-ticket 1-on-1 teaching, which accounts for 20%-30% of the overseas study and exam preparation revenue.

(2) Although the new businesses (quality education and training, learning devices) are still in a high-growth phase overall, with a 49% year-on-year increase in Q1, the growth rate of enrollments in quality education and training has noticeably slowed, with only a 10% year-on-year increase. Even with rising ticket prices, this suggests that the revenue growth rate for quality education and training may drop to 20%+ next quarter, making it difficult to continue matching growth valuations.

Between these two points, Dolphin Research is more concerned about (2). Are there any one-off factors? Is it the company's proactive slowdown or intensified industry competition? For detailed explanations, pay attention to the earnings call.$NEW ORIENTAL-S(09901.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.