$NIO(NIO.US)First Take: As the last Chinese concept stock to release earnings, Dolphin Research was initially nervous, but the actual results turned out to be a safe landing.

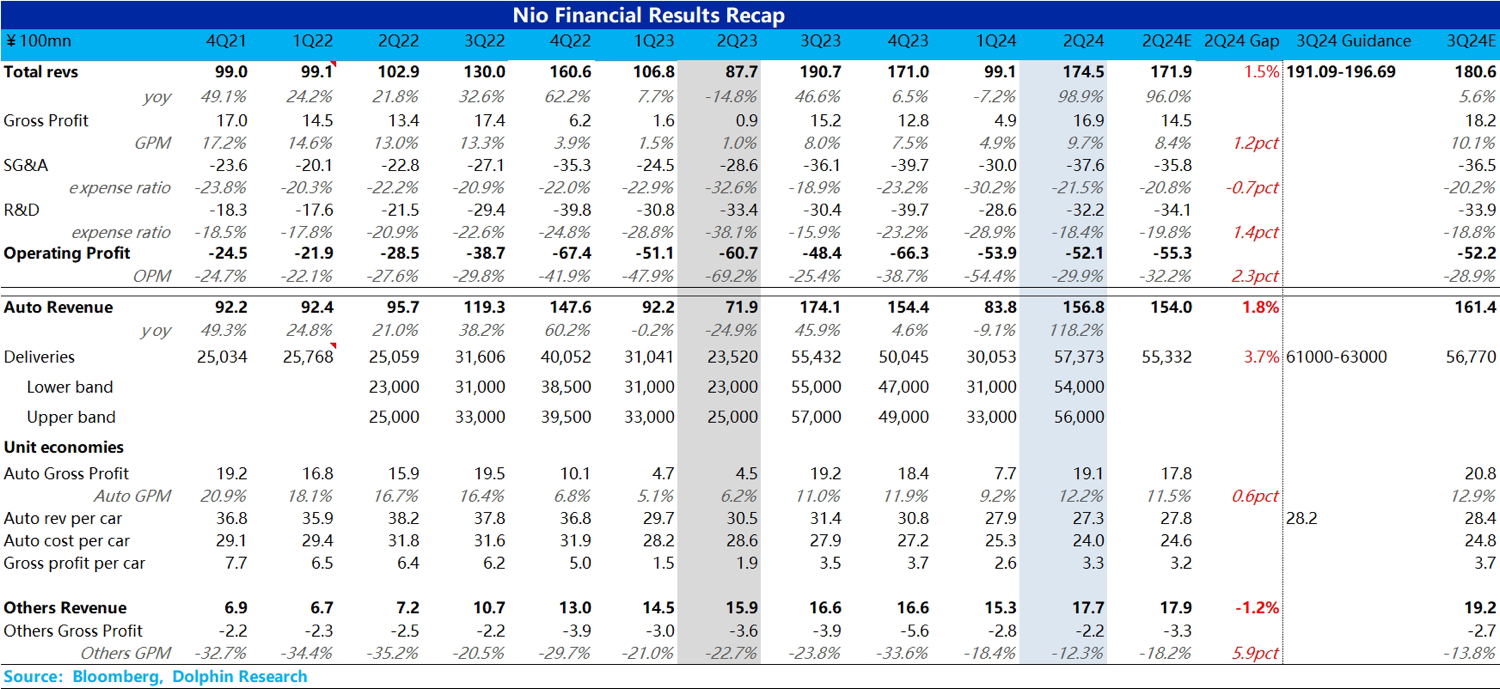

Since the sales figures were already known, the truly positive news this time was that the gross margin per vehicle didn't bomb, and the reason behind this, apart from the increase in sales, was the company's renegotiation with suppliers, which benefited the Q2 gross margin.

As for the critical guidance for the next quarter, the sales of the main brand Nio are expected to stabilize at over 20,000 units per month, with some incremental growth starting from late September when deliveries of the new model begin. The company's guidance for Q3 sales is 61,000-63,000 units, which is basically in line with expectations.

However, the implied price per vehicle from the revenue guidance of 19.1-19.7 billion RMB is approximately 282,000 RMB, also within expectations and slightly higher than this quarter. The return to this price level likely implies that the old inventory has been mostly cleared, and from now on, only new models will be sold, which naturally reduces gross margin pressure.

In terms of expenses, sales costs were slightly higher, but the operating loss still stood at 5.02 billion RMB.

Overall, this earnings report is clearly not stunning, but it is more than sufficient to match its 2024 PS of 1-1.2X.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.