Posts

Posts Likes Received

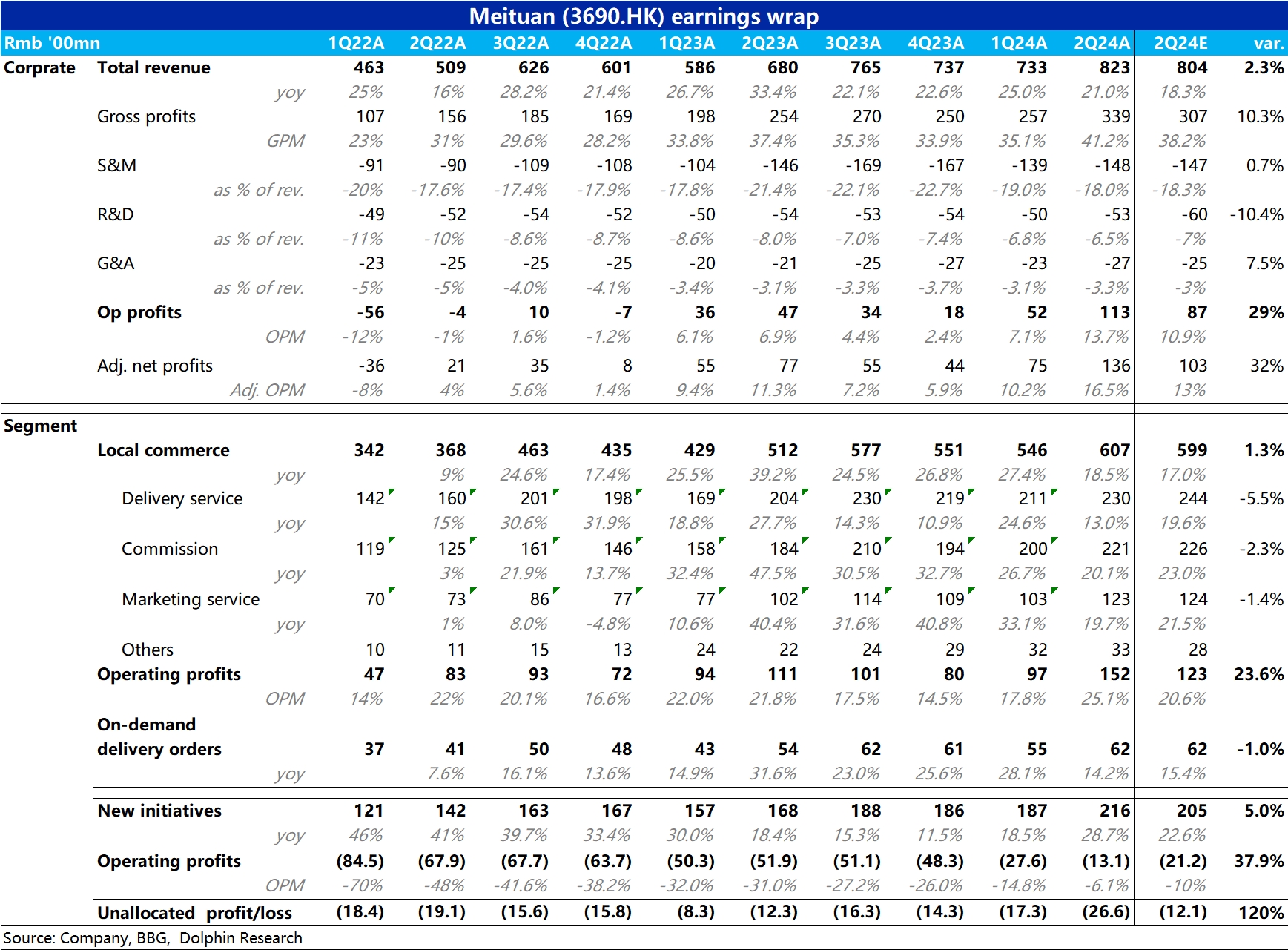

Likes Received$MEITUAN(03690.HK) 2Q24 first take:Against the backdrop of many peers' "bombs", Meituan delivered a relatively impressive performance this quarter.

Total revenue was about 1.9 billion higher than expected. Both core local retail and new businesses contributed revenue that exceeded expectations, with new businesses being relatively more impressive in terms of both the volume and magnitude of the excess. Based on the financial data, Dolphin Research initially speculates that the growth of Xiaoxiang Supermarket may be good.

From a profit perspective, depending on the calculation method, Meituan actually delivered about 2.5~3 billion more than expected, exceeding expectations to a greater extent than revenue. In other words, in addition to incremental revenue, profit margins also saw unexpected improvements. Breaking it down by segment, core local commerce profits were higher than expected, and the reduction in losses for new businesses was also stronger than expected, with both contributing.

Since the company no longer discloses the specific performance of each segment, we cannot clearly determine which business contributed more, and we need to wait for further information from the company's communication with investors. However, given that the actual delivery order volume is roughly in line with expectations, we believe that the growth of the in-store business should still be relatively strong, and the higher-margin in-store advertising and commission revenue further released more profits than expected.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.