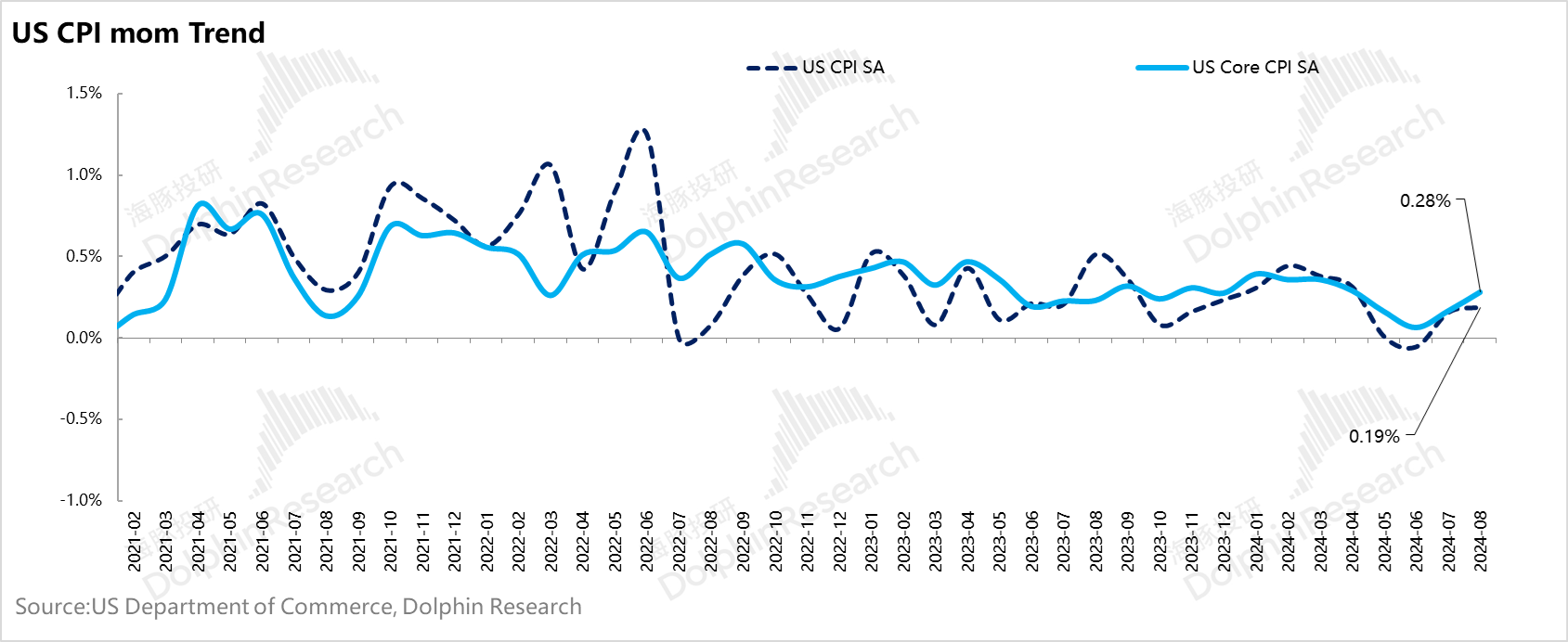

As a key indicator for next week's interest rate cut, last night's August core CPI data basically confirmed that the first rate cut will only be 25 basis points.

Structurally, overall inflation increased by 0.2% month-on-month, which is perfectly controllable. However, core inflation rose from 0.2% to 0.3% month-on-month. First, it indicates that the overall inflation can operate within expectations mainly due to the drop in energy prices.

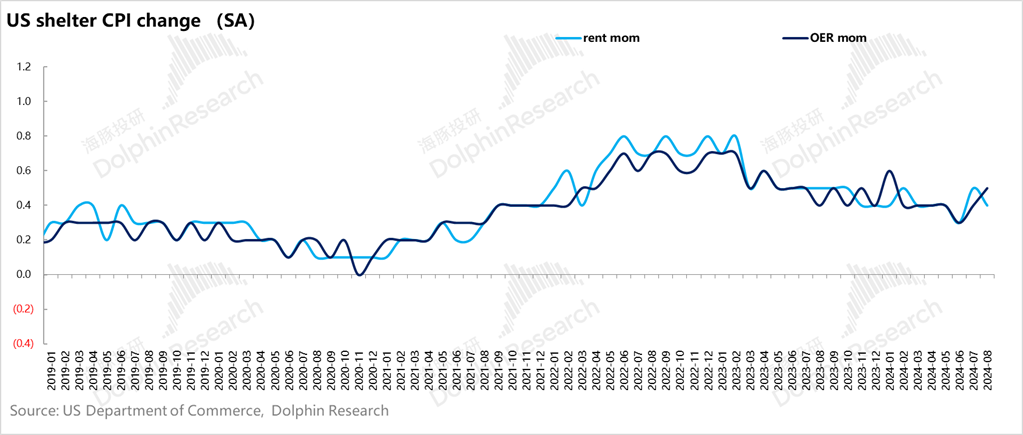

Secondly, the most critical acceleration in core inflation month-on-month growth is mainly because residential costs rose sharply again to 0.5% month-on-month. The sharp increase in residential costs is mainly due to the rise in the high-weighted owner's equivalent rent.

Owner's equivalent rent can basically be understood as homeowners' expected rental return on their own properties. This figure also rose during the last interest rate cut expectation at the end of last year and the beginning of this year.

What does this mean? People will price their asset returns in advance based on the expectation of a rate cut. In other words, once the expectation arises, even before the actual rate cut, it will produce some effect of a rate cut. In this case, an actual rate cut of 25 basis points may have an effect greater than 25 basis points.

Even to avoid a repeat of the inflation resurgence expectation at the beginning of the year, the Fed's rate cut on September 18 is most likely to be 25 basis points.

Therefore, the focus of next week's FOMC meeting is no longer how many basis points the rate cut will be, but the guidance on the future path and any wording that may further lean toward protecting employment under a 25-basis-point rate cut.

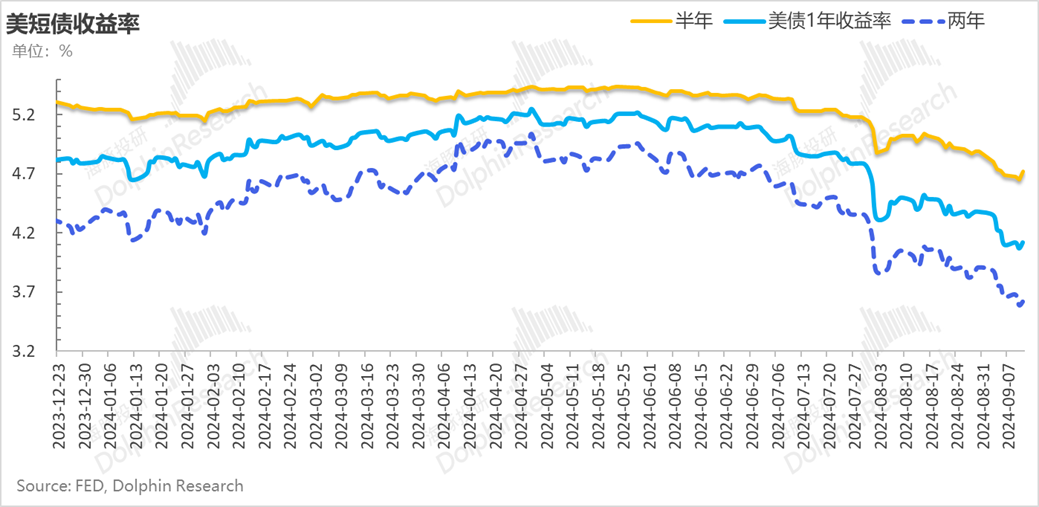

In this context, considering that the market was still speculating and pricing in the possibility of a 50-basis-point rate cut, this possibility is now basically gone. Bond prices may need to give back some gains for $iShares barclays 20+ Yr Treasury Bd(TLT.US) $Direxion 20+Yr Trsry Bull 3X(TMF.US).

Overall, with low inflation risks, interest-rate-sensitive sectors reacted sensitively after the expectation of lower interest rates emerged, indicating a high possibility of a soft landing for the economy, which is actually favorable for equity assets. $S&P 500(.SPX.US) $SPDR S&P 500(SPY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.