As the first interest rate cut by the U.S. dollar entering the post-pandemic era of rate cuts, this rate cut can be described as both "big" and "hawkish."

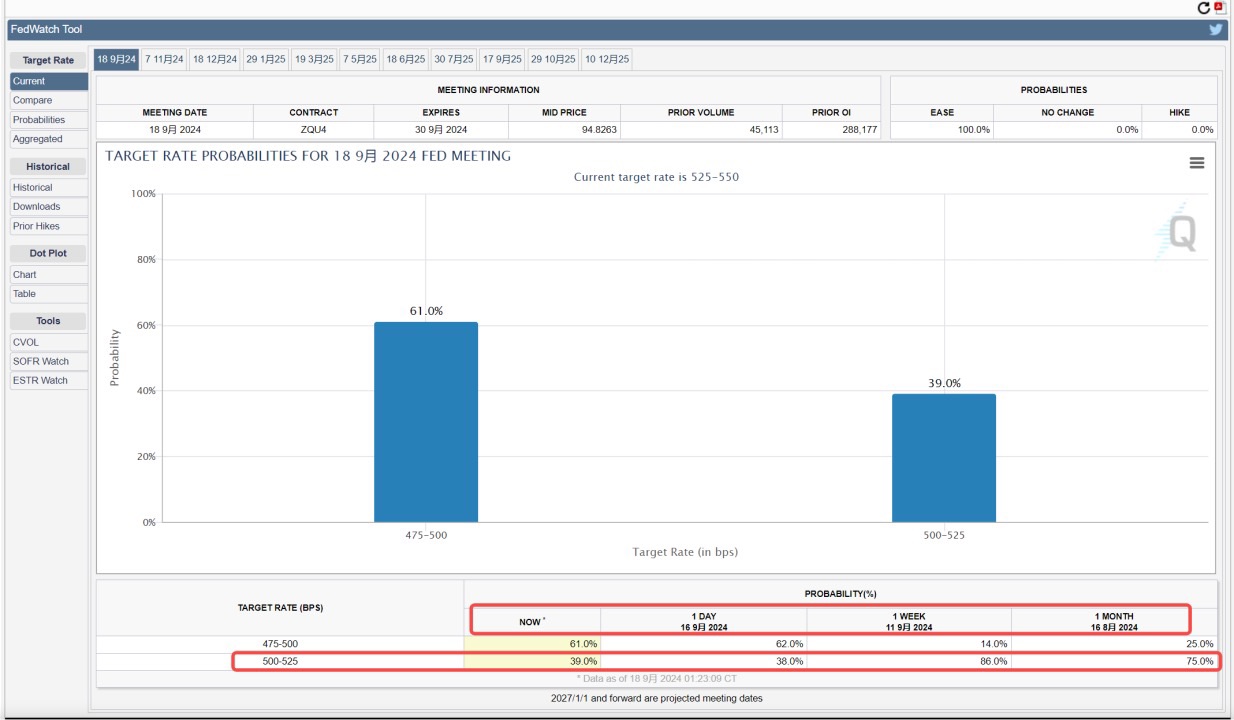

The "big" lies in the fact that the first rate cut directly slashed 50 basis points, which was indeed unexpected compared to market expectations; the "hawkish" aspect was conveyed during the conference call and the dot plot, indicating that this 50-basis-point cut should not be linearly extrapolated, and future decisions will still be data-driven. This 50-basis-point cut was merely to demonstrate the Federal Reserve's determination to protect the economy.

An interesting point was when several reporters repeatedly asked Powell whether this was a "catch-up" rate cut. Powell emphasized that, given the relatively good data on inflation and consumption, the large rate cut was more focused on being a forward-looking move. However, he also admitted that if the July employment data had been known earlier, a rate cut might indeed have been implemented at the previous meeting on July 31.

From Dolphin Research's perspective, this illustrates two points:

a. Among the various economic data, the current unemployment rate and new employment figures are the real core data, as subsequent CPI and PPI reports did not raise any red flags for the Federal Reserve.

b. The dot plot released by the Federal Reserve to some extent only reflects the Fed's wishes and guides the market to trade on these wishes, but it does not mean this path will necessarily materialize.

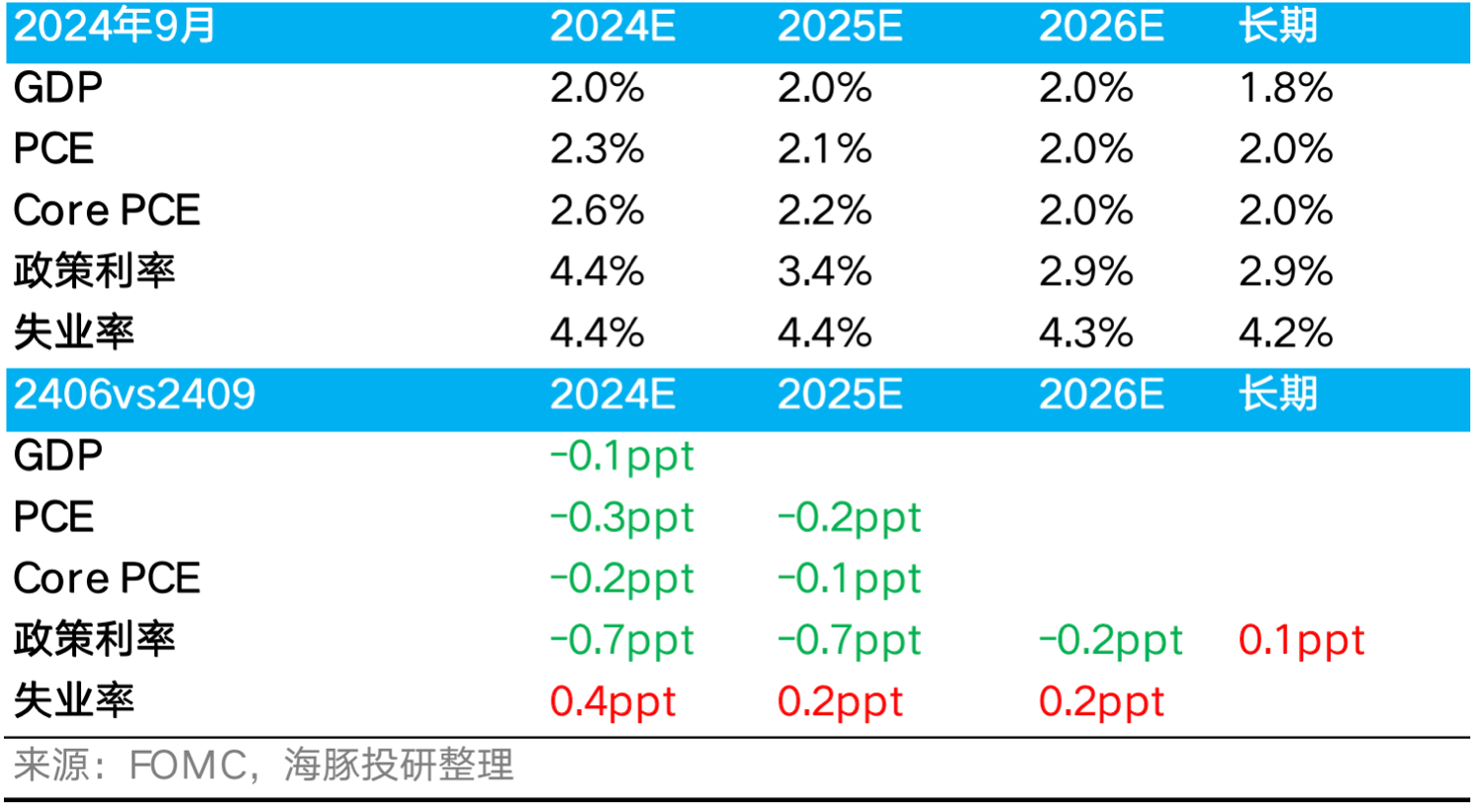

From the revisions in this economic forecast, it can be seen that among the root variables of the economy, the most significantly revised was the unemployment rate. The 大幅下修的政策利率预期 is merely a result of this root variable.

Therefore, in the coming period, a key tracking point for the expected rate cut 幅度 will be the labor market: What is the labor participation rate? How much has labor supply increased? How much has job demand decreased? How much has the unemployment rate increased, and is it within the "controllable" range below 4.5%?

Especially given the 惯性下修 in 每次新增非农就业, it’s prudent to build in some 保险 upfront. Based on the downward adjustments over the past few months, some decline should already be factored in. At least, this is how Powell indicated the Federal Reserve would approach the data.

Furthermore, Dolphin Research is not overly concerned about this hawkish rate cut path guidance. The key still lies in the employment data, particularly if the weakening is primarily due to an oversupply from increased immigrant inflows rather than a decline in corporate job demand. In that case, the economy may not be as weak as feared.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.