Posts

Posts Likes Received

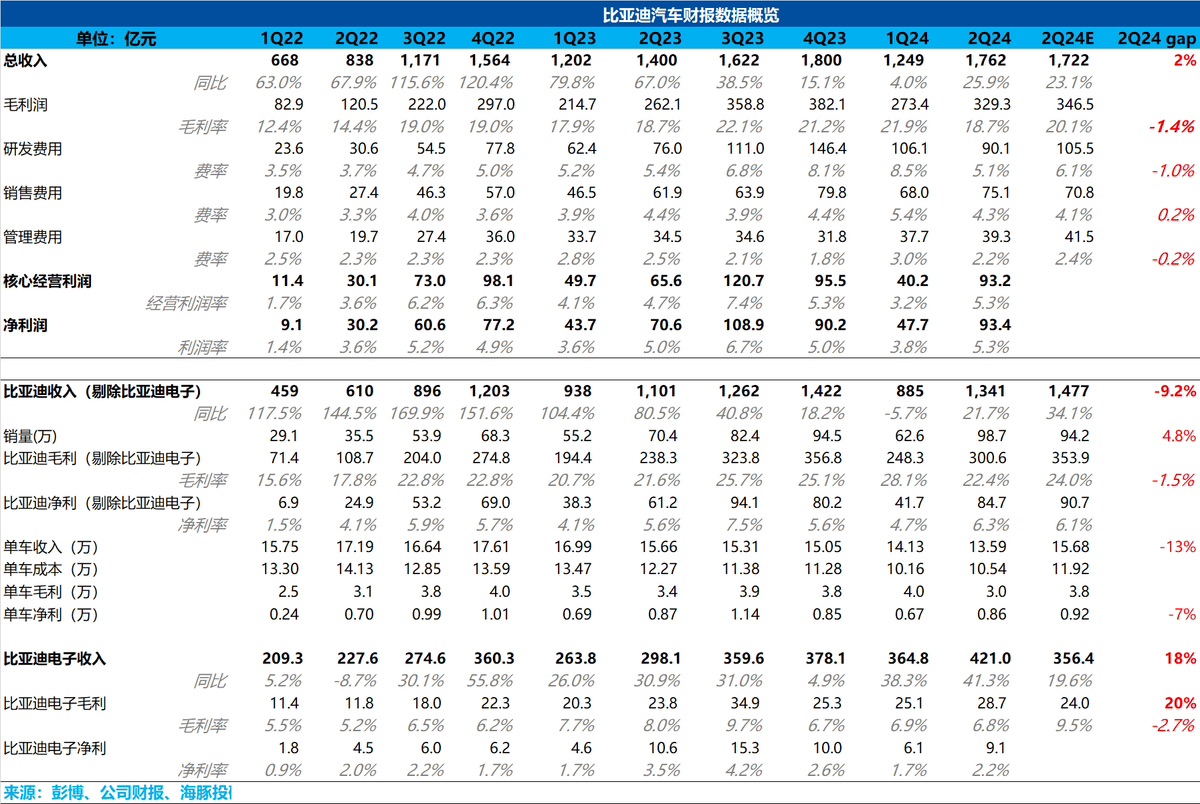

Likes Received$BYD COMPANY(01211.HK)first take:Under the price war in the auto industry, even BYD, the king with extremely strong cost control capabilities, saw a significant decline in gross margin this quarter. Both auto business revenue and gross margin missed market expectations, and the core reason behind this expectation gap lies in the average selling price of vehicles.

In Q2, BYD's average vehicle price (including a rough estimate of the battery business) was only 136,000 yuan, down 5,000 yuan quarter-on-quarter compared to Q1. The market had completely wrong expectations for BYD's Q2 price, estimating that the price would rebound to 157,000 yuan this quarter. The misjudgment may have been due to the belief that the launch of the DMI 5.0 version would bring both volume and price increases.

However, this price decline was entirely within Dolphin Research's expectations. From Dolphin Research's breakdown of BYD's sales structure, several key changes were observed:

1) The proportion of high-end models + export models in the sales structure declined: High-end and export models usually enjoy higher ASP per vehicle, but this quarter, the proportion of high-end + export models in the sales structure dropped from 21.8% in Q1 to 15.3% in Q2, with a significant decline in the proportion of export models, which fell by 5% to 10.7% this quarter.

2) Gradual loss of mid-to-high-end market share: BYD's long-standing problem has been the difficulty in breaking through the pure electric high-end market. This quarter, the mid-to-high-end plug-in hybrid segment began to show obvious weakness, driving an overall decline in both the proportion of mid-to-high-end models in the sales structure and their market share.

The reason behind this may be that the mid-to-high-end market has gradually become the domain of Aito and Li Auto, with BYD's mid-to-high-end market share being snatched by these two giants. BYD is eager to break the deadlock.

It cannot be denied that, in terms of the basic sales volume, Q2 saw an accelerated recovery in market share driven by the price cuts of the Honor Edition and the pull of DMI 5.0. However, since the recovery was mainly driven by low-end models (Qin Plus DMI under DMI 4.0 + Destroyer 05 DMI / Qin L DMI + Seal 06 under DMI 5.0), the mid-to-high-end share continued to decline, resulting in a further drop in the average price this quarter.

Fortunately, this quarter's profit release was achieved with restraint in the three expenses and the release of operating leverage due to the sales recovery. The net profit per vehicle rebounded to 8,600 yuan, which is basically in line with the expectations of major institutions (8,500-9,000 yuan) as seen by Dolphin Research.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.