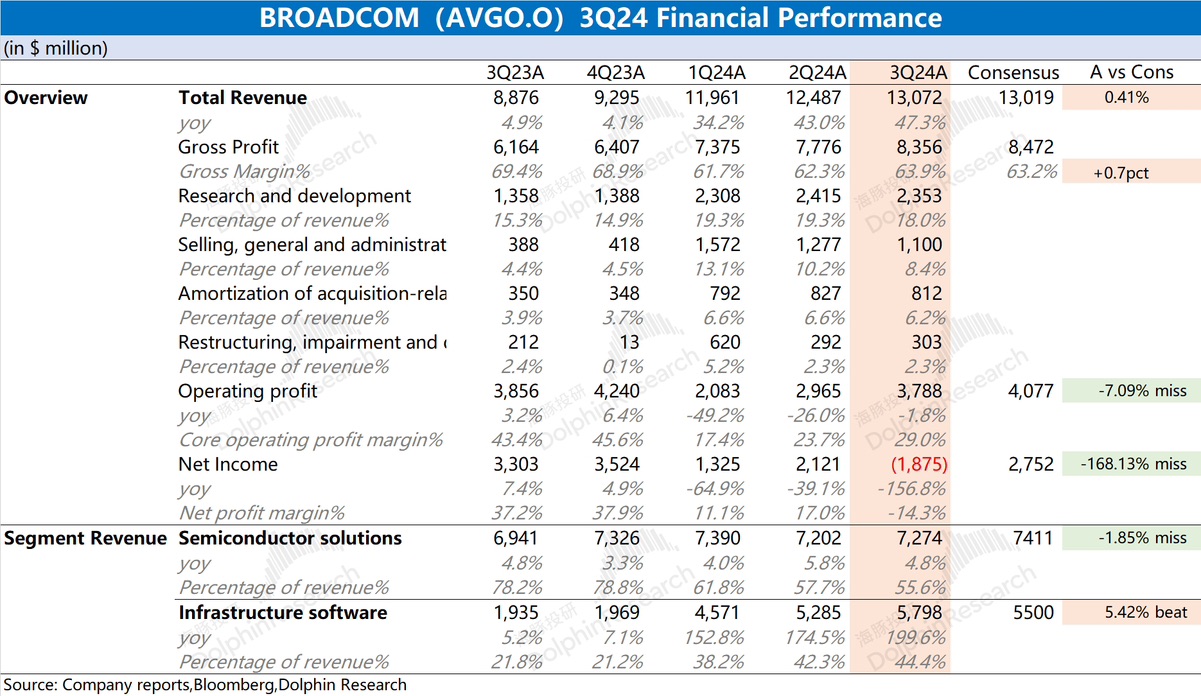

$Broadcom(AVGO.US)First take: Although the company's overall revenue this quarter was decent, operating profits still fell short of market expectations. By business segment, the company's growth this quarter mainly came from the consolidation of VMware. Excluding this impact, the growth rate of the company's original business was only 4%, showing a slowdown again.

In addition, the company's revenue guidance for the next quarter is only $14 billion, lower than market expectations ($14.1 billion). Driven by demand from AI and other sectors, the market has high expectations for the company. However, apart from the consolidation of VMware, the company's operational growth has not shown significant acceleration. Although management stated that non-AI chip businesses have largely bottomed out and AI demand remains strong, the company's semiconductor business continues to grow at a single-digit rate, which will somewhat affect market confidence.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.